ING 2Q15 underlying net result EUR 1,118 million

5 August 2015

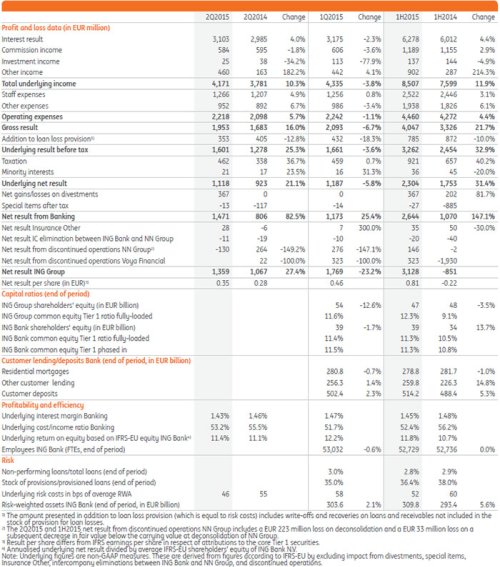

- ING Bank 2Q15 underlying net result EUR 1,118 million, up 21.1% from 2Q14 and 5.8% lower than in 1Q15

- 2Q15 results driven by strong loan and deposit growth, lower risk costs and positive CVA/DVA adjustments

- Consistent execution on Think Forward priorities: EUR 8.7 billion core lending growth in 2Q15; 600,000 new customers in 1H15

- ING Bank underlying return on IFRS-EU equity rose to 11.8% for the first six months of 2015, in line with Ambition 2017

- ING Group 2Q15 net result EUR 1,359 million (EUR 0.35 per share) including Insurance results and NN deconsolidation

- Further execution on restructuring: ING Group’s stake in NN Group reduced to 37.6%, leading to deconsolidation

- Further execution on restructuring: ING Group’s stake in NN Group reduced to 37.6%, leading to deconsolidation

- Capital position continued to strengthen; ING declares 2015 interim cash dividend of EUR 0.24 per ordinary share

- Strong fully-loaded CET1 ratios: ING Group increased to 12.3%; ING Bank ratio stable after capital upstream

- Interim cash dividend of EUR 0.24 per ordinary share, equivalent to 40% of underlying net profit for the first half of 2015

CEO Statement

“ING posted a strong set of commercial and financial results during the second quarter of 2015,” said Ralph Hamers, CEO of ING Group. “We also achieved a key milestone in our restructuring by reducing our stake in NN Group to 37.6% and deconsolidating it from our accounts, thereby ending restrictions on price leadership and acquisitions.”

“ING Bank’s second-quarter underlying result before tax was EUR 1,601 million, up 25.3% year-on-year, driven by robust loan and deposit growth and lower risk costs. Positive CVA/DVA adjustments amounted to EUR 208 million, but were largely off set by non-recurring impacts in income relating to mortgage refinancings. On a sequential basis, the underlying result before tax was 3.6% lower than in the first quarter of 2015.”

“Our businesses across the Bank continued to generate strong commercial growth and attract new customers. Total customer deposits increased by EUR 9.3 billion in the quarter, primarily through Retail Banking, where growth was recorded in all segments. During the second quarter, we extended EUR 8.7 billion of net lending in our core lending businesses. We made significant progress on building sustainable balance sheets in key Challengers & Growth Markets such as Germany and France. Germany, in particular, demonstrated strong momentum in its lending capabilities, with funded Commercial Banking assets increasing nine-fold over the past five years to reach EUR 10 billion, and consumer lending growing by EUR 1 billion in less than two years to EUR 5 billion.”

Ralph Hamers, CEO of ING Group

In the second quarter, we continued to expand our digital offerings for retail customers and also identified new ways to facilitate the financing needs of small companies

“During the first six months of 2015, ING gained over 600,000 new individual customers and established approximately 250,000 primary relationships. We take great pride in supporting our customers’ banking needs and providing them with a differentiating customer experience. In the second quarter, we continued to expand our digital offerings for retail customers and also identified new ways to facilitate the financing needs of small companies. For example, in Belgium we partnered with Koalaboox, an online financial services provider, to off er small companies cash management and invoicing tools to help them manage their financial position. And by using data mining in Poland, we have been able to provide pre-approved loans to selected entrepreneurs, which has improved the customer experience and made the lending process more efficient.”

“ING Bank performed well against its Ambition 2017 targets during the first half of 2015. The underlying return on IFRS-EU equity increased to 11.8% and our capital position strengthened further as we continued to allocate our resources efficiently. ING Group’s fully-loaded CET 1 ratio increased to 12.3% at the end of the second quarter, following the further sell-down and subsequent deconsolidation of NN Group. ING Bank’s fully-loaded CET 1 ratio was 11.3%, roughly stable quarter-on-quarter, reflecting 30 basis points of capital generation and a EUR 1.2 billion capital upstream to Group.”

“Today, we are pleased to announce an interim cash dividend of EUR 0.24 per ordinary share, amounting to EUR 922 million, or 40% of the underlying net profit of the first half of 2015. We remain committed to returning value to shareholders and reiterate our intention to pay a full-year dividend of at least 40% of ING Group’s total annual net profits. The Board’s final decision will be made at year-end and will be subject to financial and strategic considerations, and future regulatory developments.”

“ING’s performance during the first half of 2015 demonstrates consistent delivery on our Think Forward priorities, to which we hold ourselves accountable every day. Looking forward to the rest of this year, I am confident that our franchise is well positioned to empower our customers around the world while delivering sustainable returns to our shareholders.”

Consolidated Results

Analyst and investor conference call

5 August 2015, at 9:00 a.m. CET

NL +31 20 794 8500

UK +44 20 7190 1537

US +1 480 629 9031

Listen to the investor conference call at www.ing.com

Media conference call

5 August 2015, at 11:00 a.m. CET

NL +31 20 531 5871

UK +44 203 365 3210

Listen to the media conference call at www.ing.com

IMPORTANT LEGAL INFORMATION

ING Group’s Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’).

In preparing the financial information in this document, the same accounting principles are applied as in the 2014 ING Group Annual Accounts.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) break-up of the euro, (4) ING’s implementation of the restructuring plan as agreed with the European Commission, (5) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit markets generally, including changes in borrower and counterparty creditworthiness, (6) the frequency and severity of insured loss events, (7) changes affecting mortality and morbidity levels and trends, (8) changes affecting persistency levels, (9) changes affecting interest rate levels, (10) changes affecting currency exchange rates, (11) changes in investor, customer and policyholder behaviour, (12) changes in general competitive factors, (13) changes in laws and regulations, (14) changes in the policies of governments and/or regulatory authorities, (15) conclusions with regard to purchase accounting assumptions and methodologies, (16) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (17) changes in credit ratings, (18) ING’s ability to achieve projected operational synergies and (19) the other risks and uncertainties detailed in the Risk Factors section contained in the most recent annual report of ING Groep N.V. Any forwardlooking statements made by or on behalf of ING speak only as of the date they are made, and, ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction. The securities of NN Group have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold within the United States absent registration or an applicable exemption from the registration requirements of the Securities Act.