ING 1Q17 net result EUR 1,143 million

Amsterdam, 10 May 2017, 07:00 am CET

- ING continues to record commercial growth in 1Q17 with consistent focus on innovation and sustainability

- Primary customer numbers up: EUR 5.7 billion net core lending growth and EUR 6.7 billion net customer deposit inflow

- ING’s innovative new products and services as well as sustainability initiatives are increasingly being adopted by the market

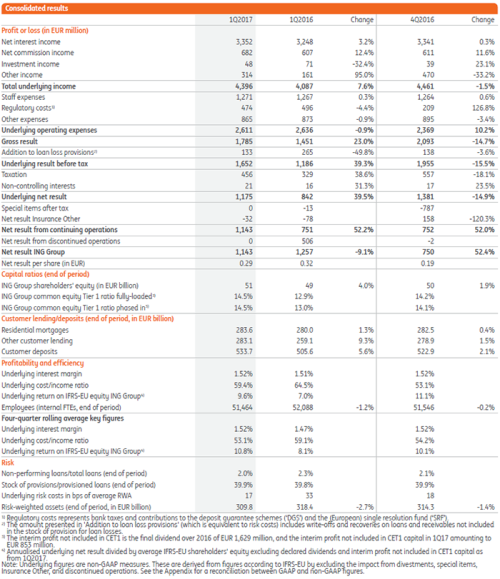

- ING 1Q17 underlying pre-tax result of EUR 1,652 million, up 39.3% year-on-year

- Strong result reflects robust loan growth at resilient margins, improved performance in Financial Markets and lower risk costs

- ING Group fully-loaded common equity Tier 1 (CET1) ratio of 14.5%, up from 14.2% at year-end 2016

CEO statement

“ING had a strong first quarter supported by continued commercial growth,” said Ralph Hamers, CEO of ING Group. “ING’s underlying pre-tax result rose 39.3% to EUR 1,652 million from a year ago, reflecting continued loan growth, good cost control and relatively low risk costs. Wholesale Banking’s contribution was particularly strong, led by higher income from Financial Markets and commissions. While the first-quarter net result declined to EUR 1,143 million from EUR 1,257 million a year ago, this is explained by a EUR 506 million profit from the sale of shares in NN Group in the first quarter of 2016.”

“We continued to innovate in Wholesale Banking, where Easy Trading Connect reached a milestone by successfully completing the first test of a large oil trade using blockchain technology, in cooperation with one of our clients and a major French bank. This proves that the commodity trade finance sector, where processes are largely paper-based and labour intensive, can be digitalised. We also collaborated with our client Royal Philips, acting as Sustainability Coordinator in the creation of the first syndicated loan where the pricing is linked to the client’s Sustainalytics rating. If the rating goes up, the interest rate on the EUR 1 billion revolving credit facility goes down—and vice versa. This is an example of how companies are increasingly integrating sustainability into their business objectives.”

“We’re innovating across other areas of the bank as well. For example, with Payconiq, the mobile payments platform developed by ING, launched in Belgium in 2015 and now supported by two other Belgian banks. The number of Belgian retailers using the service has increased to 25,000 from 6,500 in July of last year. Following this success, ING and five other Dutch banks announced plans to launch Payconiq in the Netherlands this summer.”

Ralph Hamers, CEO of ING Group

ING is uniting people, platforms and processes to build the bank of the future.

“I am proud that all of the innovations highlighted above were developed by ING and then adopted by other banks. This underscores our record as a digital banking leader and shows that we’re able to provide an experience for customers that makes us stand out from our competitors. This approach is just one of the reasons why our Net Promoter Score has improved to number one in eight countries, up from seven countries last quarter. ING had 36.1 million customers as at 31 March 2017, including 9.85 million primary bank customers, which is an increase of 8.4% year-on-year.”

“Our net core lending grew by EUR 5.7 billion in the quarter, well diversified across Retail and Wholesale Banking, and net customer deposits increased by EUR 6.7 billion. Stable margins and higher commissions helped drive a 39.5% increase in the underlying net result compared with the first quarter of 2016. Operating expenses were well controlled, despite seasonally high regulatory costs, while risk costs remained low. ING Group’s fully loaded CET1 ratio increased by 0.3 percentage point to 14.5% at the end of March 2017, while the four-quarter underlying return on equity improved to 10.8% from 8.1% a year ago.”

“As we announced in October 2016, ING is uniting people, platforms and processes to build the bank of the future. In Belgium, ING and our trade union partners agreed on a Social Plan that supports employees whose jobs may be impacted and results in a lower number of compulsory lay-off s, while staying in line with the financial impact we estimated in October.”

“We said farewell to CFO Patrick Flynn this week and will do the same for CRO Wilfred Nagel in August. I’m grateful for all that they have done for ING and for me personally over the years. As of this week, we welcome Koos Timmermans and Steven van Rijswijk to the Executive Board, and Roland Boekhout to the Management Board Banking. Their leadership will help drive ING’s transformation into the digital bank of the future as we focus on remaining relevant for our customers, thereby ensuring our own sustainable success.”

Analyst and investor conference call

10 May 2017, at 9:00 a.m. CET

NL +31 (0)20 341 8241

UK +44 203 365 3209

US +1 866 349 6092

Live audio webcast at www.ing.com

Media conference call

10 May 2017, at 11:00 am CET

NL +31 (0)20 531 5871

UK +44 203 365 3210

Live audio webcast at www.ing.com

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 51,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s corporate strategy, which is evidenced by ING Group shares being included in the FTSE4Good index and in the Dow Jones Sustainability Index (Europe and World) where ING is among the leaders in the Banks industry group.

IMPORTANT LEGAL INFORMATION

Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014.

Projects may be subject to regulatory approvals. Insofar as they could have an impact in Belgium, all projects described are proposed intentions of the bank. No formal decisions will be taken until the information and consultation phases with the Work Council have been properly finalised.

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2016 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) potential consequences of European Union countries leaving the European Union or a break-up of the euro, (4) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness, (5) changes aff ecting interest rate levels,(6) changes aff ecting currency exchange rates, (7) changes in investor and customer behaviour, (8) changes in general competitive factors, (9) changes in laws and regulations and the interpretation and application thereof, (10) geopolitical risks and policies and actions of governmental and regulatory authorities, (11) changes in standards and interpretations under International Financial Reporting Standards (IFRS) and the application thereof, (12) conclusions with regard to purchase accounting assumptions and methodologies, and other changes in accounting assumptions and methodologies including changes in valuation of issued securities and credit market exposure, (13) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (14) changes in credit ratings, (15) the outcome of current and future legal and regulatory proceedings, (16) ING’s ability to achieve its strategy, including projected operational synergies and cost-saving programmes and (17) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com. Many of those factors are beyond ING’s control.

Any forward looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.