ING survey: a cashless society is coming

26 April 2017

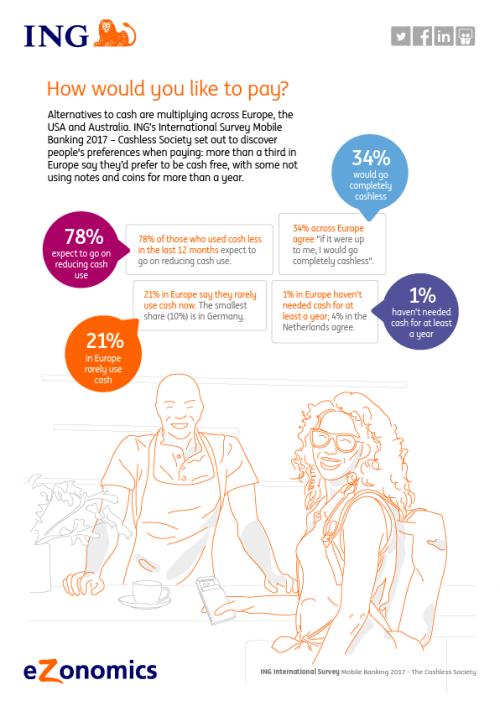

Cash is king, right? Yes, but its dominance is dwindling in many countries. And people seem to like it that way too: given the choice, one in three people in Europe would go completely cashless, according to a new ING survey.

Due to the rise of cash alternatives and the convenience of using them, 68% say that they would rather visit a shop that only accepted cashless payments instead of just cash.

The desire to drop cash altogether is higher in emerging economies than in rich countries.

These are a few of the findings from the fifth ING International Survey Mobile Banking 2017 – Cashless Society.

The aim of this annual survey is to learn how consumers around the world spend, save, invest and feel about money. The focus this year was to explore their preferences when paying for goods and services. Around 1,000 people in 15 countries (Europe plus the US and Australia) took part in the internet-based polling during the month of February.

Cash alternatives on the rise

Technological progress in the last few decades has led to a rapid rise in alternatives to cash. Physical notes and coins were initially replaced by debit and credit cards. Yet all four of these options are again replaced by new digital alternatives, such as paying for something through a mobile device (called mobile payments).

Meanwhile, some countries are actively discouraging, or outlawing, cash payments altogether. According to some experts, this is in order to halt corruption and tax evasion. In the eurozone, for example, the EUR 500 note will be withdrawn completely by the end of 2018.

ING’s latest consumer survey suggests that a cashless society is not only within reach, but desired by many Europeans.

One in five people in Europe (21%) said they rarely carry cash anymore. And if given the option, one in three in Europe would go completely cashless.

Of all the 15 countries surveyed, Germans carry the most cash and French and Americans the least.

Over half of all respondents said they are using less cash today than they did 12 months ago.

“The days of rushing to the ATM so you have enough money for the weekend are long gone,” commented ING senior economist Ian Bright. “Card and even mobile phone payments are increasingly being seen as safe substitutes.”

Country differences

However, there are stark differences in attitude between countries.

One would expect that in countries that already have a sophisticated infrastructure for digital payments, the public there would embrace a cashless society the most. Not so. The desire to go cashless is more pronounced in emerging economies than in developed economies.

In Turkey, for example, 42% would be willing to go completely cash-free versus 21% of Brits and 23% of Dutchmen – the two lowest percentages of all the countries surveyed.

The small stuff

Cash is still the dominant way to pay for smaller transactions. Almost 90% of respondents say they usually use cash when paying for amounts up to EUR 10. That percentage falls to around half for sums between EUR 11 and EUR 50. Once a transaction amount exceeds EUR 100, only 12% of people like to use cash.

How ‘safe’ is cash?

By contrast, attitudes about the safety of cash and cash equivalents are surprisingly similar across all countries.

More than half (55%) associate cashless payments with a ‘high’ or ‘very high’ level of security. That is more or less on par with the percentage of people (59%) who said that paying with cash is ‘safe’ or ‘very safe’. Here, Germany and Austria are the outliers: people in these countries have less trust in cash alternatives than anywhere else: 77% of Germans and 71% of Austrians believe cash is much safer than cashless payments.

No cash in my wallet – what now?

Despite a growing preference for cashless transactions, there is still a limit to how long people would be willing to walk around without cash.

Asked whether they thought they could get by if they didn’t have cash on them, but did have their debt cards or a mobile device, two-thirds said they felt comfortable that they could get by for the next three days. But once the horizon extends, the level of comfort declines: 38% believed they could get by for the next month with no cash on hand.

In retreat, but not dead

While the role of cash is clearly declining in daily life, it’s still likely to stick around for a while. Despite a growing preference for cashless transactions, around three quarters of people surveyed in Europe said they never go completely cashless.