Mobile app use sees emergence of cashless society

Amsterdam, 9 April 2015

- 185m European consumers expected to use mobile payment apps over the next year

- Demand greatest from consumers in Turkey and Poland, but lack of trust is the biggest barrier to uptake

- 9% Europeans have used ‘digital wallet’ services such as Apple Pay

Half of European adults with access to a mobile device such as a smart phone or tablet computer expect to use mobile payment apps over the next 12 months, according to the ING international survey of more than 14,000 consumers.

Towards a cashless society

While 33% of Europeans have already used a mobile payment app, which allows the user to make payments via mobile or tablet, this is expected to increase to 51% over the next 12 months. This means as many as 185m European consumers could be moving towards a cashless society choosing to pay electronically rather than with physical cash.

The Survey on Mobile Banking also revealed that Turkish (56%) and Polish (43%) mobile device owners are leading the way when it comes to embracing mobile payment apps – a higher adoption rate than in the USA (42%).

However, the uptake of mobile payment apps is more gradual across some of the stronger European economies. Just one in eight have made payments via smartphone or tablet in the Netherlands (13%), while a quarter across Germany (23%) and France (25%), and 30% in the UK have done so – all of which lag behind leaders Turkey and Poland.

For those yet to embrace mobile payment apps, a lack of trust is cited as the biggest barrier (42%). These figures suggest there is still work to be done in reassuring consumers that their details are secure.

Other key findings:

1. Netherlands most “developed” mobile banking market; Europe lags United States

The Netherlands is the “most developed” mobile banking market in the ING International Survey 2015 – a position it has held for the previous two surveys. The United States is in second place in the survey, closely followed by the United Kingdom. Overall, uptake in Europe (indicated by the weighted average European consumer) is lower than in the United States and Australia, but the share in Europe who intend to use it in the next 12 months is higher.

The question was only asked to people in the survey who had indicated they own a mobile device (such as a smart phone or tablet). Because of this change to the way the question was asked, direct comparisons cannot be made with mobile banking penetration rates in ING International Surveys from previous years. Our measure of the degree to which mobile banking is “developed” is formed by multiplying the percent in each country who said they use mobile banking by internet penetration in each country, as reported by the European Commission, Turkish Statistical Institute, Australian Communication and Media Authority and US Census Bureau. This adjustment is particularly useful as the ING International Survey is internet-based and adjusting in this way gives a proxy for the whole population.

Turkey future “hotspot” mobile banking

Turkey has the highest share of internet users who use mobile banking, suggesting that the usage in Turkey has potential to rapidly grow. It is for this reason that Turkey is identified as a future “hotspot” for mobile banking. Its potential is further demonstrated by the comparison to the internet-adjusted measure, where Turkey has the joint 12th highest share using mobile banking. Once only internet users are considered, it rises to the top.

The question was only asked to people in the survey who had indicated they own a mobile device such as a smart phone or tablet. Because of this change to the way the question was asked, direct comparisons cannot be made with mobile banking penetration rates in ING International Surveys from previous years. Internet users in Romania and Italy are particularly likely to expect to use mobile banking in the next 12 months.

2. Most say mobile banking leads to better money management

Mobile banking is perhaps most often lauded for its convenience; however, there appear to be many other benefits as well. The vast majority of people who use mobile banking indicate their money management has improved since using the technology, such as feeling more “in control” of finances, not missing payments and even saving more.

In fact, 85% of mobile bankers in Europe list at least one way their money management has improved since using it, rising to 90% or higher in Italy, Romania, Poland and Turkey. Mobile banking is not always linked with positive change. In a separate question, a common reason respondents do not use mobile banking is a lack of trust in the security.

3. Feeling more in control of money and paying bills on time

Many mobile bankers in Europe say the technology helps them feel “more in control” of their finances, with almost half giving that response – the most frequently cited of all options. And almost a quarter say they now use internet banking much less often to manage their money.

1:5 never missed a payment

Remarkably, one-in-five mobile bankers in Europe say they have never missed a payment since using mobile banking. The technology may also help people avoid other financial mistakes such as missing bill payments and going into overdraft (and potentially being charged penalties or fees). The results add to more than 100% as respondents could give more than one answer.

4. “My closest store is my phone” for many in Europe

How common is it to shop on a mobile device? More than half of people in Europe and the United States who have a mobile device have shopped on it in the last 12 months, buying goods and services via a smartphone or tablet. Turkey, Poland, Romania and Italy have the highest share of “mobile shoppers” in the survey. Belgium, the Netherlands and France have the lowest.

Mobile shopping doesn’t preclude also using more traditional brick and mortar stores as well. This question was asked only to people who indicated they owned a mobile device, such as a smart phone or tablet.

5. Clothing and electronics most commonly bought by mobile shoppers

Clothing and electronics were the items most commonly bought in the last 12 months using a mobile device on average in Europe and across the United States and Australia. Games, groceries and music round out the top five.

Within countries in Europe there are some nuances, with electronics taking the top spot from clothing in Italy, Romania, Luxembourg and the Czech Republic. Buying groceries using a mobile phone is particularly popular in the United Kingdom, where it is the second most popular category after clothing.

Mobile shopping is most common in Turkey of all countries surveyed. In contrast, the uptake is much lower in the Netherlands and Belgium.

6. Easier to splash the cash on mobile?

Mobile banking might encourage people to feel more in control of their money. However, new technology may also leave these people vulnerable to tempting shortcuts when shopping. Of mobile shoppers in Europe, 55% agree they are more inclined to shop at stores that save payment details for “one-click” ordering. This compares with 22% of non-mobile shoppers.

