ING Bank reports strong first quarter results

ING Bank posted a strong set of results for the first quarter of 2015. The underlying result before tax was EUR 1,661 million, up 41.2% from the first quarter of 2014 and more than double the pre-tax result in the fourth quarter of 2014.

The result was driven by solid loan growth and seasonally strong revenues in Financial Markets at Commercial Banking. It was also due to capital gains, positive effects from hedging and positive currency effects, largely from a weaker euro.

Key Points

Customer and employee feedback inspires innovation

“During the first quarter, ING made notable progress on innovation and finding even better ways to empower our customers,” said Ralph Hamers, CEO of ING Group.

“In addition to introducing several Retail Banking innovations, we are gradually rolling out our digital Commercial Banking platform, called InsideBusiness, after its recent successful pilot. InsideBusiness will provide clients with a single point of access to all of their Commercial Banking products and services, such as payments and cash management, trade finance and lending. It provides real-time information and customised reporting, and can be accessed 24/7 from any mobile device. It is another prime example of how we are pioneering technologies that keep us at the forefront of modern banking.”

“The inspiration behind such ideas comes from customer feedback and our employees, who are enthusiastic about creating solutions that help our customers to stay a step ahead. Our employees submitted over 1,800 ideas during our second annual Innovation Bootcamp, which aims to increase the pace of innovation at ING. The top 20 ideas are now being further developed. The first Innovation Bootcamp in 2014 generated 774 ideas, of which seven received funding and support to be launched commercially. One of them is Direct Lease, an online leasing platform that will help small and medium-sized enterprises at every step of the leasing cycle. A first version of Direct Lease was tested with clients in the first quarter and it will be launched this year.”

“ING Bank’s first-quarter underlying result before tax was EUR 1,661 million, up 41.2% year-on year and more than double the result in the previous quarter. This strong performance was achieved despite the challenging operating environment, characterised by unprecedented low interest rates and the uneven economic recovery. In adapting to these circumstances, we have been obliged to reduce savings rates as we continue to offer affordable and competitive borrowing. During the quarter, we attracted EUR 13.6 billion of net customer deposits and our core lending franchises grew by EUR 6.9 billion. Income was robust, reflecting our commercial growth and a seasonally strong quarter at Financial Markets. We maintained our focus on cost discipline; nevertheless, regulatory costs weighed on our expense base.”

“We continued to simplify our business portfolio through several actions in the past few months: the reduction of our stake in NN Group to 54.6%, the completion of the divestment of Voya, and the completion in April of the merger between ING Vysya Bank and Kotak Mahindra Bank which accelerated our vision for Vysya. The net profit from the Voya share sale is included in ING Group’s first-quarter net result of EUR 1,769 million while the impact of the NN share sale is reflected in shareholders’ equity.”

“Our capital position strengthened significantly since year-end. ING Group’s fully-loaded CET1 ratio increased to 11.6%, reflecting the quarterly net profit and capital relief from the NN and Voya share sales. ING Bank’s fully-loaded CET1 ratio was stable at 11.4% due to a EUR 1.0 billion dividend upstream to Group. We maintain a prudent approach to capital allocation and funding in both entities, and have a substantial surplus in place for evolving regulatory requirements and to return capital through an attractive dividend. In early April, we completed our very successful inaugural AT1 bond issuance, which augmented our total capital level.”

“Our achievements in this quarter demonstrate that our Think Forward strategy is on track. I am confident that ING is well placed for the future and that our capabilities as a leading European bank will continue to empower our customers around the world.”

Tailwinds in the first quarter

Income higher

Total underlying income was strong at EUR 4,335 million, up 13.5% compared to the first quarter in 2014, and 15.4% compared to the previous quarter. The strong increase, which was visible in both Retail and Commercial Banking, was mainly attributable to higher interest results, which were supported by volume growth, increased fee income and positive effects from hedging as well as EUR 65 million of positive currency impacts.

Expenses

ING remained vigilant on costs while continuing to invest in our strategic priorities and in business growth. Underlying operating expenses rose 3.1% compared to the first quarter 2014, but fell 12.8% compared to the previous quarter, which included EUR 375 million of redundancy provisions.

The rise in the first quarter operating expenses was largely due to higher annual regulatory costs in Poland and Germany, business growth in Industry Lending and in the Retail Challengers & Growth Markets, and higher IT investments in Retail Netherlands to improve the customer experience and to enhance operational excellence. This was partly offset by the benefits from the ongoing cost-savings programmes in place at ING Bank.

The first-quarter underlying cost/income ratio for ING Bank was 51.7%, down from 56.9% in the first quarter 2014.

Capital buffers strengthened

ING Group* further strengthened its capitalisation in the first quarter of 2015. This strengthening reflected significant progress made with ING’s restructuring programme as well as strong profitability in the period.

In February 2015, ING sold 52 million shares in NN Group for total proceeds of EUR 1.2 billion. As a result, ING Group’s stake in NN Group was reduced from 68.1% to 54.6%. Subsequently, in March 2015, ING fully divested its remaining shareholding in Voya Financial by selling 45.6 million shares. These two transactions had a strong positive impact on ING Group’s fully-loaded common equity Tier 1 ratio (the core capital buffer), and eliminated ING Group’s core debt (double leverage). The total capital base of ING Group was further strengthened by the issuance of USD 2.25 billion of CRR/CRD IV (Basel III) compliant Additional Tier 1 securities in April.

