ING posts 2Q2022 net result of €1,178 million, supported by increased income and modest risk costs

Amsterdam,

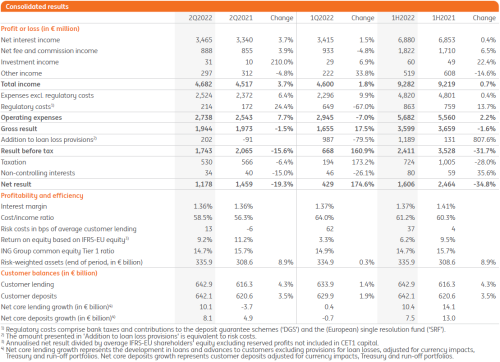

2Q2022 profit before tax of €1,743 million; capital position remains strong with a 14.7% CET1 ratio

- Higher net interest income, supported by an increase in liability margins

- Increases in both customer lending and customer deposits highlight the strength of our universal banking model

- Risk costs in the quarter were modest as book quality remains strong

- Hyperinflationary conditions in Turkey require application of IAS 29, which combined with a goodwill impairment had an impact of €-277 million on net profit, but the impact on CET1 was slightly positive

- ING declares interim cash dividend of €0.17 per ordinary share

CEO statement

“The backdrop to ING’s performance in the second quarter of 2022 was one of ongoing geopolitical uncertainty and pressure on the global economy,” said ING CEO Steven van Rijswijk. “Despite these difficult operating conditions, I’m pleased with our results. I believe resilience and adaptability are two of ING’s core strengths, and we showed these qualities once again by growing our primary customer base by 228,000 since the first quarter and continuing to diversify our revenues, with fee income up 4% year-on-year. Our resilience is underpinned by our strong capital position and risk management framework, with limited risk costs in the second quarter. There was a small quarter-on-quarter rise in underlying expenses, but that was well below inflation.

“At our Investor Update in June, I was proud that we were able to show how well ING has performed on many key financial metrics over the past few years, including during the pandemic. Looking ahead, we aim to reinforce our position as the leading universal bank in Europe by focusing on delivering value through our Retail Banking and Wholesale Banking businesses. The strength of our Wholesale Bank is in its blend of global reach, local knowledge and sector expertise, and during this quarter Wholesale Banking increased its income contribution by €338 million compared with the second quarter of last year. In Retail Banking we’re focusing our capital, cost and efforts on where we can build sufficient local scale. In this way we can offer truly superior customer propositions, attract and retain the right talent, and achieve good returns.

“Our strong commercial performance in this quarter flows from our overarching strategic priorities: to provide a superior customer experience and put sustainability at the heart of what we do. This is how we aim to make a difference for people and the planet. We continue to invest in a customer experience that’s relevant, easy, personal and instant, tailored to the needs of our customer segments. Our strong, scalable technology and operations foundation facilitates digital innovation, which in turn leads to impactful improvements for customers. Examples from the second quarter include a more digital mortgage application process in Romania and Belgium, new easy payment possibilities in the Dutch app, and account aggregation in Spain. When it comes to sustainability, we have committed to aligning with climate goals limiting the rise in global temperatures to 1.5 degrees Celsius. We've therefore set intermediate sector-specific goals for 2030 that match a global emissions decrease of 45% compared to 2010 levels.

“The economic and political challenges the world is facing will likely persist for the foreseeable future. Despite this unsettling outlook, I’m confident in ING’s ability to provide the necessary support to our customers and to continue to create value for all stakeholders, while intensifying our efforts in the fight against climate change."

Analyst and investor conference call

4 August 2022 at 9:00 am CEST

Live audio webcast

Media conference call

4 August 2022 at 11:00 am CEST

Live audio webcast

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 57,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability is an integral part of ING’s strategy, evidenced by ING’s leading position in sector benchmarks. ING's Environmental, Social and Governance (ESG) rating by MSCI was affirmed 'AA' in December 2021. As of September 2021, Sustainalytics considers ING’s management of ESG material risk to be ‘strong’, and in June 2022 ING received an ESG rating of 'strong' from S&P Global Ratings. ING Group shares are also included in major sustainability and ESG index products of leading providers STOXX, Morningstar and FTSE Russell.

