European-grown payment solution takes shape

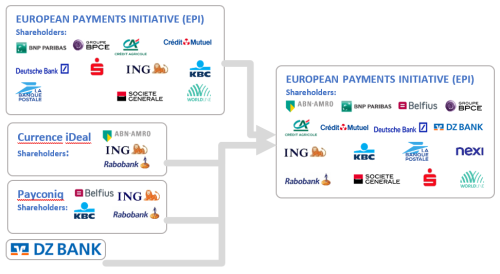

The European Payments Initiative (EPI), a commercial platform supported by a group of 14 European banks including ING, and two major European payments companies, takes a next step toward building a pan-European payment solution under one brand. The aim: to replace the current patchwork of payments solutions on country level and make Europe less dependent on foreign payment solutions.

EPI’s ambitious plans for a European ‘home grown’, all-in-one digital wallet and payment solution, which focuses on a peer-to-peer and a peer-to-pro (ecommerce) solution, is set to give an important impetus to Europe’s position as a global leader in payment innovations.

As part of this, EPI is acquiring Currence iDEAL, the leading Dutch payment scheme, from its shareholders ABN Amro, ING, and Rabobank and account-to-account payments technology provider Payconiq International (PQI) from its shareholders Belfius, ING, KBC and Rabobank. Financial details of these transactions will not be disclosed.

EPI will leverage PQI and iDEAL’s strong operational experience and know-how in local markets as it builds the new, scalable pan-European platform. The digital wallet with P2P payment functionality is planned to be launched commercially by the end of 2023, initially covering three countries: Belgium, France and Germany. Those three geographies together represent more than half of all retail payments in the EU. The solution currently provided by iDEAL will be migrated to the new platform over time.

ING innovations

The important role of iDEAL and Payconiq in paving the way for EPI’s new payments platform means that ING innovations have no small role to play in EPI’s new payments initiative. ING, together with peer Dutch banks ABN Amro and Rabobank, was a founder of iDEAL in the Netherlands in 2004. And Payconiq was developed in ING’s innovation lab. Other Benelux banks joined the platform as it gained a commercial foothold after ING launched it in Belgium and Luxembourg.

Pinar Abay, member of ING’s management Board Banking and head of Market Leaders: “At ING, we are proud of our pioneering role in payments and for having contributed to the development of the successful solutions iDEAL and Payconiq. Both are highly valued by our Benelux customers and we look forward to taking them to the next level by being part of the new, innovative unified payment solution for Europe.”

Martina Weimert, CEO of EPI Company: “EPI is delighted to welcome Currence iDEAL and PQI. Together, we will join forces to realise EPI’s vision as we build an innovative solution based on a new, unified instant payment scheme and platform for Europe. We are developing a new, scalable platform to address the modern and evolving payment needs of European consumers and merchants in the best way.”

Click here to read the press release by EPI.

(Footnote: Currence iDEAL is a subsidiary of Currence Holding. Whilst Currence Holding owns 100% of Currence iDEAL, the economic ownership of the subsidiary is attributed to the F-shares held by ABN Amro, ING and Rabobank)