ING Viewpoint January 2018

Koos Timmermans, CFO ING Group

"The Eurozone has been strengthened since its debt crisis peaked in 2011-12. Eurozone economies are recovering steadily, and government budgets are generally looking healthier today. Banks have become healthier as well, while concrete measures to tackle non-performing exposures are steadily emerging from both the public and private sector.

A political commitment to establish a Banking Union has been made, and two of its three pillars are up and running, which should be considered a success.

The Eurozone's debt crisis already feels like a distant memory. Sense of urgency for reforms is receding quickly as the Eurozone's economy continues to grow. Yet, it is important to further strengthen the Eurozone institutional setup and fix its structural issues, so the Eurozone will be more resilient and stable in a next downturn. This will also help strengthening trust in the European banking sector, increasing its competitiveness in a global market."

Koos Timmermans, CFO ING Group

Introduction and summary

In the second half of 2017 both French president Emmanuel Macron and the European Commission laid out their vision on the future of the EU and the Eurozone. Though we very much welcome the acknowledgement that the Eurozone needs further reform, we believe more ambition is needed.

The Eurozone needs to be more resilient when a next economic downturn would arise. To achieve that, financial risks in the Eurozone need to be shared more, both via private sector and public sector channels. A stable structure must be set-up to facilitate this. This entails not only addressing the Banking Union's structural issues, but also facilitating more public risk sharing. The Capital Markets Union project, which aims to facilitate cross-border capital markets, will by its very nature also facilitate private sector risk sharing across the EU.

Concretely we support policy that:

- Addresses the sovereign debt-bank doom loop – by treating sovereign bond exposures as concentration risk, e.g. by imposing capital charges increasing with concentration.

- Fosters fiscal risk sharing – by considering an ambitious approach to pooling government debt issuance in the Eurozone, and by facilitating the use of EUwide public funds that can balance out asymmetric shocks.

- Further strengthens political accountability of Eurozone governance – by strengthening the Eurozone’s institutions.

Not changing is not an option

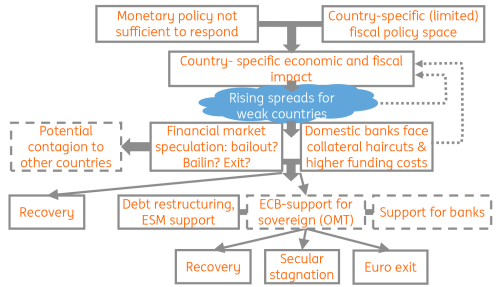

The institutional setup of the Eurozone needs to be strengthened, increasing its resilience in economic downturns. Despite progress since 2012, Eurozone member states are still vulnerable to economic and financial shocks, with limited capacity to absorb such shocks (see diagram below). A protracted economic downturn, deteriorating government finances and doubts about the health of domestic banks could spark renewed financial market speculation.

Investors may doubt the no-bailout principle (preventing Eurozone member states from bailing each other out), given that it has been set aside in the past. Continued market turmoil and economic hardship would in turn threaten the stability of the Eurozone as a whole.

Options to improve cross-border risk sharing

The European Commission has put several options on the table for Eurozone reform that would strengthen both private and public linkages between countries and would thus spread the pain of country-specific recessions. Proper reforms could also reduce contagion and speculation, and would increase chances of a swift recovery. Financial and political stability would be strengthened. In our view, reforms needed fall under three headings:

I. Completing the financial union

To enhance cross-border private sector financing, and to break the feedback loop between sovereigns and domestic banks, top priority should be the completion of Banking Union, by introducing a European Deposit Guarantee Scheme and adding a liquidity backstop to the Single Resolution Fund, backed by Eurozone governments.

Eurozone banking groups should also be able to centrally manage their capital, liquidity and loss absorbency requirement without fragmentation across Eurozone borders. This not only enables banks to better manage their risks, but also fosters financial stability and the efficient allocation of funds across the Eurozone. This would be best achieved through providing waivers for local requirements. Likewise the Banking Union should be considered as one jurisdiction in international financial regulation.

We believe the home bias that exists today in banks' sovereign bond portfolios needs to be tackled. Sovereign bond exposures should be approached as a concentration risk from a prudential perspective. As Nicolas Véron recently suggested, concentration charges could be applied on government bond holdings at consolidated bank group level, rising with exposure to bonds issued by individual sovereigns.

And finally, further building the Capital Markets Union is needed to enhance cross-border debt and equity ownership.

II. Realising a more integrated economic and fiscal union

More harmonisation of economic policies should produce more synchronised cycles, which is a great way to avoid asymmetric shocks in a monetary union in the first place.

On sequencing...

It is sometimes argued that public sector risk sharing can only be considered once risk reduction steps have been taken. This however ignores the fact that public sector risk sharing already exists in the Eurozone. Past sovereign bailouts prove that in case of deep trouble, Eurozone countries are able to cooperate financially. Moreover, the ECB's "Outright Monetary Transactions" Programme, initiated with President Draghi's famous "Whatever it takes" speech is in essence an uncapped commitment to share risks through the ECB. As the ECB’s profits and losses end up with Eurozone governments, this is a potentially large channel of public sector fiscal risk sharing.

A European Monetary Fund could play a useful role in promoting more harmonised policies and providing aid before economic and financial problems spin out of control.

Eurozone-wide public funds and schemes are a form of public sector risk sharing. The Eurozone should moreover carefully consider different models of sovereign risk pooling through new securities. Starting with joint debt issuance (on a limited and capped scale) can strengthen the position of sovereigns in a difficult situation. In that case, dedicated EU revenue sources (e.g. taxes) should also be reconsidered, to safeguard bond repayment.

Apart from providing Eurozone governments with stable access to finance, joint issuance would also provide the financial system with a new top-rated asset. This could help to reduce home bias in bank sovereign bond portfolios.

III. Political and institutional reforms.

Finally, it is clear that more public sector risk sharing has to go hand in hand with increased ambition on Eurozone governance. This also requires increasing democratic accountability as Eurozone institutions are strengthened and become more important for the block's economy.

While all these issues apply in first instance to the Eurozone, it is important to involve non-Euro Member States as the project develops further. This will not only foster the idea that the Euro-project is open to non-Members, but also increase political accountability of the EU project.

Conclusion

Facing the structural challenges of the Eurozone is crucial to secure a stable and predictable environment in which the economy can continue to grow. Reforms remain necessary. A number of valuable proposals has been tabled in 2017, but more ambition is needed to strengthen the intertwined elements that will determine the Eurozone's success: Banking Union, risk sharing through fostering an Economic and Fiscal Union, political and governance reforms, as well as the Capital Markets Union. Strengthening EMU is a long, but important process. A more stable Eurozone benefits all citizens and the economy.

We believe momentum is building in Europe to make progress on these reforms, and we urge EU policy makers to use this momentum ahead of the European elections in May 2019 to make this happen.