The “new abnormal” – low interest rates here to stay?

8 June 2016

The European Central Bank has been pursuing a policy of low interest rates aimed at jump-starting economic growth and boosting recovery in the aftermath of the financial crisis. Now official rates have gone below zero – a watershed moment. So what does it all mean for lenders and borrowers? We asked two experts at ING – chief economist Mark Cliffe and retail banker Guido Bosch – to shed some light on the issue.

Banking has been around seemingly forever. At its heart is a tacit agreement between lender and borrower based on a very simple proposition. Savers hand over their cash and in return receive something back, usually in the form of interest. It’s been a highly successful formula for centuries, fuelling the growth of the modern banking industry.

Now – with the spread of persistently low or even negative rates – the traditional relationship between lenders and borrowers has been turned on its head. This was not supposed to happen. Banking is based on positive rates, isn´t it? The received wisdom among economists was always that interest rates would stay high enough to ensure that relationship would continue indefinitely.

Brave new world

That cosy assumption has been shattered lately and the banking industry is now having to face up to a brave new world where to be successful the best operators will have to devise new and innovative ways to deliver value to the customer in a zero rate environment. But is it all really doom and gloom for lenders and borrowers?

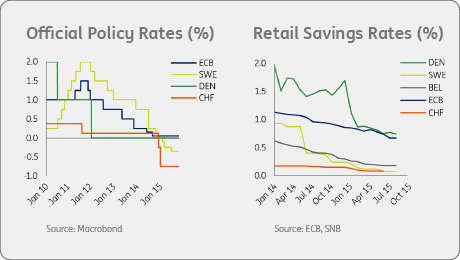

"The European Central Bank (ECB) has had to take unprecedented steps to cut interest rates to a minimum in an attempt to revive the economy, stave off deflation and prompt banks to lend more money,” explains chief economist Mark Cliffe. “The aim is to make saving less attractive and encourage borrowing, boosting consumer spending and kick-starting economic recovery. But so far there has been little movement – now we’re moving into unknown territory, or what we’ve called the ‘new abnormal’.”

The ECB also recently announced the next phase of its stimulus programme to further lower the cost of borrowing.

“It looks as if super low or negative rates will be with us for some time yet,” Cliffe adds. “In the longer term, a recent survey we conducted makes sobering reading for banks and central banks. It found that if rates drop below zero that might lead to mass withdrawals by customers.” For borrowers, the opposite is true – lower rates make it more attractive and affordable to borrow.

About Guido Bosch

Guido Bosch spent many

years as head of Product

Management for ING Direct

and knows the retail banking

market very well.

In his current role as Head

of Orange Sharing he

coordinates all global

knowledge sharing and

international cooperation

for ING’s Retail business.

New business models

On the retail side, one of the sources of revenue traditionally has come from current accounts, which usually don’t pay interest, explains retail banker Guido Bosch. These “free” funds are lent out in the form of mortgages, consumer loans and other products. “The problem now is, with lower rates, our margin is rapidly dropping. What was already a zero sum game is now losing money, while overall costs stay the same. Filling ATMs for example is an expensive cost item.”

The basis of our relationship has often been the interest incentive - that’s how we added value.

Guido Bosch, Head of Orange Sharing

Banks have two options: cut costs and continue to digitise processes, or apply negative rates on savings and current accounts. The second option means that customers will need to pay for keeping money in the bank.

This all comes at a time when the banking industry is radically rethinking its business model as it adjusts to the new reality of extremely low interest rates, weak economic growth, a new competitive landscape, changes in customer behaviour and stakeholder expectations, as well as a raft of regulatory reforms that have been introduced since 2008.

Greater innovation

Both men agree that the upside to all this change is that banks are being forced to work more efficiently and to be far more innovative - something that they haven’t always been good at. That now is changing.

"The success of ING Direct shows just innovative we can be," says Bosch. "In an environment where none of our savings accounts pay more than 0.5% interest, we really have to pull out all the stops to identify how and where we can add value to a customer without there being a financial incentive. And remember, the basis of our relationship has often been the interest incentive - that’s how we added value."

With interest rates unlikely to change for the foreseeable future, customers have to come to terms with a situation in which they can no merely longer sit back and watch their savings grow automatically, Cliffe adds. He believes there will be a sea change in the way people manage their financial resources as banks shift from interest to fee-based income.

"For our part, we have to be far more proactive in helping them reach their financial goals by other means, through astute financial planning," he says. An example would be shifting from savings to investments, which would “involve taking greater risks with the resources at their disposal. We need to empower them to take more responsibility for their financial future”.

Opportunities

Both Cliffe and Bosch are highly positive about the future, pointing to the recent launch of digital advice apps in France and Spain and rapid adoption of mobile technology as further proof of the bank´s determination to push digitisation. “We´re very proud of these products because they allow us to rein in costs and provide customers with tailored advice through a channel of choice,” says Bosch. The rapid growth of mobile platforms in particular has seen interactions between customers and banks leap, opening up huge opportunities for cross-selling.

About Mark Cliffe

Mark Cliffe is chief economist

at ING Group and leads a

team of economists and

strategists in 16 offices

around the world.

Read more articles by ING

experts at www.ezonomics.com.

Negative rates are definitely pushing banks to be more innovative

Mark Cliffe, chief economist of ING

"Negative rates are definitely pushing banks to be more innovative," adds Cliffe. "But what is important to remember is that customers will still need banks to help them secure their financial future because we have the expertise in-house. We need to leverage that core relationship with customers better, while at the same time continuing to sell valuable products such as consumer loans, insurance and ‘beyond banking’ services.

Bosch agrees: “In the final analysis, we`ve been forced to rethink our business model and improve customer service through digital channels while opening up new revenue streams. This has enabled us to keep a firm lid on costs, while improving our primary relationship with the customer. We’re adjusting to the ‘new abnormal’ - so in that respect every cloud really does have a silver lining.”