ING Bank continued to generate a sizeable amount of capital in the first quarter of 2015, driven by continued strong profitability and higher debt and equity revaluation reserves. ING Bank remained strongly capitalised at the end of the first quarter with a fully-loaded common equity Tier 1 ratio of 11.4% (core capital buffer), equal to year-end 2014, well ahead of our 2017 target (greater than 10%).

Commercial momentum

Commercial growth remained robust as ING continued to support customers’ financial needs throughout the quarter.

Net growth in the core lending business (excludes loans in run-off portfolios such as WestlandUtrecht Bank and Lease as well as sales of mortgage portfolios) was EUR 6.9 billion. Residential mortgages grew by EUR 0.3 billion as declines in Retail Netherlands and Retail Germany were more than offset by growth in most other countries.

Net growth in other customer lending in the core lending business was EUR 6.6 billion: Retail Banking reported a net growth of EUR 1.8 billion, which was generated entirely outside the Netherlands. Net growth at Commercial Banking was EUR 4.8 billion (in Structured Finance, General Lending and Financial Markets).

In Retail Banking net customer deposits grew by EUR 8.9 billion in the first quarter, of which half was in Germany, however deposit growth was registered in almost all countries. In Commercial Banking net deposits grew by EUR 3.4 billion, driven primarily by Transaction Services and Financial Markets.

Risk costs normalising

Risk costs were lower than the first quarter 2014, but increased on the previous quarter. Most businesses, with the exception of Retail Netherlands, are now operating close to the longer-term average as the overall economic environment gradually improves.

In the first quarter of 2015, ING Bank’s non-performing loans (NPL) situation remained stable, and improved slightly for Dutch mortgages with payments in arrears by more than 90 days. This reflects the gradual improvement in the Dutch housing market and economy.

However, this improvement is not yet reflected in the credit quality of the Business Lending Netherlands portfolio. Therefore both the NPL ratio and the risk costs of Business Lending Netherlands are expected to remain at elevated levels in the coming quarters.

Customer focus

ING’s customer promise is to be clear and easy, to be available anytime and anywhere, to empower people and to keep getting better. In the first quarter of 2015, ING launched several initiatives and won several awards for enhancing the customer experience.

InsideBusiness

ING introduced a new digital banking platform for its corporate clients called InsideBusiness, following the successful pilot launch in late 2014 and early 2015. InsideBusiness will bring together all ING channels, products and services on one platform with a single sign-on. It enables clients to conduct many transactions themselves and to get key information that affects their companies’ financial position from any internet-enabled device. InsideBusiness has been launched for selected clients with a limited set of features. Eventually, all of ING’s corporate clients will be able to view and manage all their ING Commercial Banking products and services on InsideBusiness.

Supporting customers in need

In the first quarter ING Netherlands and Randstad HR Solutions launched a pilot programme which aims to help customers who have lost their jobs to find a new job, or to start a business. One of ING’s core sustainability pillars is financial empowerment for individuals, for instance, supporting customers who are in financial distress.

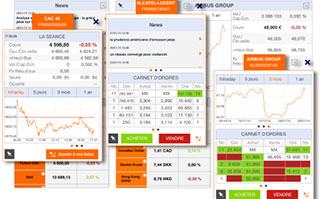

Online trading

In March, ING-DiBa was named ‘Online Broker of the Year’ by the readers of Börse Online, a German financial magazine. ING-DiBa recorded the highest customer satisfaction score among the 11 largest banks in Germany. This is the sixth time in a row that ING-DiBa has won this award. In France, ING Direct launched a a new mobile share trading app. The new app enables ING’s retail customers to access their portfolio no matter where they are. They can browse and search the stocks of their choice as well as make orders.

Innovation

In 2014, ING held its first Innovation Bootcamp, an in-house initiative that challenges employees to come up with ideas that can improve the customer experience, and ways to implement them. One of the 774 ideas that came out of the first session was Direct Lease, an online platform that will help small to medium-sized enterprises (SME) at every step of the leasing cycle.

ING tested the first version of Direct Lease with clients during the first quarter and will launch it this year to all of ING’s SME customers in the Netherlands. The Innovation Bootcamp sessions are an example of ING’s efforts to harness innovation to meet customers changing needs.

There may be differences in the historical quarterly figures in this edition compared to the figures in prior ing.world publications. This is because underlying results have been restated to reflect the following:

- the bank-wide allocation of Bank Treasury across both Retail and Commercial Banking segments in all countries, whereas they were previously fully allocated in either Retail Banking or Commercial Banking.

- the segmentation of ING Turkey into Retail Banking and Commercial Banking (previously fully in Retail Banking).

- the replacement of ‘interest benefit on economic capital’ by ‘interest benefit on total capital’.

For more information about ING Group’s results, please go to the press release and the presentation in the Quarterly Results section of Investor Relations on ing.com