UK tops European Savings League

Amsterdam, 14 January 2015

More than a third of European consumers have no savings whatsoever

The UK is leading the way when it comes to saving money, according to more than 12,000 consumers across Europe in our International Survey on Savings 2015. Almost one third (31%) of UK consumers grew their savings in 2014 compared to the European average of 19%.

Steady state of saving

Consumers in the Netherlands come a close second with 27% of consumers growing their savings across the year. Taking Europe as a whole, the rate of consumer saving remained similar to levels recorded in the 2014 survey suggesting a steady state of saving.

Stability across Europe

Overall, the 2015 survey painted a picture of stability across Europe as neither personal savings nor debt positions deteriorated from the levels recorded in 2014. So, while the number of European consumers adding to their savings failed to increase over the last 12 months, consumers were no more likely to dip into their savings either.

The Netherlands tops the ING Savings Comfort League this year

For the last four years, respondents to the ING International Survey on Savings have been asked how comfortable they are with the amount of money they have in savings – a question that taps into feelings around money. The Netherlands tops the ING Savings Comfort League this year with the highest proportion saying they are very comfortable or comfortable with the amount they have in savings, up one place from second last year.

38% of people in Europe say they do not have any savings

It is a small rise on last year and rises to a high of 60% in Romania. Rises were seen in 10 of the 13 countries surveyed. In the survey, savings was defined as money readily available (specifically excluding pensions and policies that may pay out in the future).

Fewer are saying the current economic situation has led to a deterioration in their finances

In nine of the 13 countries surveyed, fewer people compared with this time last year are saying the current economic situation has led to a deterioration in their finances. It suggests more feel the wider economic environment is improving, despite pressure on the savings stockpile of some people.

More likely to know how much interest they are paid on savings than how much they are paying on debts

Balancing savings with paying off debts appears to continue to challenge many people in Europe. Somewhat alarmingly, respondents are more likely to know how much interest they are paid on savings than how much they are paying on debts. And some appear to be missing an opportunity to use their savings to pay off high interest debt more quickly, with 44% in Europe with credit card debt saying they also have savings.

There is widespread caution around borrowing, with about four-in-five in Europe agreeing “It is easy to borrow money and get trapped in a cycle of debt”. The level of agreement is high across all of the 13 countries surveyed and there is little difference in the attitude of those people who have debt and those who do not.

Europe’s money secrets revealed

Are we open with our loved ones about how much we earn and what we buy? The ING International Survey on Savings 2015 asked almost 13,000 people in 13 countries in Europe to find out.

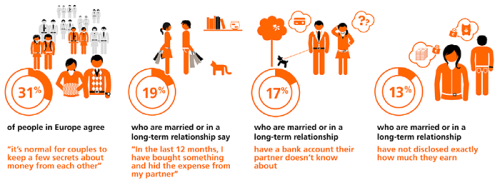

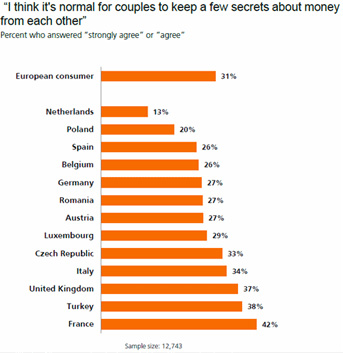

Money secrets “normal”, say three-in-ten

About three-in-ten people in Europe agree it’s normal for couples to keep a few secrets about money from each other. People in France, Turkey and the United Kingdom are the most likely to agree. At the other end of the spectrum, the Dutch are most likely to expect their partner to be open and honest about all money matters, followed by the Poles.

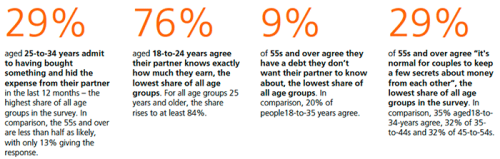

There was little difference in attitude between men and women. However, more mature respondents – particularly those aged 55 and older – were less likely to agree it’s normal for couples to keep a few secrets about money from each other.

