Inflation’s here to stay, say European consumers

This article is a copy of the original article on Think.ing.com

Inflation is a major concern for consumers, and policymakers should worry that they think it's a long-term problem. Our latest ING Consumer Research survey indicates that people in eight European countries not only expect inflation to stay high for at least three more years but also expect those same goods to keep getting more expensive

Consumers across Europe are suffering from rising food prices and they don't expect this to change

Food and energy prices top list of perceived inflationary pressures

Households across Europe are worried that the so-called 'cost of living crisis' is here to stay. That's despite inflation rates in most European countries recently coming down, not least on the back of base effects and subsiding food and energy price pressures. Economists expect prices to fall further, but the consumers we've been speaking to in Germany, Belgium, the Netherlands, Spain, Luxembourg, Poland, Romania and also Turkey beg to differ. Most expect prices to stay well above what they consider 'stable' for at least three more years. And they also assume their inflationary pain points will stay the same.

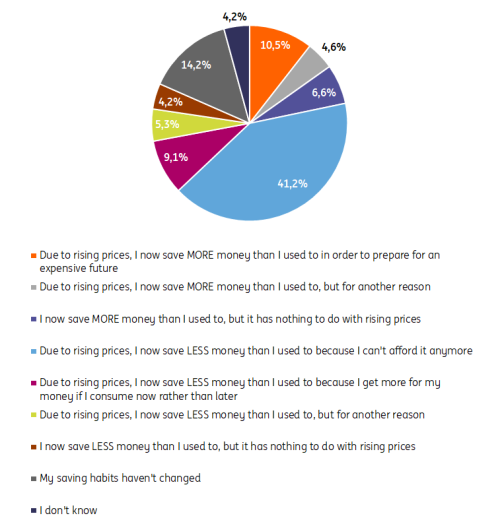

These perceptions are concerning as far as they relate to future spending. We'll dive into the figures shortly, but our survey suggests three-quarters of people whose saving habits were impacted by inflation say they're saving less because they can't afford to or they're saving more to be prepared for future price increases. So, this should have a negative impact on discretionary spending. Only one in eight say they're saving less to spend their money now.

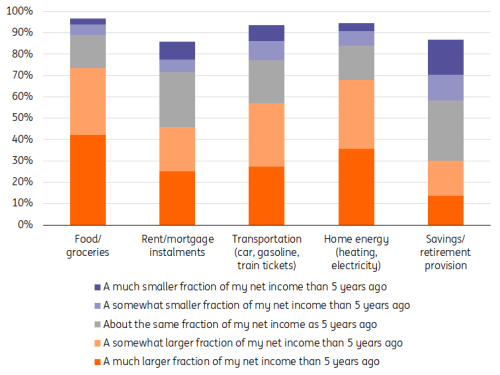

In a survey for ING Consumer Research, consumers were asked to compare the percentage of their net income they now spend on various groups of goods to what percentage they had been spending 5 years ago. Unsurprisingly, food and energy top the list; these items have also been leading official inflation statistics.

This picture is roughly the same across participating countries, with Belgium and the Netherlands consistently producing some of the lowest numbers. In most eurozone countries, spending on savings and retirement provision suffered, whereas the non-eurozone countries had considerably larger fractions reporting increases rather than decreases.

Compared to 5 years ago, I now spend on:

Diff. to 100%: “I don’t know”, unweighted average across surveyed countries; source: ING Consumer Research

Consumers expect more of the same

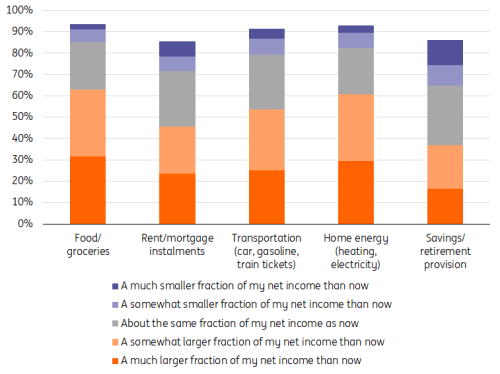

We asked consumers to make an assumption about the percentage of income they'd be spending five years down the line compared with today. And this column chart looks remarkably similar across the countries we surveyed. Most consumers do not appear to believe in any sort of base effect. Instead, they expect to spend more of their income on those categories that have already seen the largest increases.

5 years ahead compared to now, I assume I will spend this much on...

