ING 3Q16 underlying net result EUR 1,336 million

Amsterdam, 3 November 2016, 07:00 CET

ING's 3q16 results in 90 secondsOur CEO Ralph Hamers shares the highlights of ING's 3Q16 in 90 seconds.

Posted by ING on Wednesday, November 2, 2016

- ING Bank 3Q16 underlying net result EUR 1,336 million, up 22.3% year-on-year, reflecting solid commercial momentum

- ING Bank recorded EUR 3.6 billion of net core lending growth and attracted EUR 2.0 billion of net customer deposits in 3Q16

- Performance reflects continued loan growth at healthy margins, as well as higher commission and fee income

- Operating expenses declined slightly year-on-year and sequentially; risk costs remained relatively low at 34 bps of average RWA

- ING Group 3Q16 net result EUR 1,349 million (or EUR 0.35 per share); robust ING Group CET1 ratio and ING Bank ROE

- ING Group fully-loaded CET1 ratio rose to 13.5%; ING Bank underlying ROE of 11.3% for the first nine months of 2016

- ING Group fully-loaded CET1 ratio rose to 13.5%; ING Bank underlying ROE of 11.3% for the first nine months of 2016

CEO Statement

“ING delivered another quarterly result that exemplifies our Think Forward strategy in action,” said Ralph Hamers, CEO of ING Group. “We again recorded solid commercial growth and introduced several new innovations. Year-to-date, we have established over 400,000 new primary customer relationships. To foster further growth and maintain our standing as a leading European bank, we strive to keep getting better every day, while managing the pressure on returns from the continuous regulatory burden and the low interest rate environment. In this context, I am convinced that our recently announced investment programme and intention to converge towards a single digital banking platform are necessary steps to enable ING to evolve with changing customer expectations and to increase operational efficiency.”

“ING Bank recorded EUR 3.6 billion of net core lending growth and attracted EUR 2.0 billion of net customer deposits in the third quarter. Lending growth was well diversified across Retail and Wholesale Banking. We also continued to facilitate our clients’ sustainable transitions through deals that support recycling, the circular economy and renewable energy. We are proud that our integrated sustainability approach earned ING the number-one ranking among global listed banks by Sustainalytics in August. We also achieved a significant year-on-year improvement in our Dow Jones Sustainability Index ranking, and received the highest possible score in CDP’s annual review for our performance and disclosure related to our climate change strategy.”

“During the third quarter, we introduced another wave of innovative and insightful financial tools that empower customers. In Spain, the launch of Twyp Cash provides customers with greater convenience by enabling them to withdraw cash using their smartphones when making purchases at more than 3,500 supermarkets and petrol stations. In Wholesale Banking, we developed Virtual Cash Management, an advanced application that allows companies to manage their cash across banks and borders. It provides corporate treasurers with enhanced cash visibility, access and control, anytime and anywhere.”

“More recently, we created and launched the money management platform Yolt as a next step in digitalisation and in preparation for upcoming European regulation that will open the payment services market to new players in 2018. Yolt gives users insight into their account information from different banks in one easy overview, helping customers stay on top of their finances. The app is currently being tested only in the United Kingdom, but we will explore opportunities for expansion.”

Ralph Hamers, CEO of ING Group

We again recorded solid commercial growth and introduced several new innovations. To foster further growth and maintain our standing as a leading European bank, we strive to keep getting better every day, while managing the pressure on returns from the continuous regulatory burden and the low interest rate environment.

“ING’s third-quarter underlying result before tax was EUR 1,878 million, reflecting continued loan growth at healthy margins, effective cost control and a relatively low level of risk costs. Challengers & Growth Markets delivered another record quarterly result on the back of further organic growth. Retail Benelux showed resilience, as the performance of the Netherlands compensated for the decline in results at Retail Belgium, which were down 16.5% year-on-year. ING Group’s fully-loaded CET1 ratio rose to 13.5%. ING Bank’s underlying ROE was 11.3% for the first nine months of 2016.”

“As announced on 3 October, we intend to invest EUR 800 million over the next five years to create a scalable banking platform to cater for continued commercial growth, an improved customer experience and a quicker delivery of products. Regrettably, our intended transformation will impact many of our employees, particularly in Belgium and the Netherlands. We will do our utmost to build on our track record of helping colleagues who are or could be affected to find new job opportunities. All of those affected will be treated with respect and care.”

“I fully appreciate the hard work of our employees that is reflected in our quarterly results. While change is not easy, it is essential to build on our position of strength. I have complete confidence in our ability to execute on our strategy and truly believe that the measures we intend to implement will ensure that we continue to empower customers to stay a step ahead.”

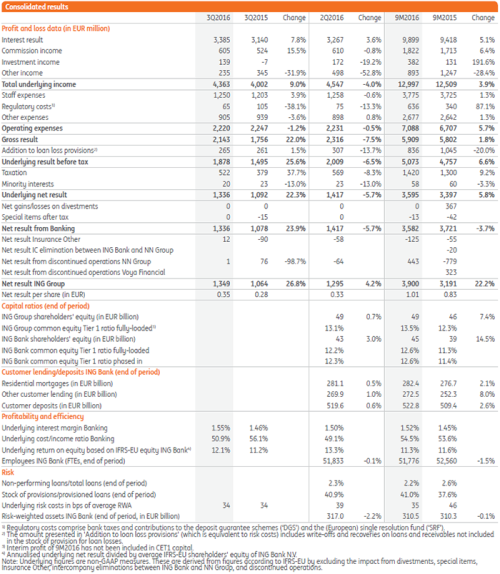

Consolidated Results

Analyst and investor conference call

3 November 2016, at 9:00 a.m. CET

NL +31 20 703 8261

UK +44 20 3043 2026

US +1 719 325 2213

Listen to the investor conference call at www.ing.com

Media conference call

3 November 2016, at 11:00 a.m. CET

NL +31 20 531 5871

UK +44 203 365 3210

Listen to the media conference call at www.ing.com

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s 52,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s corporate strategy, which is evidenced by ING Group shares being included in the FTSE4Good index and in the Dow Jones Sustainability Index (Europe and World) where ING is among the leaders in the Banks industry group.

IMPORTANT LEGAL INFORMATION

Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014.

Projects may be subject to regulatory approvals. Insofar as they could have an impact in Belgium, all projects described are proposed intentions of the bank. No formal decisions will be taken until the information and consultation phases with the Work Council have been properly finalised.

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2015 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) break-up of the euro, (4) potential consequences of European Union countries leaving the European Union, (5) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit markets generally, including changes in borrower and counterparty creditworthiness, (6) changes affecting interest rate levels, (7) changes affecting currency exchange rates, (8) changes in investor and customer behaviour, (9) changes in general competitive factors, (10) changes in laws and regulations, (11) changes in the policies of governments and/or regulatory authorities, (12) conclusions with regard to purchase accounting assumptions and methodologies, (13) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (14) changes in credit ratings, (15) ING’s ability to achieve projected operational synergies and (16) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com. Any forwardlooking statements made by or on behalf of ING speak only as of the date they are made, and, ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.