ING Viewpoint January 2017

KoosTimmermans

Vice-Chairman

Management Board Banking

"Banks are an essential part of the financing chain in Europe, and will remain so in the foreseeable future.

This sets Europe apart from other jurisdictions, where the role of banks is smaller and market financing is much more developed.

It is therefore important that European banks are able to allocate the funds entrusted to them in an efficient matter. This requires a regulatory capital framework that is sensitive to actual risks. Without risk based price differentiation, the allocation of funds gets distorted, which in turn reduces economic potential."

Koos Timmermans,

Vice-Chairman Management Board Banking

The various new regulatory initiatives and consultations concerning banks’ capitalisation continue to be a source of uncertainty. The most prominent ones are the Basel proposals aimed to reduce different risk weightings of what is perceived to be the same risk. These proposals constrain the use of internal model approaches, aiming to make risk weight calculation simpler and more comparable across banks.

ING is supportive of initiatives to address undue risk variability. However, the Basel proposals would allocate very high risk weights to mortgages and corporate lending which are not in line with historical loss rates and which distort sound economic incentives.

Implementing these proposals without regard to the specific structure of finance in the Eurozone economy makes the necessary funding of economic activities more difficult and more expensive. It is therefore key that lower risks should be translated into lower risk weights and higher risks should be translated into higher risk weights.

The virtues of risk sensitivity are worth preserving

Internal models are based on historical experience with impairments, risk developments and advanced statistical simulations within a specific sector or asset class. Internal models, approved by regulators and external auditors, enable banks to make the most efficient capital allocation and pricing decisions. At the micro level, these benefit our customers. At the macro level, pricing according to risk enables finance in the economy to flow to opportunities where it is put to best use. Therefore, regulatory capital requirements need to be based, as closely as possible, on real underlying risk.

Models are periodically monitored, back-tested and validated by an independent validation unit. If needed, they are updated to stay fit for their purposes. The relation between allocated risk weights and actual realised losses can be compared between institutions. This allows for much better comparability tests than the alternative, more standardized, approaches could ever bring. And results in lower risks being translated into lower risk weights, whereas higher risks are translated into higher risk weights.

For instance for residential mortgage portfolios high quality data are available to substantiate risk assessments. These data show significant differences between local housing markets and jurisdictions. In the Netherlands defaults and losses in the housing market have been extremely low, even during the crisis. For specialised lending history shows realised losses tend to be very limited. For example because banks can exit early as a result of a self-liquidating trade or restructuring, or because of good quality collateral or pledged cash flows.

The role of banks in financing the economy in Europe

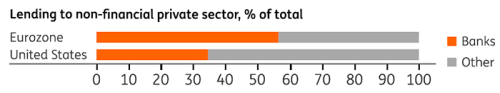

Europe is still very dependent on bank financing, compared to the US. Banks in the US play a relatively smaller role in financing the economy than European banks. And whereas European banks are primarily responsible for the financing of residential mortgages, in the US Fannie Mae and Freddie Mac support the financing of US mortgages and these therefore enjoy an implicit US government guarantee. In addition, in Europe banks have remained competitive with capital markets for more borrowers than in the US by providing financing more cheaply than capital markets.

Source: IMF (Global Financial Stability report)

Alternatives to bank finance

A consequence of the Basel proposals is that bank capital requirements will increase. This could incentive banks to shrink their balance sheets substantially, running off or even selling their loan portfolios. The question is which type of investors and/or instruments can adequately compensate for this:

- A consequence of the Basel proposals is that bank capital requirements will increase. This could incentive banks to shrink their balance sheets substantially, running off or even selling their loan portfolios. The question is which type of investors and/or instruments can adequately compensate for this:

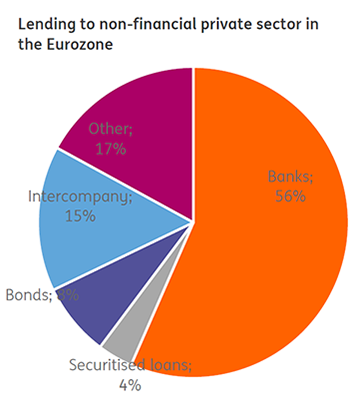

- The bond market currently provides a mere 8% of financing and only caters for large corporates.

- Securitised loans represent only 4% of Eurozone loans to households and non-financial businesses. A revival of this market is hindered by regulatory uncertainty.

- Other non-bank loans, including institutional investors, represent only 17%.

Examples of impacted lending categories

Specialised lending for corporates:

Under the proposals, a structured loan with an aircraft as collateral will receive a higher risk than the standardised risk weight of an un-collateralised loan to the airline company, which has a worse credit profile.

Instead of providing structured loans, banks would be incentivised to extend unsecured loans at higher interest rates to the parent companies, increasing their overall riskiness.

Mortgages for retail clients:

Average risk weights for residential mortgages may double under current Basel proposals. The resulting increase in required capital is not at all supported by historical losses on mortgages.

Infrastructure projects:

In a comparable way to specialized lending, infrastructure financing might be hurt.

Banks would have to reduce their financing and increase their pricing.

Conclusion:

A risk sensitive approach should remain at the heart of the way banks are financings loans to their clients. It allows for price differentiation and can take into account the specific characteristics of a particular loan. The European economy, which is still very much reliant on bank financing, would suffer if risk sensitivity is abandoned and standardization is introduced.