ING amends Executive Board remuneration based on new legislation

19 March 2015

Today, ING published its Annual Report 2014. In the remuneration chapter, the Supervisory Board explains how the remuneration policy, which has been in place since 2010, will be amended.

No variable remuneration since 2008

Since ING received State aid in 2008, no variable remuneration has been paid to the Executive Board. In 2010, in the annual General Meeting shareholders adopted a new remuneration policy. Since then, the fixed salary of the Executive Board has remained unchanged and the Supervisory Board has consistently mentioned not to review the remuneration policy until the State aid had been repaid in full to the Dutch State and there was more clarity about national and international regulations in the area of remuneration.

The Dutch State was repaid in full on 7 November 2014 and the Dutch Law on Remuneration Policies of Financial Undertakings (Wbfo) has been enacted with the effect from 7 February 2015. Under this law, the variable remuneration for the Executive Board is set at a maximum of 20% of the fixed salary. In light of these developments, the Supervisory Board has reviewed the remuneration of the Executive Board.

Current remuneration policy far below median of peer group

The primary objective of ING’s remuneration policy is to enable ING to retain and recruit highly qualified and experienced leaders. In compliance with the Dutch Banking Code, the Executive Board remuneration policy stipulates that total direct compensation should be slightly below the median of the peer group.

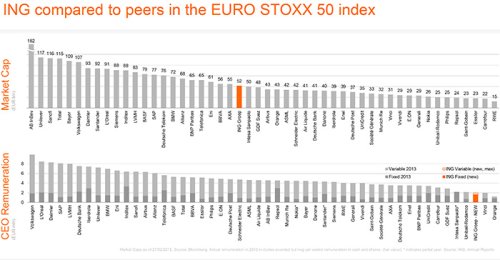

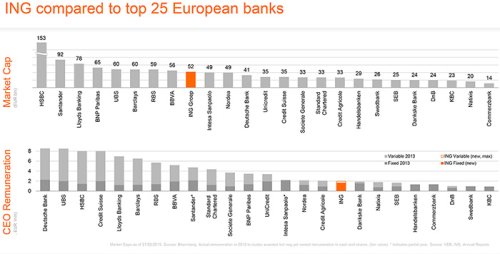

ING has just over 30 million customers in 40 countries, with approximately 70% of its workforce outside the Netherlands and 70% of its income earned abroad. Given its size, scale and international character, for a long time, ING has used as a reference group the companies in the Dow Jones Euro Stoxx 50 index, 50 financial and non-financial businesses, including ING, which are based within the eurozone.

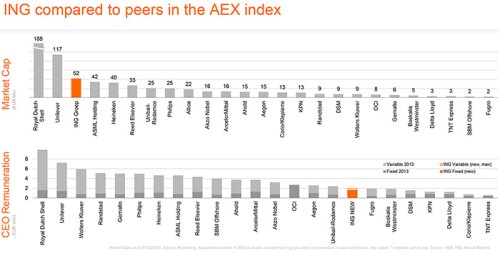

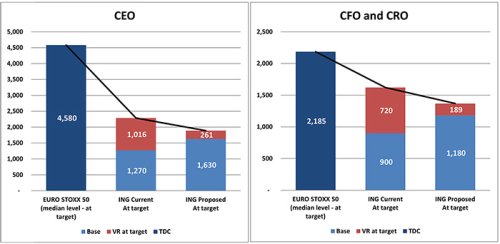

The current remuneration policy, which was approved by the Annual General Meeting in 2010, includes fixed and variable remuneration, which amounts to 80% of the fixed salary, if the targets are met, and can be up to 100%. In practice, the total remuneration of the ING directors is far below the average of the benchmark group. In comparison with other reference groups, such as the AEX index, in which ING is the third largest company by market capitalisation, the current remuneration of ING’s Executive Board is significantly below the remuneration offered by other companies.

Once it had repaid the State aid, ING was again permitted to award variable remuneration to the Executive Board. Implementing the Wbfo sets variable salary at a maximum of 20% of the fixed salary. The Supervisory Board will propose to the annual General Meeting that the variable remuneration should be set at 16%, if the targets are met, rising to a maximum of 20% of the fixed salary if the targets are exceeded.

Decrease remuneration policy 35% to 40% at unchanged policy

If the policy were to remain unchanged, this would lead to a 35% to 40% decline in the total remuneration of the Executive Board in relation to the remuneration policy approved by the shareholders in 2010. This would only further widen the gap with comparable companies. Given the context of the international labour market, as an international bank, ING cannot afford for its remuneration to differ significantly from similar companies for a long period.

To limit a further widening of the gap between the remuneration at ING and at comparable companies as a result of the Wfbo, the Supervisory Board has decided to increase the fixed salary of the members of the Executive Board. As a result of this amendment, the decline in the total remuneration, if performance-related targets are met, will be limited to approximately 20% in relation to the current remuneration policy.

Variable remuneration in future in shares only

Furthermore, to ensure that the correlation between the overall remuneration and the long-term objectives of ING is also adequately safeguarded following the review, the Supervisory Board is proposing to pay the variable remuneration in ING shares only from now on.

As is the case under the current policy, and based on European legislation, 40 percent of this variable remuneration will be paid at the time of allocation while the remaining 60 percent will be deferred over a three-year period. Likewise, the members of the Executive Board will be required to hold their allocated shares for a period of at least 5 years after grant date.

New remuneration policy still far below median of peer group

Even after the amendments to the remuneration policy, the remuneration of ING’s Executive Board will still be far below the average remuneration offered by similar business, as shown in the graphs below. This remains an area of concern, however, the Supervisory Board deems fully bridging this gap with comparable companies currently not appropriate in the context of the public debate. The current package will mean in any event that any further widening of the gap will be restricted.