ING posts 3Q18 net result of €776 million

Amsterdam, 1 November 2018, 7:00 am CET

- ING recorded strong commercial momentum with continued growth in primary customers and core lending

- Primary customer base increased in 3Q18 by 200,000 to 12.2 million and the total retail customer base stood at 38.0 million

- Net core lending was well diversified and grew by €6.8 billion in 3Q18; net customer deposit inflow amounted to €3.4 billion

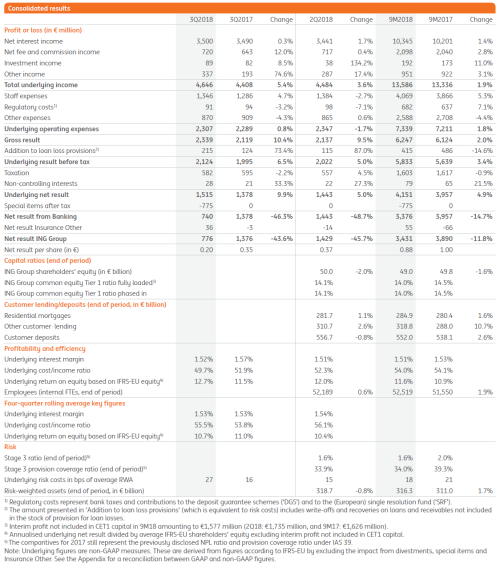

- ING 3Q18 underlying pre-tax result of €2,124 million; Net result was €776 million after €775 million settlement amount

- 3Q18 result reflects continued business growth at resilient margins, low level of risk costs and expense control

- 3Q18 net result includes €775 million settlement agreement with the Dutch authorities as announced on 4 September 2018

- ING’s 3Q18 four-quarter rolling average underlying ROE was 10.7% and the fully loaded CET1 ratio remained strong at 14.0%

CEO statement

“The third quarter of 2018 for ING was deeply marked by the settlement agreement with the Dutch Public Prosecution Service. As a bank, we have the responsibility to ensure that our operations meet the highest standards, especially when it comes to securing the integrity of our own operations and that of the financial system,” said Ralph Hamers, CEO of ING Group. “Not meeting these standards is unacceptable. It is sincerely regrettable that the investigations identified serious shortcomings in the execution of policies to prevent financial economic crime at ING Netherlands. We take this very seriously and accept full responsibility. Under the terms of the agreement, ING has paid a fine of €775 million in the third quarter of 2018.

“We are committed to conducting our business with integrity, and are taking a number of robust measures to strengthen our management of compliance risks and support a stronger risk awareness culture. We are enhancing our customer due diligence files where necessary and are working on various structural improvements in our compliance policies, tooling, monitoring and governance. To embed these improvements thoroughly and sustainably across the organisation, we will give continuous attention to fostering a stronger compliance risk management mindset. Regulatory compliance is a key priority which we will advance on through clear leadership communication, training courses, integrity dilemma workshops and behaviour risk assessments. Integrating regulatory compliance more deeply into our DNA will support sustainable results. Last, but not least, we find it very important to continue our collaborations with public and private entities, including our supervisors and regulators, to achieve better structural outcomes in this area.

“Commercial momentum was strong in the third quarter of 2018 and ING recorded continued business growth at resilient margins. The underlying result before tax was €2,124 million, up both year-on-year and sequentially. Net core lending growth in the third quarter was robust at €6.8 billion and was well diversified across Retail and Wholesale Banking. We gained 200,000 primary customers during the quarter, bringing the total to 12.2 million, while our total global customer base was 38.0 million at the end of the quarter. Expenses remained under control and were only slightly higher than a year ago. Compared with the previous quarter, expenses were 1.7% lower. Risk costs amounted to an annualised 27 basis points of average risk-weighted assets, well below the through-the-cycle average, notwithstanding broader financial market volatility including events in Turkey. The underlying return on equity on a four-quarter rolling average basis rose to 10.7%. The quarterly net result was €776 million, including the settlement amount, which was recorded as a special item after tax. ING Group’s fully loaded CET1 ratio remained strong at 14.0%.

“Banks also have a responsibility to finance positive change and we are stepping up to that. In the third quarter, we announced ING’s commitment to steer our lending portfolio toward the well-below 2-degree goal of the Paris Climate Agreement. This will be done using an innovative measurement approach, which we are co-developing with the 2 Degrees Investing Initiative. We are pleased to be the first global bank to commit to using science-based scenarios to steer our business strategy.

“The settlement did have an impact on our reputation and quarterly results. We remain focused on the execution of our Think Forward strategy and our commitment to our customers, shareholders, supervisors, regulators and other stakeholders. Our transformation plans are on track to reach the milestones set out in our strategy. We move ahead with a heightened resolve to strengthen our compliance risk management framework and further embed compliance into our corporate DNA. This will guide us as we build a sustainable future for ING.”

Analyst and investor conference call

1 November 2018 at 9:00 am CET

+31 (0)20 531 5821 (NL)

+44 203 365 3209 (UK)

+1 866 349 6092 (US)

Live audio webcast at www.ing.com

Media conference call

1 November 2018 at 11:00 am CET

+31 (0)20 531 5871 (NL)

+44 203 365 3210 (UK)

Live audio webcast at www.ing.com

Note for editors

For further information on ING, please visit www.ing.com. Frequent news updates can be found in the Newsroom or via the @ING_news Twitter feed. Photos of ING operations, buildings and its executives are available for download at Flickr. Footage (B-roll) of ING is available via ing.yourmediakit.com, or can be requested by emailing info@yourmediakit.com. ING presentations are available at SlideShare.

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 52,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s strategy, evidenced by ING’s ranking as a leader in the banks industry group by Sustainalytics. ING Group shares are included in the FTSE4Good Index and in the Dow Jones Sustainability Index (Europe and World), where ING is also among the leaders in the banks industry group.

IMPORTANT LEGAL INFORMATION

Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/2014.

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2017 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that

are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) potential consequences of European Union countries leaving the European Union or a break-up of the euro, (4) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness, (5) changes affecting interest rate levels, (6) changes affecting currency exchange rates, (7) changes

in investor and customer behaviour, (8) changes in general competitive factors, (9) changes in laws and regulations and the interpretation and application thereof, (10) geopolitical risks and policies and actions of governmental and regulatory authorities, (11) changes in standards and interpretations under International Financial Reporting Standards (IFRS) and the application thereof, (12) conclusions with regard to purchase accounting assumptions and methodologies, and other changes in accounting assumptions and methodologies including changes in valuation of issued securities and credit market exposure, (13) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (14) changes in credit

ratings, (15) the outcome of current and future legal and regulatory proceedings, (16) operational risks, such as system disruptions or failures, breaches of security, cyberattacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business, (17) the inability to protect our intellectual property and infringement claims by third parties, (18) the inability to retain key personnel, (19) business, operational, regulatory, reputation and other risks in connection with climate change, (20) ING’s ability to achieve its strategy, including projected operational synergies and cost-saving programmes and (21) the other risks and uncertainties detailed in the 2017 annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com. Many of those factors are beyond ING’s control.

Any forward looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.