The trend is seen in all countries in the survey. It is highly pronounced in the United States, United Kingdom, Italy and Australia. While one-click ordering is not necessarily problematic, this ease of ordering might encourage spending while reducing the impulse to shop around for a cheaper deal.

7. Men buy gadgets and games, women buy clothes

When it comes to buying furniture and home delivered meals using a mobile device, a similar share of men and women in Europe have made such a purchase in the last 12 months. But for other categories there are some clear differences.

More women say they have bought clothing on a mobile device in the last 12 months. Meanwhile, a much higher share of men indicate they shopped on mobile for electronics, music and games in the last 12 months. The results are only from people in Europe who own a mobile device.

8. Half are using cash less – but we are not cashless (yet)

There are more ways to shop than ever. Do you swipe a credit card, wave for contactless payment, buy via a mobile payment app, hand over cash or use another way? Against this backdrop, half of people in Europe say they are using physical cash less.

People in Turkey, Poland and Italy are giving up cash at the fastest pace. Austria and Germany have the joint lowest share saying they use cash much less than 12 months ago. More people in the United States agree with the statement than in Europe.

9. Future of spending online? Digital currencies not seen as the answer

Bitcoin, launched in 2009, is arguably the most high-profile of several digital currencies that have existed. However, few people in Europe see digital currencies – such as bitcoin – as “the future of spending online”.

Of people in Europe, 72% either disagree with that statement or do not have an opinion about it, a slight drop from 76% from the ING International Survey on Mobile Banking 2014. Turkey, Italy, Spain and Poland are among the countries where acceptance is highest. These countries also have a higher share which say they have used bitcoin in the past 12 months.

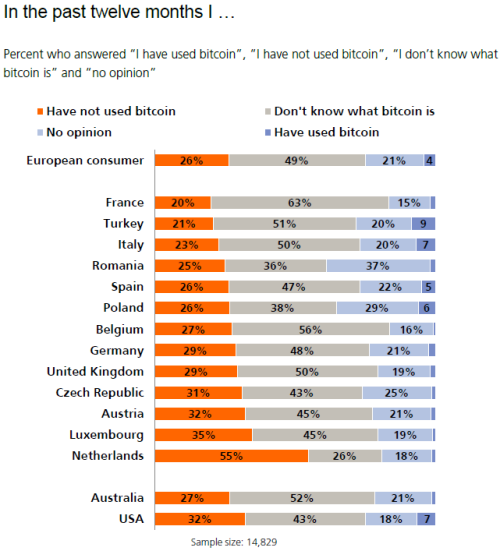

10. Media hype makes bitcoin attractive but awareness still low

Bitcoin is arguably the most high profile digital currency and has been the topic of media attention, academic studies and the term was even added to the Oxford Dictionaries Online in August 2013. Despite this, use and awareness of the decentralised cryptocurrency remains low among most people in Europe. When asked if they have used bitcoin in the past 12 months, 26% of people in Europe say they have not and 49% say they don’t know what bitcoin is. Only 4% in Europe say they have used it in the last year.

Turkey is home to the highest share who say they have used bitcoin in the past 12 months, followed jointly by the United States and Italy, then Poland and Spain.

When asked why they had used it, answers varied. An Austrian man, aged 33, wrote: “I found it interesting to concern myself with it (was curious after there were media reports about it again and again).” An Italian woman, 29, had an app that uses bitcoin to recharge her mobile phone. A French man, 51, wrote: “I had to buy things on the dark net.” A Dutch man, 74, received it as a gift. When others were asked why they did not use bitcoin, responses included an Australian woman, 69, who wrote, “I have heard bad publicity about it” and an American man, 30, who noted, “I have no idea how to access it”.

11. Trust the biggest barrier to using mobile payments

Of people in Europe who have not used a mobile payment app, 42% say a reason is lack of trust . A similar share state they have never had the opportunity to use the technology. In contrast to the share of self-declared early adopters, few people favour the opposite view (the “late majority” or “laggards”) and are reluctant to use new technology.

12. Owe friends? Traditional channels still more popular way to repay

The launch of Apple Pay, Google Wallet, payments via WhatsApp and other ways to pay via alternative providers have been in the mainstream media headlines. However, mobile payment apps offered by respondents’ own banks are the most common way to repay friends for a small loan, such as a share of a dinner bill. Overall, 14% of people in Europe have repaid friends through their own bank’s mobile payment app and a further 45% would consider using it.

Social Media lag behind

The next most common in the survey is using “named groups”, such as Google Wallet or Apple Pay. Social media (such as Twitter or Facebook) lags behind the other options. This question was only asked to people who indicated they owned a mobile device, such as a smart phone or tablet.

13. Fewer than one of 10 have used digital wallets services

Despite the introduction of Apple Pay and Google Wallet, two leading services that allow payments to be made from debit or credit cards via smartphone, 9% respondents has used these or other ‘digital wallet’ services to date. Additionally, users are far more likely to consider using the app associated with their bank for mobile payments (59%) than ‘named groups’ such as Apple or Google (39%).

ING Senior Economist Ian Bright comments:

“The global market for mobile payments is reported to be growing rapidly and what we’re seeing is a major shift in consumer attitudes and behaviour to support that growth – though not everyone is convinced about moving to a cashless society just yet. While physical cash still has its place in society, mobile payment apps are giving consumers greater freedom when it comes to managing their finances. The instant visibility offered by mobile banking also means more consumers feel in control of their finances, claiming to have avoided missing payments and keeping on top of bills.”

Full report

The full report can be downloaded, viewed or embedded in an online article via our slideshare account