Diff. to 100%: “I don’t know”; source: ING Consumer Research

Many can't afford to save anymore

More than 80% of consumers reported changes in their savings behaviour, with the vast majority being related to rising prices. Being forced to reduce the amount that goes into savings was by far the most-selected answer in all countries. Depending on the circumstances, it might also make sense from an economic point of view to save less and spend the money on goods before they become even more expensive. But this is not a popular choice among consumers, who instead prefer to save more in order to be better prepared for rising prices. More than 20% in Turkey reported this.

So, while spending on basic needs is likely to simply go up or down with prices and stay more or less constant in real terms, discretionary spending is going to be hit. If prices do come down faster than consumers expect, we might see a bit of a spending spree from those who were able to build up savings in preparation for higher prices that never came. But that's unlikely to affect the overall picture.

Which of the following statements best describes the influence that inflation has had on your saving habits?

Source: ING Consumer Research

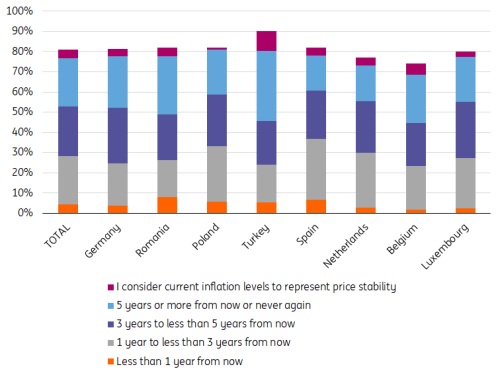

Inflation is believed to stay high for longer, especially in Turkey

Turkish consumers have a different kind of experience with inflation than the rest of Europe. So, it doesn’t come as a surprise that only 10% do not have an opinion as to when inflation numbers will come down to a level of price stability; at least 18% selected “I don’t know” in all other countries.

Some Turkish consumers are sceptical; others are fatalistic. The number of 35% for “5 years or more from now or never again” is the survey’s largest, and so are the 10% who already consider current inflation levels to mean price stability, as they are at least a bit removed from 2022’s record levels.

When do you think official headline inflation in your country will come back down to a level that you would consider price stability?

Diff. to 100%: “I don’t know”, TOTAL: unweighted average across surveyed countries; source: ING Consumer Research

Consumers' assessment of their financial situation shows little signs of improvement

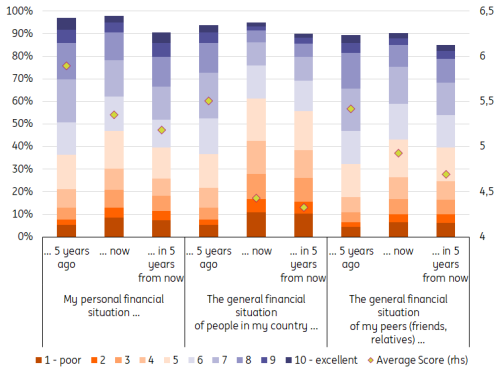

If you don’t believe that the most pressing economic issue will subside anytime soon, you most likely won’t expect things to get better, and European consumers don’t either. Ratings of their own current financial situation on a scale from 1 to 10 compute to an average of 5.4, ranging from 4.6 in Turkey to 6.2 in the Netherlands.

Looking back on their situation five years ago, consumers give an average score of 5.9, with every country seeing a drop of at least 0.1. And the outlook is bleak: Consumers’ expectations for their situation in 5 years average out at 5.2, with no country expecting an upswing.

How would you rate the following?

Diff. to 100%: “I don’t know”, unweighted average across surveyed countries; source: ING Consumer Research

Consumers were also asked to rate the financial situation of their own peer group and that of their country’s general population over the same time span. Their peers' finances rank a bit lower than their own, with lower percentages for the extreme ends of the scale and a higher one for “I don’t know”.

But the nationwide picture looks alarming: Consumers rate their fellow countrymen’s finances five years ago at just a bit lower than their own. But the current situation and the future look much worse to them, with a drop twice as big as the one they experienced themselves.

What’s striking about this finding is that consumers’ individual perceptions and expectations about inflation don’t appear to tally with what they expect for their economies as a whole. Inflationary pressures, not least in food and energy, have been dominating global news headlines since the war in Ukraine started. That sustained media focus on people’s troubles may well explain the discrepancy.

A detailed analysis of the results for Belgium is available here in French and here in Dutch. A more detailed look at the German results, including additional questions on price caps, can be found here.