ING Viewpoint May 2017

Ralph Hamers, CEO ING Group

"Sometimes the smartest ideas come from outside. This is why ING is closely watching and working with fintechs, primarily seeking to differentiate the customer experience. It is important that both banks and fintechs can operate throughout the EU in a regulatory level playing field that allows for innovation in the best interest of customers and EU’s competitive position at large. Barriers as a result of a fragmented regulatory landscape can be overcome by further harmonising EU legislation. This is in particular relevant in the area of customer due diligence, data protection and anti-money laundering rules "

Ralph Hamers, CEO ING Group

Introduction

Probably the biggest change in the financial landscape over the past few years has been the rise of fintechs. A fintech is a company which provides an innovative and disruptive product or service that is of added value within the financial service industry. Fintechs use these technologies for instance to help customers manage their finances in an easier, quicker or smarter way. New technologies are not only revolutionary when it comes to offering customers a better experience, there is also a lot of potential in terms of optimizing and digitizing processes, reducing costs and detecting risks.

Payments and SME lending services are examples of areas where fintechs have found solutions that truly offer a better customer experience than those offered by traditional banks. When looking at the existing regulatory landscape in Europe there is a need for legal certainty and level-playing-field, both for incumbent and fintechs, to develop and invest in new services. In this viewpoint we set-out ING’s approach to fintechs. Based on this experience we mention the key elements to regulate the future to accommodate innovative solutions that fintechs offer and to allow banks and fintechs to compete at equal footing serving the best interest of customers.

ING’s partnering with fintechs

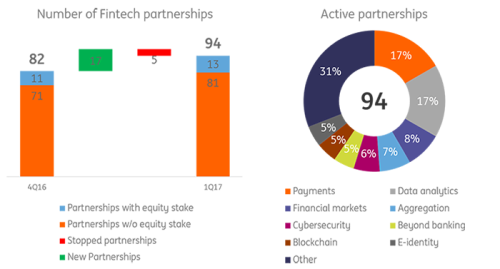

Within ING we are pragmatic in partnering with all types of fintechs. Currently we hold over more than 90 partnerships with fintechs in different areas of our business. We connect and cooperate to accelerate innovation whereby improving customer experience is the main objective. When investing in fintechs ING undertakes a thorough selection process to carefully select a company.

Some examples of ING fintech related initiatives are:

Kabbage (partnership/investment): A leading technology and data platform powering automated lending to small and medium enterprises (SMEs). We are currenty offering Kabbage to customers and non-customers in Spain. The partnership fits ING’s strategy to expand its lending capabilities to SMEs and helps them to get the capital they need to grow.

Payconiq (internal start-up): With Payconiq, an innovation by ING, customers can do more than just pay in store and get loyalty points. They can also make payments online and instantly transfer money to friends and family, regardless of their bank.

Yolt(startup): A free mobile app to help people keep track of their finances. With the app called Yolt, users can manage their money matters with different banks for different financial services in one place.

Twyp: A free phone application for transferring money to friends. Payments are made from a list of contacts via the mobile phone. Twyp has more than 300,000 users in Spain and is growing quickly. The application, a peer-to-peer payment system, uses ING's systems but is suitable for any bank.

The use of fintech and the EU regulatory landscape

If we want to give fintech a fair chance to succeed, they need a large market. Looking at the existing regulatory landscape in Europe there is a need for legal certainty for both the incumbents and fintechs in order to develop and invest in new services. Below we list the three focus areas that in our view should be taken into consideration by EU regulators:

- Foster innovation and allow fintechs to develop When new regulation is drafted the ongoing innovation and digitalization of financial services should be taken into consideration. We think this can be achieved by including an innovation sanity check during the impact assessment phase of the legislative process. Also, it is important to ensure a technology neutral position is taken in future legislation. Furthermore the existing fragmented regulatory landscape is a barrier for fintechs to scale up within Europe. Similar to banks, fintechs that want to operate cross-border currently suffer from the fact that in every country you have to meet a different set of KYC and AML rules, also the licensing requirements are different. The use of cloud services is an important aspect of fintech innovation; in this respect it is key that not all cloud services are treated as outsourcing; it is not the technology that determines the risk, but the business model process.

- Same services - same rule Of course there is a level playing field angle to the fintech developments as well. Not only for banks and fintechs, but for any company (e.g. telcos, social media companies, web merchants) that operates in the financial services environment. In case a fintech or any other company offers genuine banking business (handle customer deposits) or provide financial services, they should comply to the same regulation as applicable to banks so that everyone gets an equal chance to compete; the PSD II is a clear example of this. A sandbox approach at both national and European level would facilitate a thorough fit to market test, as long as they are available to both banks as well as new players.

To conclude

Fintechs are an opportunity; if banks partner with those that fit well in the bank’s strategy a partnership will ultimately result in a differentiating customer experience. However, banks should be selective in the choice of partners and also regulators should ensure that fintechs are subject to the same rules in important areas such as cyber security and privacy. To allow fintechs and banks’ use of fintechs to scale up cross-border, it is important that upcoming regulation that is linked to innovation is sufficiently forward looking and technology neutral.