ING to make final repayment

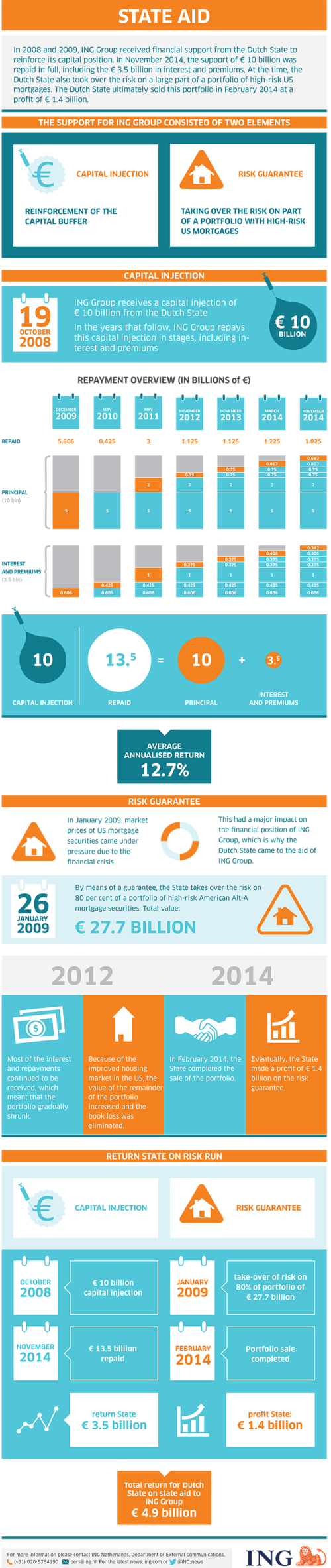

ING has announced that it will make on 7 November 2014 the final EUR 1,025 million repayment on the Dutch State aid it received during the financial crisis in October 2008. With the repayment, ING will have repaid EUR 13.5 billion to the Dutch State, including EUR 3.5 billion in interest and premiums.

ING Group CEO Ralph Hamers said: “This support from the Dutch State saw us through the crisis and helped us to emerge stronger from it. Therefore we are grateful to the Dutch State and its citizens, but also to our customers who continued to stand by us during the last couple of years. I also want to thank our employees, all over the world, but especially in the Netherlands, for their perseverance and commitment to our customers.”

In 2008 and 2009, ING received State aid to strengthen its financial position during the financial crisis. The State aid took the form of a EUR 10 billion capital injection. It also included an Illiquid Assets Back-Facility (IABF) which was established to reduce the risk for ING from a portfolio of US mortgage securities.

To date ING has repaid EUR 9,317 million in principal and EUR 3,189 million in interest and premiums. The final repayment on 7 November 2014, which has been approved by the Dutch Central Bank and the European Central Bank, will consist of EUR 683 million in principal and EUR 342 million in interest and premiums. ING will fund the repayment from the capital surplus at ING Group. As a result the repayment has no impact on ING Bank´s capital ratios.

Restructuring

In order to receive approval from the European Commission (EC) for the Dutch State aid, ING Group was required in 2009 to develop and submit a Restructuring Plan to the EC that included the divestment of ING Group’s insurance and investment management businesses across the world.

From 2011 to 2013, in line with the Restructuring Plan, ING Group divested its insurance and investment management businesses in the United States, Latin America and Asia/Pacific (other than Japan).

In July 2014, ING successfully listed NN Group (ING’s European and Japanese insurance and investment management operations) on the Amsterdam Stock Exchange, and currently holds a 68.1% stake in the business. Under the restructuring agreement, as amended in November 2013, ING Group has agreed to divest more than 50% of NN Group by year-end 2015 and complete the divestment of 100% of NN Group by year-end 2016.

Repayment begins

ING began repaying the EUR 10 billion capital injection as early as 2009. In December 2009, ING repurchased the first half of the core Tier 1 securities of EUR 5 billion plus a total premium of EUR 606 million. This was funded through a rights issue of shares to shareholders.

Furthermore, on 13 May 2011, ING exercised its option for early repurchase of EUR 2 billion. The total payment in May 2011 amounted to EUR 3 billion and included a 50% repurchase premium.

In November 2012 and November 2013, ING repaid EUR 1.125 billion on each of the two occasions.

Unwinding of IABF

The unwinding of the illiquid assets back-up facility (IABF) was agreed with the Dutch State in 2013, and in February 2014, the IABF was completely unwound. Together with the settlement of the fees, the unwinding resulted in a cash profit for the Dutch State of EUR 1.4 billion.

Final repayment

In 2014, ING made the last two repayments: EUR 1.225 billion in March and EUR 1.025 billion to be made on 7 November. In total, the Dutch State has earned EUR 5.3 billion from the aid given to ING. This consisted of EUR 3.5 billion in interest and premiums from the EUR 10 billion capital injection, and EUR 1.4 billion profit on the IABF facility, which came to a total of EUR 4.9 billion. In addition, EUR 0.4 billion in fees was paid to the Dutch State on Government Guaranteed Notes, all of which have been redeemed in full.

The State aid background in one infographic