Annual Review 2015

ING in 2015

Here are all the main facts and figures and general information about ING in 2015 as well as an account of the market and regulatory conditions that affected the company during the year.

Who we are

We are a global financial institution with a strong European base offering banking services. Our customers are at the heart of what we do.

Our customers

34.4 millionOur employees

54,000+2015 Highlights

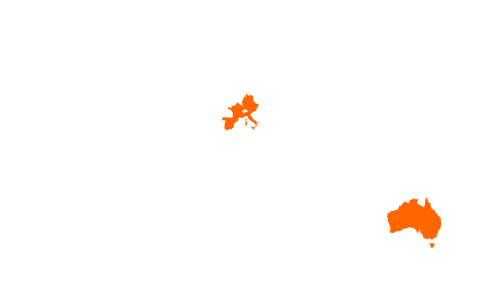

Where we operate

We operate in more than 40 countries in Europe, North America, South America, the Middle-East, Asia and Australia.

Germany, Austria, Spain, Italy, France, Czech Republic, Australia

Poland, Turkey, Romania and business units in Asia

At ING, we have defined three categories of markets: market leaders, challengers and growth markets.

Financial highlights ING Bank

Underlying net result

+ 23 %Fully loaded CET 1 ratio

11.6 %Underlying Return on Equity

10.8 %Underlying cost/income ratio

55.9 %Read more about the financial results

Non-financial highlights ING Bank

Net Promoter Score Retail Banking

Top ranking: 7 out of 13 countriesSustainable transitions financed

€ 23.8 blnSustainable assets under management

€ 2.57 blnCO2 emissions

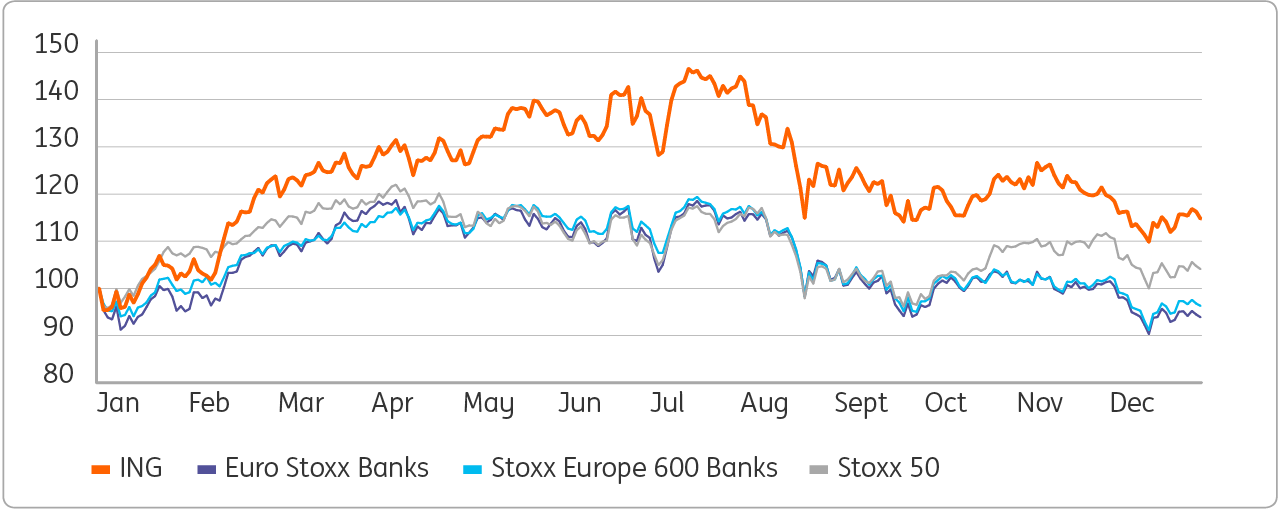

96kilotonnesING shares

Depositary receipts for ING Group ordinary shares are listed on the stock exchanges of Amsterdam, Brussels and New York (NYSE). Options on ING Group ordinary shares (or the depositary receipts thereof) are traded on

the Euronext Amsterdam Derivative Markets and the Chicago Board Options Exchange.

Dividends

The Board proposes to pay a total dividend of EUR 2,515 million, or EUR 0.65 per (depositary receipt for an) ordinary share over the financial year 2015, subject to the approval of shareholders at the Annual General Meeting on 25 April 2016. Taking into account the interim dividend of EUR 0.24 per ordinary share that was paid in August 2015, the final dividend will amount to EUR 0.41 per ordinary share and will be paid in cash.

Geographical distribution of ING depository shares in %*

Development of ING Bank depositary receipts for shares

ING share price

year-end 2015

€ 12.45Annual General Meeting of shareholders

25 April 2016Market and regulatory context

Three distinct trends had a major influence on ING and our competitors in 2015: the prevailing uncertain economic conditions and low interest rate environment; increased regulatory scrutiny and costs; and continuing digitalisation and changing customer behaviour. In combination, these trends are altering the competitive context in which we operate.

Read more about market and regulatory context

Competitive landscape

Technology is removing the barriers of entry to our industry. Technology giants, payment specialists, retailers, telecommunication companies, crowd-funding initiatives and aggregators are all encroaching on traditional banking services.

However, ING’s solid foundations give us an excellent platform from which to face existing and future challenges and to become a better company for all our stakeholders. We have a long track record as a financial institution and a strong brand.

Read about what we perceive to be our strengths, weaknesses, opportunities and threats