Do investors read newspapers?

8 May 2017

The media are full of worrying economic news. For some reason, investors aren’t impressed, writes macroeconomist Maarten Leen.

Donald Trump’s plans for the US economy don’t seem to keep investors awake at night.

Maarten Leen is

head of

Macroeconomics

at ING Global

Markets Research

If you feel that there has been a lot of worrying economic news lately, you are right. Rarely have the media been so full of articles and reports about uncertain economic prospects and speculation on government policies.

The Global Economic Policy Uncertainty Index (GEPU) keeps track of all this news for you. Focusing on 19 countries accounting for 68% of the global economy, the GEPU scans a broad selection of news media for the joint occurrence of the terms ‘economy’ or ‘economic’ (E), ‘uncertain’ or ‘uncertainty’ (U) and a word relating to policy (P) such as minister, budget or tax.

Using this method, the GEPU has calculated that uncertain economic prospects are currently written about two to three times more often than ‘normal’.

Political unrest all around the world

The GEPU’s finding is hardly surprising. The new US presidency is highly unpredictable and there is no telling how the UK’s divorce from the EU will work out.

Question marks also hang over Italy’s EU membership, while countries like Brazil and South Korea are in the midst of corruption-related political scandals.

So how is all this uncertainty playing out in the minds of investors? We can say something about this by comparing the GEPU with another mysteriously-named index, the VIX.

The VIX, or Chicago Board Options Exchange Market Volatility Index in full, is a barometer of investor fear that is derived from price fluctuations in options based on the S&P 500 Index. Usually, stock markets are more volatile in times of uncertainty. Investors become anxious, trading volumes rise and stock prices often swing violently up and down.

Investors stay calm

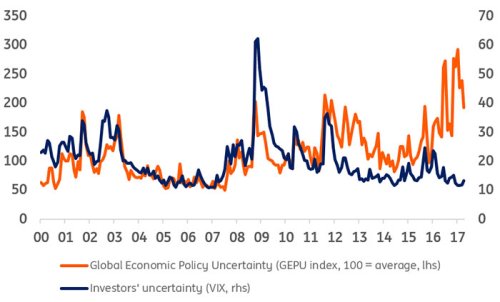

As the chart shows, investor uncertainty rose and fell in recent years in tandem with the prevailing level of uncertainty about the economy and future government policy.

Intriguingly, this pattern was broken last year. While economic uncertainty rose to record levels, investors appeared to become steadily less concerned.

It is surprising that investors of all people are evidently so unperturbed. The divergence of the GEPU and the VIX raises the question whether investors aren’t too optimistic. Perhaps the uncertainty about the new US presidency and the future of the European Union is simply too great to estimate the consequences. Or is the persistent low-interest rate policy of central banks the reason why investors are so calm?

If you ask me, it’s a combination of both factors.

Are investors too optimistic?

For more information about the Global Economic Policy Uncertainty Index, go to www.policyuncertainty.com