ING posts 2Q2021 net result of €1,459 million

Amsterdam,

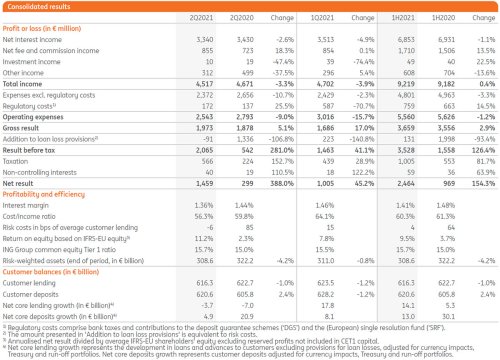

- 2Q2021 result before tax of €2,065 million; capital position strengthens to 15.7%

- Growth in fee income of 18.3% year-on-year, especially in daily banking and investment products. Net interest income declined due to liability margin pressure.

- Net release of risk costs following an update of macroeconomic indicators. Expenses remained under control.

- Shareholder distribution of €3,618 million after 30 September 2021

- More customers choose ING as their primary bank; lending decreases

- Primary customer base rose by 281,000 in 2Q2021 to 14.0 million.

- Net core lending growth of €-3.7 billion in 2Q2021 due to repayments; improvement in lending margin. Net core deposits growth of €4.9 billion.

CEO statement

“I’m pleased with another set of resilient results in the second quarter,” said ING CEO Steven van Rijswijk. “Fee income of €855 million was in line with the strong result in the first quarter, while net interest income and in particular our liability margin remained under pressure. The improving economic environment meant that risk costs were significantly reduced, and expenses are developing in the right direction, which I will continue to monitor closely.

“I’m encouraged by the growth in primary customers, and we continue to see high demand from retail customers for digital investment products, which complement our savings product offering. An example is ‘Komfort-Anlage’ (‘Comfort Investing’), launched in Germany during the second quarter. ‘Komfort-Anlage’ empowers customers to invest online in one of seven funds that best matches their risk appetite, and features enhanced digital and video interaction capabilities to provide customers with advice when needed.

“In addition to diversifying income, we continued to take steps to future-proof our business and optimise capital allocation by making decisions on where and how we serve customers. We’ve reached an agreement to transfer our retail banking operations in Austria to bank99, the digital banking arm of the national postal service Österreichische Post. And the transfer of our retail customers in the Czech Republic is proceeding smoothly, with around half of customers and 60% of client balances migrated to Raiffeisenbank. We’re also conducting a strategic review of our retail banking business in France. I know these changes cause uncertainty for our colleagues and I’m grateful for their continued commitment.

“The effects of climate change are increasingly apparent, and taking action becomes more urgent by the day. I believe that for climate action to be successful, with the goal of net zero emissions by 2050, a concerted collaborative effort is needed from all sectors of society. That’s why ING has committed to the Net-Zero Banking Alliance. The pathway to net zero brings many opportunities for financing and investing in the necessary transition, and in the first half of 2021 we supported 133 sustainability deals. An example is the US$401 million Infrastructure Asset-Backed Securitised (IABS) issuance by Singapore-based Bayfront Infrastructure Management. This was the first public securitisation with a sustainability tranche, for which ING acted as Joint Global Coordinator and Sole Sustainability Structuring Advisor.

“We will distribute €3,618 million after 30 September 2021. We will pay an amount of €0.48 per share in October 2021 and make an additional distribution of €1,744 million related to the amount reserved over 2019. The latter will be in the form of cash and/or a share buyback, subject to relevant approvals.

“With the pandemic continuing to affect life and business, I want to once again thank all ING colleagues, more than 80% of whom are still working from home, as they continue to help customers through these challenging times.”

Analyst and investor conference call

6 August 2021 at 9:00 am CEST

NL: +31 (0)20 341 8221

UK: +44 203 365 3209

US: +1 866 349 6092

Live audio webcast

Media conference call

6 August 2021 at 11:00 am CEST

NL: +31 (0)20 531 5855

UK: +44 203 365 3210

Live audio webcast

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 57,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s strategy, evidenced by ING’s leading position in sector benchmarks by Sustainalytics and MSCI. ING ranks first in our market-cap group by Sustainalytics as of July 2020. ING's ESG rating by MSCI was upgraded to 'AA' in December 2020. ING Group shares are included in major sustainability and Environmental, Social and Governance (ESG) index products of leading providers STOXX, Morningstar and FTSE Russell. In January 2021, ING received an ESG evaluation score of 83 ('strong') from S&P Global Ratings.

