Consumers face losing out by holding both savings and debt

With the ECB expected to keep interest rates very low for the foreseeable future, new research shows that European consumers may risk paying millions in unnecessary interest by not considering the use of savings to reduce expensive debts.

Amsterdam, 5 March 2015

€3,500 debt combined with €5,200 in savings

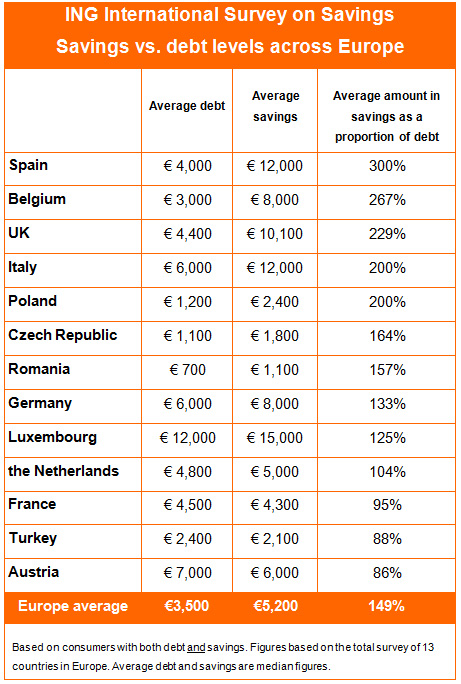

Based on the spending habits of more than 12,500 consumers across 13 European countries, the ING International Survey on Savings shows that almost one in four (22%) consumers in Europe hold both savings and non-mortgage debt at the same time. Among those European consumers with debt and savings, the average (median) debt held is €3,500 while typical savings amount to €5,200 more than enough to clear this debt and still have some left in the kitty.

Europeans could be spending €32m a day on debt that could be reduced with savings

With interest rates received on savings typically lower than on debt, experts at ING calculate Europeans are potentially paying €32 million a day in interest on debts that they could potentially reduce with the savings they also hold. Furthermore, two thirds (67%) of respondents with debt are still actively adding money to their savings. While consumers may hold debts and savings for numerous and valid reasons, this suggests that many Europeans could be prioritising saving over paying off relatively expensive debts.

In aggregate, Spanish consumers have the highest average savings to average debt ratio amongst those with both savings and debt – potentially meaning that average savings could repay average debt three times. The figures tell a similar story for the UK and Belgium, with both countries on average having enough savings to pay off their debts twice over. When savings are matched to debt on an individual basis, 60% could afford to pay off all their debt from savings. The remaining 40% could at least reduce their debt.

Reasons for debts & savings

Economic experts at ING believe that several factors could contribute to individual people having both savings and debt but they highlight two.

First, results from the survey show consumers are more likely to know what they are earning on their savings rather than what they are paying on debts, despite the latter typically being higher. 27% are unaware of the interest they are paying on their debts versus the 19 per cent who do not know their interest rate on savings.

Second, individuals may fall for the thinking trap of ‘mental accounting’ - the idea that people think of their money in separate accounts and apportion different values to it depending on where it came from. As a result, they may not recognise the joint effect on their financial wellbeing of having both savings and debt.

The trap of mental accounting

Ian Bright, senior economist at ING explains: "Individual circumstances vary and there may be many good reasons to have both savings and debt. However, some may be unaware of the impact of the two on their overall financial wellbeing because they think of the two as separate pots and fall into the trap of mental accounting.”

Full Report

More about the ING International Survey on Savings in this news article on ING.com or in the full report below.