ING Bank comfortably passes EBA stress test

ING Bank comfortably passes EBA stress test

Amsterdam, 15 July 2011

- EBA stress test confirms strong capital position of ING Bank. Strong profit and capital generation enable balance sheet to absorb adverse shocks

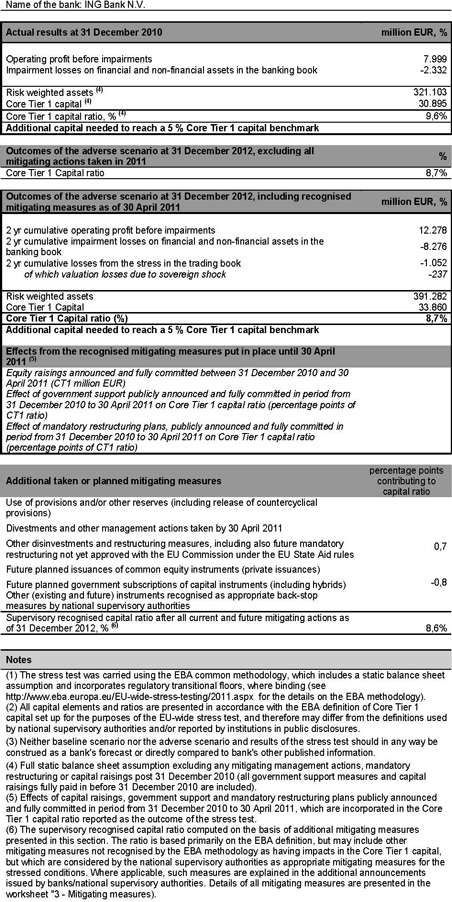

- Under adverse stress test scenario the estimated consolidated Core Tier 1 capital ratio of ING would decline to 8.7% in 2012 compared to 9.6% as of end of 2010

- ING would remain well above hurdle rate of 5% Core Tier 1 ratio with surplus Core Tier 1 capital of EUR 14.8 billion in 2012.

ING Bank was subject to the 2011 EU-wide stress test conducted by the European Banking Authority (EBA), in cooperation with De Nederlandsche Bank (DNB), the European Central Bank (ECB), the European Commission (EC) and the European Systemic Risk Board (ESRB).

ING Bank notes the announcements made today by the EBA and DNB on the EU-wide stress test and fully acknowledges the outcomes of this exercise.

The EU-wide stress test, carried out across 90 banks covering over 65% of the EU banking system total assets, seeks to assess the resilience of European banks to severe shocks and their specific solvency to hypothetical stress events under certain restrictive conditions.

The assumptions and methodology were established to assess banks’ capital adequacy against a 5% Core Tier 1 capital benchmark and are intended to restore confidence in the resilience of the banks tested. The adverse stress test scenario was set by the ECB and covers a two-year time horizon (2011-2012). The stress test has been carried out using a static balance sheet assumption as at December 2010. The stress test does not take into account future business strategies and management actions and is not a forecast of ING Bank profits.

As a result of the assumed shock, the estimated consolidated Core Tier 1 capital ratio of ING would change to 8.7% under the adverse scenario in 2012 compared to 9.6% as of end of 2010.

Details on the results observed for ING Bank:

The EU-wide stress test requires that the results and weaknesses identified, which will be disclosed to the market, are acted on to improve the resilience of the financial system. Following completion of the EU-wide stress test, the results determine that:

ING Bank meets the capital benchmark set out for the purpose of the stress test. The bank will continue to ensure that appropriate capital level must be maintained. In the adverse scenario, ING Bank remains well above this benchmark of 5% Core Tier 1 ratio with surplus Core Tier 1 capital of EUR 14.8 billion in 2012.

Following table as per EBA instructions

Results of the 2011 EBA EU-wide stress test: Summary (1-3)

Notes to editors

The detailed results of the stress test under the baseline and adverse scenarios as well as information on ING Bank credit exposures and exposures to central and local governments are provided in the accompanying disclosure tables based on the common format provided by the EBA.

The stress test was carried out based on the EBA common methodology and key common assumptions (e.g. constant balance sheet, uniform treatment of securitisation exposures) as published in the EBA Methodological note. Therefore, the information relative to the baseline scenarios is provided only for comparison purposes. Neither the baseline scenario nor the adverse scenario should in any way be construed as a bank's forecast or directly compared to bank's other published information.

See more details on the scenarios, assumptions and methodology on the EBA website: http://www.eba.europa.eu/-/report-on-the-fulfilment-of-the-eba-recommendation-adopted-on-15-july-2011

Press enquiries

Frans Middendorff

+31 20 541 6516

Frans.Middendorff@ing.com

Investor Inquiries

Investor Relations

+31 20 541 5460

Investor.relations@ing.com

About ING

ING is a global financial institution of Dutch origin offering banking, investments, life insurance and retirement services. As of 31 March 2011, ING served more than 85 million private, corporate and institutional clients in more than 40 countries. With a diverse workforce of about 105,000 people, ING is dedicated to setting the standard in helping our clients manage their financial future.

Important Legal Information

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) the implementation of ING’s restructuring plan to separate banking and insurance operations, (4) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit markets generally, including changes in borrower and counterparty creditworthiness, (5) the frequency and severity of insured loss events, (6) changes affecting mortality and morbidity levels and trends, (7) changes affecting persistency levels, (8) changes affecting interest rate levels, (9) changes affecting currency exchange rates, (10) changes in general competitive factors, (11) changes in laws and regulations, (12) changes in the policies of governments and/or regulatory authorities, (13) conclusions with regard to purchase accounting assumptions and methodologies, (14) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, and (15) ING’s ability to achieve projected operational synergies. ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.