Further information

All publications related to ING’s 2Q2021 results can be found at www.ing.com/2q2021, including a video with CEO Steven van Rijswijk. The 'Steven on Air’ video is also available on YouTube.

Additional financial information is available at www.ing.com/ir:

• ING Group historical trend data

• ING Group analyst presentation (also available via SlideShare)

• Interim financial statements for the period ended 30 June 2021 for ING Groep N.V. and ING Bank N.V.

For further information on ING, please visit www.ing.com. Frequent news updates can be found in the Newsroom or via the @ING_news Twitter feed. Photos, videos of ING operations, buildings and its executives are available for download at Flickr. ING presentations are available at SlideShare.

IMPORTANT LEGAL INFORMATION

Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/2014.

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2020 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions and customer behaviour, in particular economic conditions in ING’s core markets, including changes affecting currency exchange rates (2) the effects of the Covid-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which ING operates, on ING’s business and operations and on ING’s employees, customers and counterparties (3) changes affecting interest rate levels (4) any default of a major market participant and related market disruption (5) changes in performance of financial markets, including in Europe and developing markets (6) political instability and fiscal uncertainty in Europe and the United States (7) discontinuation of or changes in ‘benchmark’ indices (8) inflation and deflation in our principal markets (9) changes in conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness (10) failures of banks falling under the scope of state compensation schemes (11) non-compliance with or changes in laws and regulations, including those concerning financial services, financial economic crimes and tax laws, and the interpretation and application thereof (12) geopolitical risks, political instabilities and policies and actions of governmental and regulatory authorities (13) legal and regulatory risks in certain countries with less developed legal and regulatory frameworks (14) prudential supervision and regulations, including in relation to stress tests and regulatory restrictions on dividends and distributions, (also among members of the group) (15) regulatory consequences of the United Kingdom’s withdrawal from the European Union, including authorizations and equivalence decisions (16) ING’s ability to meet minimum capital and other prudential regulatory requirements (17) changes in regulation of US commodities and derivatives businesses of ING and its customers (18) application of bank recovery and resolution regimes, including write-down and conversion powers in relation to our securities (19) outcome of current and future litigation, enforcement proceedings, investigations or other regulatory actions, including claims by customers who feel mislead and other conduct issues (20) changes in tax laws and regulations and risks of noncompliance or investigation in connection with tax laws, including FATCA (21) operational risks, such as system disruptions or failures, breaches of security, cyber-attacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business (22) risks and challenges related to cybercrime including the effects of cyber-attacks and changes in legislation and regulation related to cybersecurity and data privacy (23) changes in general competitive factors, including ability to increase or maintain market share (24) the inability to protect our intellectual property and infringement claims by third parties (25) inability of counterparties to meet financial obligations or ability to enforce rights against such counterparties (26) changes in credit ratings (27) business, operational, regulatory, reputation and other risks and challenges in connection with climate change (28) inability to attract and retain key personnel (29) future liabilities under defined benefit retirement plans (30) failure to manage business risks, including in connection with use of models, use of derivatives, or maintaining appropriate policies and guidelines (31) changes in capital and credit markets, including interbank funding, as well as customer deposits, which provide the liquidity and capital required to fund our operations, and (32) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com.

This document may contain inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document. ING does not make any representation or warranty with respect to the accuracy or completeness of, or take any responsibility for, any information found at any websites operated by third parties. ING specifically disclaims any liability with respect to any information found at websites operated by third parties. ING cannot guarantee that websites operated by third parties remain available following the publication of this document, or that any information found at such websites will not change following the filing of this document. Many of those factors are beyond ING’s control.

Any forward looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.

Press enquiries

Raymond Vermeulen

Head of Media Relations & Issues Management, Retail Banking Benelux, corporate governance

+31 20 576 63 69

Send e-mail

Investor enquiries

ING Group Investor Relations

Send e-mail