Steven van Rijswijk

Sustainability Due Diligence: the case for an EU approach

“Our biggest impact on the world comes through our financing. With this influence comes responsibility, including in terms of sustainability due diligence. We want to make transparent choices about how, why and with whom we do business. We are guided by our environmental and social risk policy, which we update regularly to reflect changing social norms, regulations. And we challenge our own commitment to human rights and the environment. Sustainability due diligence legislation is being implemented in various jurisdictions, which risks a fragmented approach. An EU–wide due diligence framework would be a welcome counterbalance to this trend and could set the standard for due diligence across sectors. An EU- wide regime should be designed to have strong impact, and should allow business to focus their efforts on high-risk areas.”

Steven van Rijswijk

CEO ING Group

Sustainability due diligence require a cross border approach

Sustainability due diligence has long been part of companies’ CSR approach. ING consistently applies an Environmental and Social Risks (ESR) framework that aims to ensure that risks are properly identified, assessed and mitigated in line with regulatory requirements and our own principles, risk appetite and commitments.

Until recently, regulatory guidance and societal expectations were mainly captured in open norms and voluntary standards developed by, or in cooperation with, the industry. The Equator Principles set out a tailored framework for financial services, whilst the OECD has developed broader corporate due diligence standards. These standards have strengthened over time.

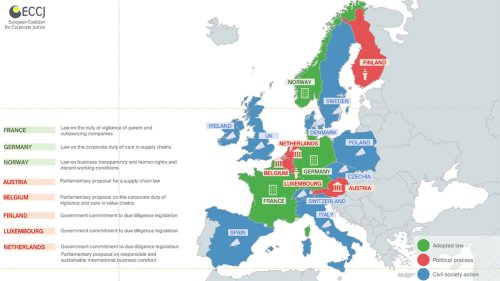

In the past years, several countries introduced specific sustainability due diligence legislation into their national laws. Some jurisdictions codified existing international standards, others also introduced new and additional requirements.

A fragmented framework jeopardises real impact

The European Commission proposed an EU-wide regime in 2022. We support this, as a fragmentated approach across EU countries is suboptimal. A EU approach will not only have more impact on improving business practices, which is the goal of due diligence legislation, it will also avoid an unlevel playing field.

Box 1 illustrates regulatory fragmentation is a real risk. Without overarching EU rules, companies and financial institutions will have to comply with different due diligence obligations and liability regimes.

We outline some considerations for EU policy makers.

Current (upcoming) regulatory environment on due diligence in the EU

ING Environmental and Social Risk assessment at work

- ESR policies apply to all corporate client relationships

- ESR assessments are embedded in early screenings, KYC practices and credit approval processes

- Not a one-off assessment. Ongoing monitoring.

Responsibilities should reflect the type of activity...

Financial institutions serve the needs of their corporate clients with a range of financial services, from project finance to general lending, payments, custodian services, advisory and financial markets transactions. The level of engagement with the client differ depending on the transaction and client’s activities. For example, there is much more deep interaction when structuring funding for a specific project than when banks process payments for a client. Due diligence requirements to prevent, mitigate and end “adverse impacts” are most effective where the financial institution has real influence over the actions of a client. For banks, such leverage typically exist most in lending relationships.

… and consequences need to be clear

While companies should be responsible to scrutinise the transactions they do and the clients they serve, their ability to mitigate adverse impacts, and as a last resort terminate contracts, is not always evident. Civil liability should be limited to instances where a company causes or contribute to the adverse impacts. “Causing or contributing to” are not unambiguous concepts, esp. in the area of human rights. We believe companies (incl banks), should not be immediately sanctioned if they inadvertently overlook something or omitted to take appropriate action. An open dialogue with regulators to gradually shape and clarify norms is needed.

A risk based approach will lead to more impact

The aim of both voluntary and mandatory due diligence practices is to identify, mitigate and terminate bad business practices in relation to human rights and the environment. Such a gatekeeper function is resource intensive for companies. The framework would benefit from a targeted approach on the most salient risks in global supply chains. This is also acknowledged by the longstanding OECD guidelines for multinational enterprises on responsible business conduct. It is key that there is close alignment and an open dialogue between public and private actors to determine these high risk areas. It is not necessary nor feasible to apply the entire range of obligations to each and every single business transaction or financial service.

For ING the following principles are key pillars of a sound EU due diligence framework:

- We support a uniform legal framework for sustainability due diligence in the EU that is closely aligned with adjacent sustainable finance legislation, particularly for reporting and transition planning. Reliance on mandatory data sources and re-use of due diligence performed according to the same set of rules should be allowed.

- Banks and other financial services providers should be in scope of the EU due diligence framework. This will ensure a consistent approach by the financial sector towards their clients (that often make use of multiple financiers at the same time), and minimise the burden for clients having to respond to multiple data requests for the same projects. For banking activities, the due diligence obligations should be limited to lending and underwriting, i.e. those financial services where financial institutions have the greatest impact.

- We need clear boundaries to the definition of the value chain. It should be clear how far into the chain companies should look. As they will have the obligation to mitigate adverse impacts, this can only go so far as they have leverage to change these impacts without necessarily terminating the relationship.

- Companies need to be allowed to apply a risk-based approach, prioritising the most salient risks. This would be in line with existing international standards. This will allow resources to be used most effectively.

- Legal liability provisions need to be clear whereby the framework should not shift legal liability to companies for damage they have not caused nor directly contributed to. An open dialogue to further shape and provide guidance on the normative framework is necessary to achieve a mature and workable set of rules.