Further information

All publications related to ING’s 2Q2022 results can be found at www.ing.com/2q2022, including a video with CEO Steven van Rijswijk. The 'ING ON AIR’ video is also available on YouTube.

Additional financial information is available at www.ing.com/ir:

• ING Group Historical Trend Data

• ING Group Results presentation

• ING Group Credit Update presentation

For further information on ING, please visit www.ing.com. Frequent news updates can be found in the Newsroom or via the @ING_news Twitter feed. Photos of ING operations, buildings and its executives are available for download at Flickr. ING presentations are available at SlideShare.

IMPORTANT LEGAL INFORMATION

Elements of this press release contain or may contain information about ING Groep N.V. and / or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/2014.

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRSEU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2021 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions and customer behaviour, in particular economic conditions in ING’s core markets, including changes affecting currency exchange rates and the regional and global economic impact of the invasion of Russia into Ukraine and related international response measures (2) effects of the Covid-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which ING operates, on ING’s business and operations and on ING’s employees, customers and counterparties (3) changes affecting interest rate levels (4) any default of a major market participant and related market disruption (5) changes in performance of financial markets, including in Europe and developing markets (6) fiscal uncertainty in Europe and the United States (7) discontinuation of or changes in ‘benchmark’ indices (8) inflation and deflation in our principal markets (9) changes in conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness (10) failures of banks falling under the scope of state compensation schemes (11) non-compliance with or changes in laws and regulations, including those concerning financial services, financial economic crimes and tax laws, and the interpretation and application thereof (12) geopolitical risks, political instabilities and policies and actions of governmental and regulatory authorities, including in connection with the invasion of Russia into Ukraine and related international response measures (13) legal and regulatory risks in certain countries with less developed legal and regulatory frameworks (14) prudential supervision and regulations, including in relation to stress tests and regulatory restrictions on dividends and distributions (also among members of the group) (15) regulatory consequences of the United Kingdom’s withdrawal from the European Union, including authorizations and equivalence decisions (16) ING’s ability to meet minimum capital and other prudential regulatory requirements (17) changes in regulation of US commodities and derivatives businesses of ING and its customers (18) application of bank recovery and resolution regimes, including writedown and conversion powers in relation to our securities (19) outcome of current and future litigation, enforcement proceedings, investigations or other regulatory actions, including claims by customers or stakeholders who feel misled or treated unfairly, and other conduct issues (20) changes in tax laws and regulations and risks of non-compliance or investigation in connection with tax laws, including FATCA (21) operational and IT risks, such as system disruptions or failures, breaches of security, cyber-attacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business (22) risks and challenges related to cybercrime including the effects of cyberattacks and changes in legislation and regulation related to cybersecurity and data privacy (23) changes in general competitive factors, including ability to increase or maintain market share (24) inability to protect our intellectual property and infringement claims by third parties (25) inability of counterparties to meet financial obligations or ability to enforce rights against such counterparties (26) changes in credit ratings (27) business, operational, regulatory, reputation, transition and other risks and challenges in connection with climate change and ESG-related matters (28) inability to attract and retain key personnel (29) future liabilities under defined benefit retirement plans (30) failure to manage business risks, including in connection with use of models, use of derivatives, or maintaining appropriate policies and guidelines (31) changes in capital and credit markets, including interbank funding, as well as customer deposits, which provide the liquidity and capital required to fund our operations, and (32) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com.

This document may contain inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document. ING does not make any representation or warranty with respect to the accuracy or completeness of, or take any responsibility for, any information found at any websites operated by third parties. ING specifically disclaims any liability with respect to any information found at websites operated by third parties. ING cannot guarantee that websites operated by third parties remain available following the publication of this document, or that any information found at such websites will not change following the filing of this document. Many of those factors are beyond ING’s control.

Any forward looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.

Press enquiries

Raymond Vermeulen

Head of Media Relations & Issues Management, Retail Banking Benelux, corporate governance

+31 20 576 63 69

Send e-mail

Investor enquiries

ING Group Investor Relations

Send e-mail