Global transport and logistics outlook: normalisation in a different world

This article is a copy of the original article on Think.ing.com

The pandemic extremes are gradually fading in transport and logistics, but normalisation comes with after-shocks and sanctions are shaking up trade routes. So what does the year ahead have in store for shipping, container shipping and aviation?

A change in transport and logistics in the wake of the pandemic

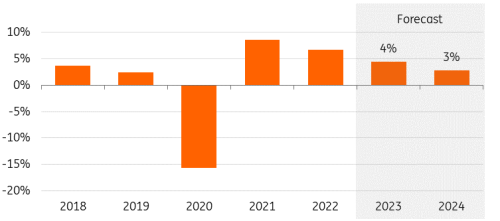

The transport and logistics sector will see growth of 4% in 2023 and 3% in 2024.

While the extremes of the Covid-19 pandemic supply shock have faded, the sector is still witnessing the ripple effects of normalisation in consumer behaviour and prolonged capacity issues. At the same time, the economy is slowing and industrial production is slumping.

The supply shock from the pandemic and the impact of the war in Ukraine have also left their mark on various parts of the transport and logistics sector. Either long because of excess capacity after a historic boom (in container shipping) or short because of lagging deliveries of aircraft and capacity-absorbing rerouting because of sanctions (in shipping).

While consumer goods logistics is facing a correction, there is a sunnier outlook for aviation which is benefiting from pent-up travel demand, while public transport is turning busier again as well.

Global transport and logistics sector slows as post-pandemic rebound fades

ING Research based on Oxford Economics

Airline passenger demand outweighs the slowdown in goods

For (inland) goods transportation, 2023 will, on balance, be a year of stagnating tonnage and some segments will show declines. On the passenger side, however, it’s the opposite. The pace of recovery is exceeding expectations since travel has opened up post-lockdowns and restrictions. As consumers continue to prioritise travel, the double-digit rebound of aviation is helping to push growth in the global transport and logistics sector to 4%, exceeding global GDP growth. After the unprecedented drop in 2020, the sector will exceed its pre-pandemic level by the end of the year.

After digesting the initial ‘after shocks’, the global economic slowdown will have a stronger impact in 2024, leading to a more challenging year for most of the sector.

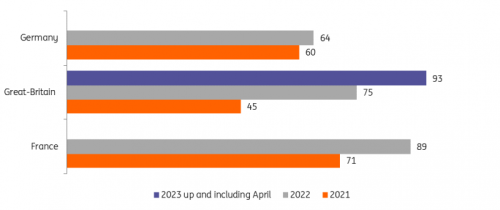

Public transport volumes continue to recover more gradually

For public transport volume, 2023 will be a year of continued recovery as well. Rail figures in European countries were still significantly below pre-pandemic levels in 2022. Full recovery won’t be reached in 2023, but figures are trending up and weekends are relatively busy.

Early indicators from the UK show a strengthening recovery this year (to 93% of pre-pandemic levels). There is a similar trend in public transport figures in the Netherlands, another services-driven economy where working from home is part of the new normal. On the other side of the Atlantic – in the US – public transport is picking up at a similar rate, recovering to 72% of pre-pandemic levels in May 2023, up from 62% a year earlier.

European railway passenger transport recovery continues in 2023

Number of railway passengers transported per country, index2019 (baseline) = 100

Eurostat, ONS, ING Research

2024 will be more challenging year for many logistics companies

On the goods side, recent stretched and vulnerable supply is helping transport and logistics companies navigate their way through a phase of lower demand. With shortages fresh in mind, companies in road transport have managed to pass on higher costs fairly well despite a sluggish market. In container shipping and logistics, locked-in higher rates – accounting for more than half of the volume – will expire in batches over 2023, leading to falling profits into 2024.

