ING Viewpoint June 2021

Steven van Rijswijk CEO and chairman Executive Board ING Group

Our social responsibility

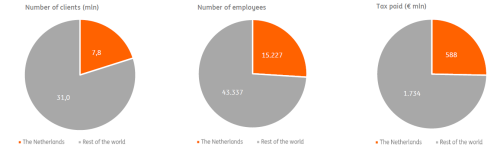

Banks fulfil a number of essential social needs. We help to ensure a safe and efficient payment system. And as the link between the supply of and demand for money, we contribute to economic and social development by redeploying the financial resources entrusted to us in the form of loans and mortgages for consumers and financing for businesses, governments and institutions. In doing so, we are involved in and have an impact on the lives of many people in society. ING is a large, universal bank for consumers, businesses and institutions and therefore a financial services provider for all segments of society, operating from its Dutch home market in about 40 countries. In total, we serve almost 40 million customers, of whom 7,8 million in the Netherlands, and we are the employer of over 14,000 permanent employees in the Netherlands (and over 43,000 abroad). The guiding principle in everything we do is: we want to help people move forward, privately and professionally. Empowering people to stay a step ahead in life and in business'; that is our ambition. We would like to explain here how we express this ambition in the role that we play in our society.

Steven van Rijswijk

CEO and chairman Executive Board ING Group

Trust in a safe financial system

As a bank, we manage the money that others entrust to us. This great responsibility requires that our customers and the society in which we operate can trust us. We therefore expect our employees to carefully weigh the interests of all the parties involved in the bank. In doing so, we put the interests of our customers first. This is an important element in the banking oath that our employees take in the Netherlands. As one of the gatekeepers of the financial system, we have strict policies in place to help prevent our systems and services from being abused for money laundering, fraud and other forms of financial and cybercrime. And we keep a close watch on our capital and liquidity levels to ensure financial stability. Consequently, we strive for profitability that enables us to offer sufficient returns to our shareholders, such as pension funds and institutional investors.

Careful consideration of interests

To carefully consider the interests of all our stakeholders in the choices we make, we constantly listen to our customers, employees, shareholders, civil society organisations, citizens and their elected political representatives and our regulators. This helps us determine how best to meet their diverse expectations and learn when we make mistakes. We are open to feedback and seek constructive dialogue with all stakeholders. We also ensure that information on our policies and positions on relevant social issues and financial laws and regulations is optimally available and accessible.

Make a positive contribution

We are convinced that we can only be successful in the long term if we make a positive contribution to a strong economy, a healthier climate and greater financial resilience in order to promote a stable society. We therefore ensure that our strategy, business operations and the remuneration policy for our management and employees are geared towards both financial and non-financial objectives. Social, ethical and environmental criteria are taken into account and translated into strict requirements in the financing and investment policies that we apply throughout the world. This policy is constantly evaluated and, where necessary, adapted to changing circumstances and insights.

... to a strong economy,

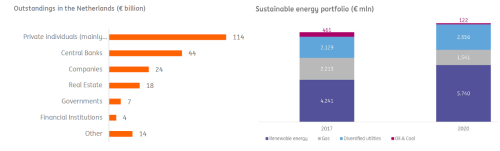

By supporting the economy in its entirety, we make an important contribution to ensuring that financial risks in our society are placed where they can best be borne. By helping consumers to manage their savings prudently and providing them with expert advice when taking out a loan or mortgage, we help them to stay as financially healthy as possible. In addition, we support companies, governments and semi-public institutions in sectors such as healthcare and education. For example, when it comes to providing working capital or meeting liquidity needs. As a large, universal bank, we use our strong funding base, knowledge and expertise and international network to solve complex funding issues. These include capital and money market transactions, such as IPOs, bond issues and hedging of currency risks. We also advise on mergers and acquisitions and offer trade, commodity and export financing to internationally active companies. In this way, we help entrepreneurs, governments and institutions to seize new opportunities and facilitate investments that contribute to sustainability and innovation.

.... a healthier climate,

In addition, we are making efforts to realise financial solutions for a climate-neutral economy. In 2019, ING and other banks signed the Dutch Climate Accord, through which the government, together with companies, NGOs and other partners, gave substance to the Paris climate objectives. We actively help our customers in their transition to a business in line with the international climate objectives. For example, we aim to bring our own loan portfolio in line with the Paris Agreement and we are working on the further development of methods to measure the climate transition of companies and sectors, to set targets and to manage them. Naturally, we are also ensuring that we minimise the ecological footprint of our own business operations.

... and a financially resilient society

Financial concerns are a major cause of stress for many in society. While financial resilience is a prerequisite for economic and social well-being. That is why we provide accessible services to all target groups, from young to old and from consumers to entrepreneurs. And we help customers gain insight into their financial situation, so they can remain financially healthy and the causes of financial problems can be tackled promptly and effectively. We actively help them to improve their skills in digital banking. We also invest in society by sponsoring associations, institutions and initiatives in the fields of sport, culture, nature and entrepreneurship and by sharing knowledge with them. With the ING Netherlands fund, we support people who take the initiative to make the Netherlands stronger by tackling social issues.

Our role in the current Corona crisis

Corona has turned the lives of many people upside down. People are worried about their health and that of their loved ones, and anxious about their finances and social exclusion. We feel a responsibility to be there for our customers, employees and society in this crisis. We have equipped our employees to work from home and we support our customers in many ways, such as providing payment deferrals, promoting contactless payments, and offering solutions to entrepreneurs to meet their liquidity needs. We also work closely with public and private partners on debt relief initiatives.

ING IN FIGURES (Source: ING Annual Report 2020)