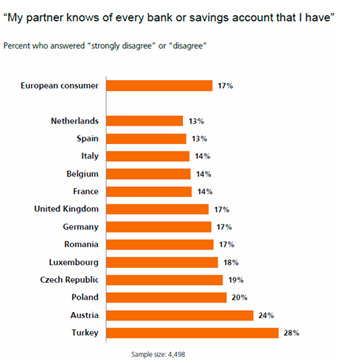

The Turks and Austrians most likely to have a secret bank account

Of those in Europe with a long term partner, 17% disagree with the statement: “My partner knows of every bank or savings account that I have”, suggesting they have a secret account. This rises to a high of 28% in Turkey and 24% in Austria. The countries with the lowest share admitting to having a secret bank account are the Netherlands and Spain (at 13%) and Italy, Belgium and France (all at 14%).

There may be positive reasons for having a bank account loved ones don’t know about – such as saving for secret future plans (for an engagement ring or surprise holiday). Or it might signal a lack of willingness to talk about money, which is seen as negative in many cultures.

This dress? That power tool? I’ve had them for years…

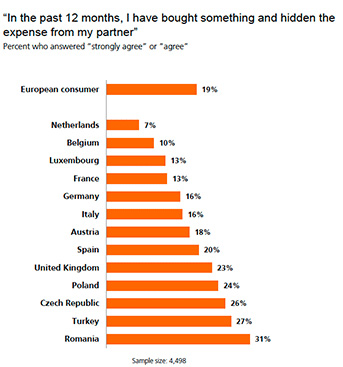

Almost one-in-five people in Europe who are married or in a long-term relationship agree they bought something and hidden the expense from their partner in the last year. But it seems much of the hidden spending is found out. Of a separate group in the survey who were asked if their partner had bought something and hidden the expense, 16% agreed. Hiding an expense is about as prevalent among women as men. However, more mature respondents – particularly those aged 55 and older – were much less likely to agree they bought something and hid the expense.

People with debts more likely to hide a splurge

People in Europe who have debt (other than a mortgage) are more likely to agree they bought something and hid the expense from their partner in the last year. It is evident in eight of 13 countries surveyed. In these places, there appears to be a tendency to be less open about spending if in debt, with the United Kingdom demonstrating this most strongly.

In four countries – the Netherlands, Italy, Germany and Spain – having debt makes no difference to the share who agree they hid an expense from their partner. In Luxembourg the reverse appears to be true and having debt may actually be linked with more openness around spending.

Older couples less likely to have money secrets

There are few differences between money secrets kept by men and by women in the survey, however, age seems to have an influence. In general, money secrets are less common among couples aged 55 and over.

Most would feel red faced if they had to borrow from family

Almost twice as many people in Europe would feel embarrassed if they had to borrow money from family or friends than if they had to borrow from the bank. This attitude of being more embarrassed borrowing from loved ones is evident in every country in Europe, with the gap particularly wide in Luxembourg (where few would be embarrassed borrowing from the bank but a large share would be borrowing from family and friends). People in the Czech Republic (57%) and Romania (58%) are the least likely to say they would be embarrassed to borrow from family and friends.

The famously pragmatic Dutch are next (63%). What is surprising is the share saying they would be embarrassed if they had to borrow from a bank. After all, some borrowing can be positive and lending money is a standard activity for many financial institutions. However, including “had to” in the wording of the statement might suggest being in a financial bind with few options. In Turkey, where borrowing from family is more common (see p13), there is little difference in attitude based on the source, with survey highs agreeing they would feel embarrassed if they had to borrow from the bank and from loved ones.

Full report

The full report International Survey on Savings 2015 can be viewed on top of this article, is available on slideshare and can also be downloaded as a pdf.

Ian Bright, Senior Economist at ING, discussed the survey results this morning on CNBC.