Sustainability under a magnifying glass

29 September 2015

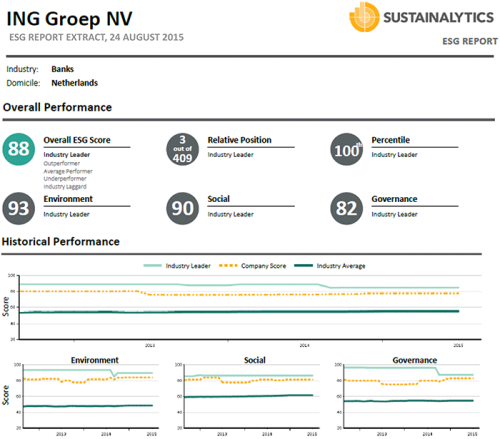

ING is one of the most sustainable listed banks in the world. Our policies and actions are assessed by independent institutions, which report on them on an annual basis. For example, in September 2015, Sustainalytics named us as the third best performing bank in a group of 409 banks. In addition, this year ING’s score in the Dow Jones Sustainability Index also rose again, as a result of which ING is now one of the highest scoring companies in the banking sector of this index.

ING & sustainability

ING pursues a comprehensive and detailed policy framework for social and environmental risks, better known as the Environmental & Social Risk (ESR) Framework. Our policy and the way in which we implement our business operations (such as our lending facilities) are highly regarded.

ING is actively involved in the climate debate. We are calling on the governments represented at the global UN Climate Change Conference in Paris this autumn to enter into a strong climate agreement. Of course, we will also be taking action ourselves. Our project portfolio demonstrates that we are increasingly funding more sustainable energy (43%) and fewer coal-fired power plants (13%). For example, we have financed the largest wind-energy project in the Philippines and participated in the financing of the largest geothermal power plant in Indonesia. Closer to home, we have been involved in the Westermeerwind Wind Farm project that will provide 160,000 Dutch households with sustainable energy. This trend has been clearly evident from our energy-project portfolio for many years.

One of the most strategic objectives of our sustainability strategy is to facilitate more sustainable transitions. By mid-2015, almost 21 billion euros had been financed in sustainable clients and projects. This involved, among other things, sustainable energy projects, CO2 and waste reduction, and funding sustainable real estate and public transport.

ING will continue to strive for further sustainability improvements, either through our portfolio or through research and publications such as those on a circular economy.

Eye for improvement

Notwithstanding recognition of our sustainability policy, ING will not be sitting back complacently. We will continue to work on the further tightening of our policy on the one hand, and on our efforts to support customers during their transition towards more sustainable working practices on the other.

- Early this year, for example, ING introduced its coal policy, on the basis of which we can place higher demands on the projects that we finance.

- Our weapons policy has also been tightened. Besides excluding funding for nuclear weapons, we do not finance any companies that are involved in nuclear weapons in addition to their civil activities, and are situated in countries that did not sign the Non-Proliferation Treaty.

Fair Finance Guide

The Fair Finance Guide is a Dutch body that assesses the sustainability policies of banks. On 29 September 2015, it published its annual policy update, in which the sustainability policies of eight Dutch banks are assessed on the basis of criteria drawn up by the Fair Finance Guide itself. ING's score in the Finance Guide has improved but shows a varying picture.

The main reason for this is that ING is making choices that differ from those that the Finance Guide would prefer. For example, the Fair Finance Guide requires that no coal, oil, gas, uranium, large-scale livestock farming, or water dams are funded. We understand that civil-society organisations are concerned about the consequences of climate change, animal welfare, and environmental damage. And it is a good thing that they ask us to develop extensive policies that take these concerns seriously. ING shares these concerns. However, excluding activities such as oil and uranium mining would mean that major sectors in society could no longer be financed: steel production (coal), the transport industry including freight transport, shipping and aviation (oil), electricity production and heating (gas), cancer treatment with medical isotopes (uranium), world food production (livestock farming) and, for example, renewable electricity generation (water dams).

Another example is the aviation sector. The most prominent producers in France and the United States also share their knowledge and technology with their governments for the national nuclear weapon programmes. ING does not fund nuclear weapons but we do want to be able to continue to finance regular aircraft manufacturing. We therefore still finance these components. ING pursues a different way of giving shape to sustainability.

We feel that the Fair Finance Guide imposes overly extreme demands in its assessment. However, we support the idea behind it, namely to ask banks to exercise clarity in their policies in the field of climate change and human rights. In the Finance Guide's most recent report, ING scored hardly any points in the categories of fisheries or animal welfare. While these are relatively smaller portfolios within ING, we would like to learn more about how civil-society organisations view this topic and will enter into a dialogue.