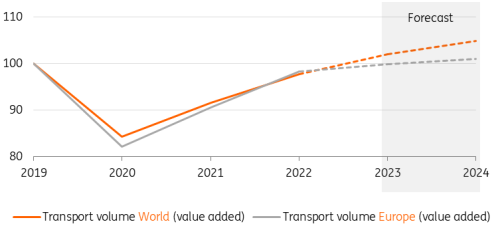

Higher transport activity in Asia as economies catch up

While advanced economies including the US and the EU are struggling to avoid recession, China's economy is bounced back after its post-pandemic re-opening, and India is returning to trend growth. This geographical mixed picture means that transport activity in Asia will grow faster. A relevant factor here as well is that Asian airline traffic lagged for much longer in the aftermath of the pandemic, and Asian intercontinental airline passenger numbers are catching up stronger now.

Global transport and logistics sector surpasses European sector in the aftermath of the pandemic

Development value added transport, logistics and storage sector and global GDP (Index 2019 = 100)

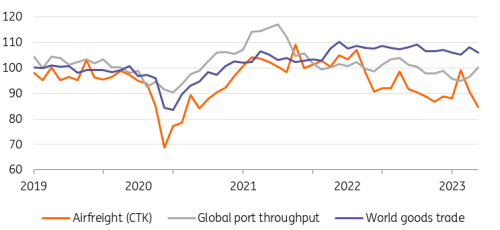

Excess inventory cuts will impact transport activity

After surging during the pandemic, container trade suffered a setback in the final months of 2022 because of a shift away from consumer spending on goods alongside the economic slowdown. Shippers had to adjust to earlier piled-up stocks in the second quarter of 2023. Effectively, this has created an accelerated slowdown (reverse bullwhip effect) across supply chains, especially in consumer products. This was most prominently felt in US logistics, but also in Europe as reflected in significantly lower container throughput in ports in the first quarter of the year.

A global wind of protectionism also hasn't helped, for instance in automotive parts. More rules and restrictions complicate trade and make it more costly and less beneficial. As outlined earlier world trade faced a correction and will only grow slightly in 2023 and 2024.

World trade flattens, air and sea freight slump on consumer products correction

Indices global trade, airfreight traffic and global ports throughput 2019 = 100

CPB, IATA,RWI, ING Research, last data point: April

Air cargo slumps – signaling lingering freight market weakness

Air cargo has suffered a double blow over the last year, not only from reduced spending on higher value consumer products – which comprises the majority of its volume – but also because of the shift back to sea transport after the immediate supply chain issues were resolved and the price gap increased. Mounting working capital costs for goods in transit couldn’t compensate for that.

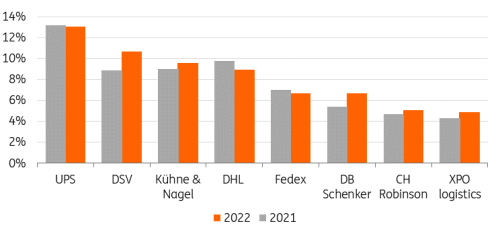

Logistics services providers boosted margins amid rebound and disruption

Operational margins of large global logistics sercvices providers (EBIT) in % per year

Annual reports, ING Research

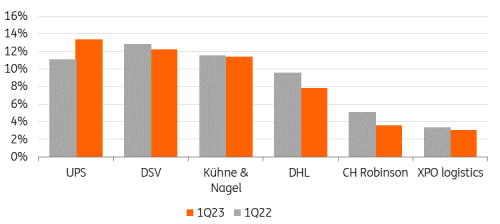

Logistics companies have managed to keep up margins fairly well, but 2023 will be more challenging

After a few strong years, the deterioration of global trade volumes will also start to impact logistics services providers. Intermediate logistics players active in sea freight, in particular, have been exposed to plummeting container rates. Spot rates on the China-Europe trade were as much as 80% lower in the first quarter of 2023 on a yearly basis. This isn’t being transferred into company financials immediately, but the turnover of C.H. Robinson, DSV and Kühne + Nagel dropped by roughly a third between the first quarter of 2022 and the first quarter of 2023. Margins have kept up relatively well, but given the decline of rates in container shipping and air cargo, it seems logical to expect further deterioration going forward.

E-commerce logistics returns to lower trend growth

Another after-shock has occurred in e-logistics. After the post-pandemic reopening, the global e-commerce surge came to an end in 2022. The correction means a return to a slightly lower trend growth rather than a structural turnaround. E-commerce volumes have been picking up again in the first half of 2023.

