Europeans diversify portfolios with alternative investments

9 March 2016

Findings from the ING International Survey on Savings 2016, which questioned nearly 15,000 people in Europe, the US and Australia, found that the record low interest rates offered on savings are leading many investors to diversify their portfolios to include non-traditional investments.

Europeans nearly as likely to put money into alternative forms of investment as in ‘safe haven’ bonds

In Europe2, around one in 20 have invested in peer-to-peer lending (6%) or ‘crowdfunded’ a project or venture looking for returns (5%) while 8% have put money into alternative investments - such as art, wine or hedge funds. In comparison, 10% are investing in bonds and 18% in shares – products commonly seen as mainstream investments.

Knowledge of alternative products remains low

Many people in Europe, however, remain unfamiliar with the ins and outs of these less traditional products. Just over half (56%) are aware of peer-to-peer lending and even fewer (39%) say they have an understanding of impact investing, where positive social or environmental effects resulting from the fund are a key goal. This suggests that many could be unaware of the risks and rewards involved.

Seeking higher return in low interest rate environment

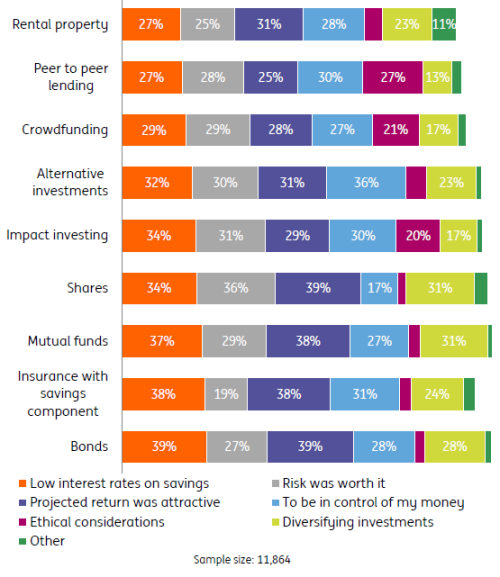

Around a third of those who have already put money into impact investing (34%) or crowdfunding (29%) did so because of persistently low interest rates offered on savings accounts.

In fact, a separate study by ING1 found that a third (33%) of those in Europe would respond to a move toward negative interest rates by moving at least some of their savings towards other investments. This suggests that if interest rates fall below 0%, people could turn to riskier investments.

Principles important driver

More than one in five across Europe said their principles were a major reason for choosing peer-to-peer lending (27%) and crowdfunding (21%). This was also the case with impact investing (20%), where investors actively seek a beneficial environmental or social impact alongside financial return, indicating that making a difference is as important as making a profit.

Overall, despite a wide variety of alternatives emerging, mainstream options still tend to be the most popular. Insurance with a saving component (19%) remains the most common type of investment, with 38%) who took out the product doing so for the attractive returns on offer, 38% because of the low interest rates on savings.

Ian Bright, senior economist at ING, commented: “The current interest rate environment across Europe is clearly on consumers’ minds when they consider where to put their money, with many choosing to invest in shares, bonds and less mainstream investments such as peer-to-peer lending too.

“However, knowledge of non-traditional types of investments remains low. There are lots of options available. It’s important people familiarise themselves with the risks and rewards and feel comfortable with their risk appetite so they choose a product that’s right for them.”

Table 1: Main reasons for putting money into each investment type

What are the main reasons you put money into...?

Percent who gave the below response. Multiple answers possible

About the ING International Survey

The ING International Survey of 14,664 people was conducted by Ipsos using internet-based polling. Fifteen countries were surveyed overall: Austria, Belgium, Czech Republic, France, Germany, Italy, Luxembourg, the Netherlands, Poland, Romania, Spain, Turkey, the United Kingdom, Australia and the USA. Polling took place between 8 October 2015 and 29 October 2015. The full report is available here.

The ING International Survey is produced three times a year by ING eZonomics. It is about money and life - combining ideas around financial education, personal finance and behavioural economics to produce regular and practical information about the way people manage their money - and how this can affect consumers' lives.

1 Additional figures taken from Negative rates, negative reactions (Dec 2015), p11, fig. 11. This report is available here.

2 All 14,664 survey respondents from the US and Australia as well as Europe, were asked the questions from the investment section of the survey. However, the sample size of respondents in Europe was 12,646.