Europeans more bullish on house prices

Despite years of austerity it seems Europeans are beginning to believe a revival in the housing market is on its way. Most consumers (53%) are becoming increasingly optimistic about house prices rising, representing a six percentage point upward change on last year and 2012.

This was revealed in the third annual ING International Survey (IIS) on Homes and Mortgages. Almost 13,000 people in Europe – and 1,000 in the United States – were asked about their expectations about house prices, how they are coping with housing costs, their satisfaction with their commute and more.

The ING House Price Optimism Index released today as part of IIS by ING Bank found that the UK (72%), Turkey (72%) and Luxembourg (72%) have the highest share of consumers who think house prices will rise over the next year, which also reflects the highest rise in actual prices according to latest data.

Ian Bright, senior economist at ING Group commented: “It’s encouraging to see growing optimism in markets where house prices have been in negative growth – ultimately property is worth what someone is willing to pay for it and has a lot to do with market confidence. This general optimism is also matched by aspiration, as more than three quarters of consumers across Europe consider owning a property is better than renting from a financial point of view. The research suggests that the desire to own a property has not been dampened by volatility in the property market over recent years.”

Sentiment is rising fast

Sentiment is rising fastest in the Netherlands, Spain and Romania – increasing by 32, 18 and 15 percentage points respectively. This comes on the back of years of turmoil in the housing markets in both the Netherlands and Spain, perhaps suggesting recoveries may be taking hold.

However, this sentiment may not be welcomed by all as the research revealed that almost two thirds of European consumers (63%) believe house prices already to be expensive.

For about three – in - ten people in Europe, the essential expense of paying mortgage or rent each month is “difficult” to manage , rising to a survey high of 46% in Spain, with Romania, Poland, Italy and Turkey also well above the weighted average.

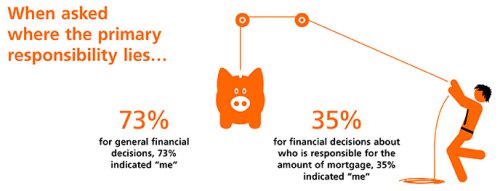

When asked where the responsibility lies when deciding how much mortgage to take, only 35% indicate it is with them, with the bulk saying it is a joint responsibility between “me and my bank”. This is in contrast to responses to a question on general financial decisions in a earlier ING International Survey to which 73% indicated the responsibility lies with them not with their bank. Likewise, during times of financial hardship when mortgage repayments cannot be met, the majority would want to work with their lender to find a solution.

Want to know more about the IIS survey, please visit www.ezonomics.com.