First time home buyer woes increase across Europe

7 September 2015

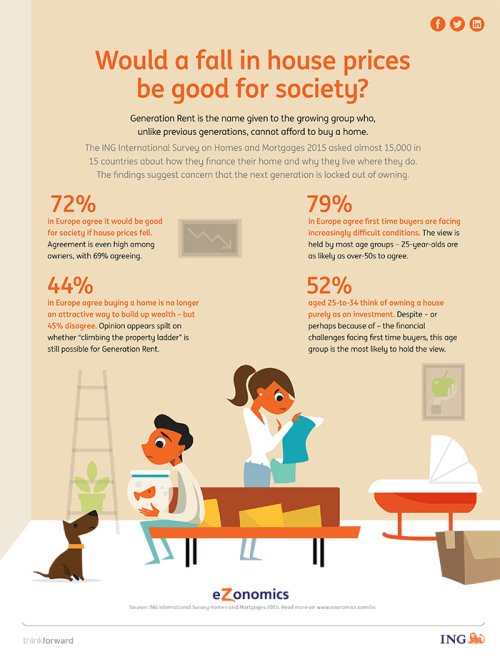

- First-time buyers face increasingly difficult conditions, with nearly 4 in 5 (79%) saying it is more difficult to buy a home

- Toughest conditions seen in the UK, Luxembourg, Spain and Turkey

- Nearly three-quarters (72%) feel society would benefit from a fall in house prices

Europe is pessimistic about the opportunities for first-time buyers, with a majority believing that the housing crisis is getting more acute and that society would benefit if prices fell.

The ING International Survey on Homes and Mortgages, published today, surveyed 15,000 people across 15 countries to understand consumers’ views on the price and affordability of housing. While the study found over half of people in Europe (56%) are bullish about house prices rising in the next 12 months – up 3% points on last year – first time buyers are facing worsening conditions as a result. Four in five (79%) Europeans say that it is becoming increasingly difficult to buy a first home.

First time buyers woes most visible in UK, Spain and Belgium

The picture is found to be stark in the UK, with 89% questioning how first time buyers will ever get on the housing ladder. This chimes with data showing a house price rise of 8% in the UK between Q1 2014 and Q1 2015I - eight times the European average. A similar number of people in Spain (88%) and Belgium (87%) worry about the ability to enter the housing market, with continued high levels of unemployment in Spain, while in Belgium tough lending conditions and stagnant wagesII could be playing a role.

Even in Germany, the country least concerned about the conditions first time buyers face, a majority (59%) feel that it is getting harder for those looking to get onto the property ladder to do so (see table 1). Meanwhile, nearly nine in 10 (89%) Australians and just under three-quarters (72%) of Americans feel the same way, with concern extending beyond European markets.

Society expected to benefit from drop in house prices

A strong housing market can be seen as a sign of a nation’s economic prosperity. However, the affordability gap has widened so much that 72% now believe that society would benefit if house prices fell. This is felt most sharply by renters, with Spanish (93%), British (75%) and French (74%) tenants believing that expensive housing blocks their path to home ownership.

And it’s not just renters who feel this way. Over two-thirds (69%) of European home owners even agree a fall in house prices would benefit society. In Turkey, where buyers experienced double-digit house growth last year, 90% of owners share this sentiment, while in Spain, despite property prices having plummeted by over a quarterIII in the past five years, 83% of those who own a house agree.

Germany is one of the few countries in the survey where a minority of homeowners agree, with only 47% believing that a fall in house prices would benefit society. With German homeownership rates the lowest in the EU at 43%IV, the lower importance that Germans place on home ownership could be influencing their views.

Despite the majority thinking that a fall in house prices would be beneficial, almost half (46%) of European consumers would consider owning a house purely as an investment, suggesting that they increasingly view property as a speculative asset as well as somewhere to live.

ING Senior Economist, Ian Bright commented: “Across the continent and in the US and Australia, consumers hold the view that first time buyers are at risk of having the door to home ownership slammed in their face. Even homeowners would consider it a good thing if house prices fell, which may indicate people are not only worried about the high level of house prices, but also realise that house prices cannot keep rising forever.

“The burgeoning economic recovery across the continent comes into play here. This will improve people’s lives in many ways but the ING International Survey shows something needs to be done if the next generation is to benefit from bricks and mortar.”

Table 1: Percentage of consumers who believe it increasingly difficult for first time buyers to enter the housing market

| Country | Latest available data |

Source | |

|---|---|---|---|

| Luxembourg | 94% | 7.0% | ECB |

| United Kingdom | 89% | 8.0% | ECB |

| Turkey | 88% | 16.7% | Central Bank of Turkey |

| Spain | 88% | 1.5% | ECB |

| Belgium | 87% | 0.6% | ECB (to Q4 2014) |

| Italy | 83% | -3.4% | ECB |

| Netherlands | 81% | 2.5% | ECB |

| Romania | 78% | -3.7% | Eurostat |

| France | 78% | -2.3% | ECB |

| Poland | 71% | 0.8% | National Bank of Poland |

| Austria | 71% | 3.6% | ECB |

| Czech Republic | 70% | 3.1% | Eurostat |

| Germany | 59% | 2.8% | ECB |

| EUROPE AVE. | 79% | - | - |

I House Price Index, Q1 2014 – Q2 2015, year-to-year percentage change (Eurostat Statistical Data Warehouse).

II Long-term interest rates (ECB) Long term interest rates in Belgium and Spain have decreased by 29% and 22% respectively in the past year (July 2014 to July 2015)

Average annual wages (OECD) shows wages in Belgium and Spain are both down in terms of purchasing power parity between 2013 and 2014 (most recent data)

III Spain, Residential property prices (ECB) – house price index in Q1 2010 was 89.99, in Q1 2015 it was 64.61

IV Wirtschaftsrechnungen Einkommens- und Verbrauchsstichprobe Wohnverhältnisse privater Haushalte (2013)