Margins for logistics services were still solid at the start of 2023

Operational margins of large global logistics sercvices providers (EBIT) in % per year

Annual reports, ING Research

Three developments shaping the future of transport and logistics

Supply chains continue to improve but are less robust than before

Global supply chains continue to stabilise in 2023, and much of the congestion in shipping and port capacity has been solved. But it will also take time to fully digest the effects of the pandemic and war-related supply shocks. Lead times of airfreight and containerised seafreight are still longer compared to pre-pandemic standards and arrival performance rates still have upward potential. In the highly regulated aviation sector, spare part supply is an ongoing constraint and consequently aircraft manufacturers are limited in ramping up production.

Global logistics will not return to the previous 'normal' due to many reasons:

- Commodity trade patterns have adjusted to sanctions on Russia. This is most visible in energy commodities trade to Europe and more indirect trade flows. On balance, this leads to reshaped routes, less efficient trade and more sea miles – which benefits tanker shipping.

- The US is attempting to ramp up regional production to move away from its dependence on China, increased with digitalisation and the shift to green technologies like electric vehicles. This is a long-term process. So far, we don’t see massive deglobalisation, but rather diversification. In Europe, the Supply Chain Due Diligence Act could impact sourcing routes.

- Supply chain uncertainty probably remains higher. Structural labour market shortages are a reason for this, and an increase in climate change-related (extreme) weather events also pose a larger disruption risk. The restrictive low water levels on the Panama Canal – a crucial link on the Asia-US East Coast trade – are a recent example, and the return of El Nino could also lead to extreme weather going forward.

Logistics is higher on the agenda of shippers

Supply chain resilience remains more important for shippers in the post-pandemic world, and contract logistics can benefit from that. Shippers seem to be sticking to higher buffer stocks to increase supply chain resilience. With the lessons learned from the pandemic, supply chain management (and risks) are still high on the agenda. Logistics services are structurally more profitable than A to B transportation. This is one of the strategic drivers of the trend of integration and end-to-end supply chain management, pursued by container liners such as Maersk, CMA CGM and MSC.

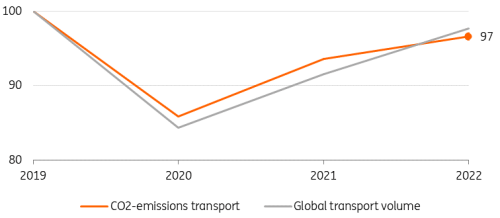

Global CO2 emissions in transport slow down, but much more is required to get on the net-zero track

Before the pandemic, the total transport sector accounted for a fifth of global CO2 emissions, with road traffic making up three-quarters of it. From an economic and business perspective, CO2 emission development is increasingly important. CO2 emissions have their price and this will gradually be incorporated into business models, since shippers and operators are increasingly pushing for progress with regulatory pressure, sustainability reporting obligations and corporate ambitions. The European emissions trading system (ETS) is already introducing carbon pricing for aviation and shipping.

CO2 emissions in transport (also including autos) dropped by more than 16% during the pandemic, with falling road traffic and the collapse of airline traffic. With combustion engines returning in larger quantities on motorways in 2021 and more aircraft returning to the skies in 2022, CO2 emissions returned to 96.5% of pre-pandemic levels last year.

Given the progress in electrification within the global car fleet (in 2020, 1% of the global stock was electric, rising to 2.5% in 2022, including plug-in hybrids), but also efficiency efforts in trucking, aviation and shipping, transport CO2 emissions are expected to continue to rise at a lower level than demand. This means the average carbon intensity of transport activity will decrease.

Electrification of the global car fleet continues, and in aviation the strong rebound in passenger numbers is likely to offset gains made by using more sustainable aviation fuels. The International Energy Agency expects oil consumption of transport to start declining after 2026.

CO2 emissions rebounded less than transport volumes in 2022

Index global CO2 emissions from transportation and global transport volume (added value) (index, pre-pandemic base 2019 = 100)

IEA, ING Research