Environmental and Social Risk (ESR)

As a global bank, our influence is through the ways we channel the flow of money entrusted to us. With this influence comes responsibility. For us, this means making transparent choices about how, where and with whom we do business. We are guided by our ESR framework, which we update regularly. We want the framework to reflect changing social norms and regulation relating to sustainability, and to challenge our own increasingly strong commitments on the topics of human rights and climate change. You can read more about the ESR framework below.

If clients in scope of our ESR framework don’t meet those standards and aren’t willing to change, we don’t do the deal.

While these policies are global and apply to all customers and clients, it’s our corporate clients that often have more significant potential environmental and social impacts. These clients account for about 30% of our total lending portfolio.

There are certain sectors and countries that are totally excluded from financing. For example, we don’t finance activities like fur production, cosmetic animal testing, controversial arms industries or deforestation of rain forests.

As we assess potential clients and deals, our approach is to have a dialogue and support them in improving their environmental and social impact where possible. Our response to funding requests is often, “yes, but…”, outlining improvements that the company will have to make first. We feel that this is how we can make the most positive impact. One example is with our client Wilmar, which you can read about below.

ING’s ESR management is in three steps: creating and maintaining our policy framework; conducting the screening of transactions and clients; and monitoring the relationship after an agreement is reached. See an example of the ESR team in action, see Should we say ‘no’ to gold.

Updating our ESR framework

The ESR framework is reviewed regularly to ensure we adequately identify and manage not only existing but also new environmental and social risks. We conducted a full review of the ESR framework in 2021, following reviews in 2018, 2015 and 2012. This was done with the active participation of internal and external stakeholders.

Changes to the updated ESR framework (valid as of 15 July 2021) take into account the recent ESR-related requirements of the EBA Loan Origination and Monitoring guidelines, improved controls and comments received from internal and external stakeholders. The update also aims to improve understanding of existing process and evaluation requirements, with special attention to supply chain due diligence. Where appropriate, internationally acknowledged certification standards and guiding principles have been added to or updated in the individual sector policies. More information can be found in the ESR framework via the link below.

We actively manage potential climate and human rights risks through our ESR framework and regularly engage with stakeholders to inspire clients, peers and others to do the same. We updated our human rights policy to reflect our commitment to the United Nations Guiding Principles and improved transparency through our regular human rights reporting.

We continue to work with the United Nations Guiding Principles in proactive ways, and we’re currently developing a tool that will help assess portfolio and client exposure to salient human rights issues. This will help us use our leverage, prioritize risks and increase client engagement.

Since 2017, we have been communicating our progress on climate risks and opportunities according to TCFD reporting. We’ve set our climate risk management ambition based on other relevant materials, such as the ECB’s recent ‘Guide on climate-related and environmental risks’. This includes integrating climate change as part of our risk appetite framework, where the progressive integration is ongoing.

Download the updated ESR framework here (PDF 1,4 MB).

An example of how our policies form part of our client engagement process:

Casestudy: Wilmar International Limited

“In implementing our ESR framework, we frequently engage with clients on specific topics and industry sectors. In the palm oil industry sector for example, there are at times issues linked to deforestation in Southeast Asia and Africa, and illegal labour practices on some plantations.

We have engaged in discussions on environmental and social issues with Wilmar, among other players in the sector. Our discussions aimed to understand Wilmar’s Environmental and Social Risk policies and their implementation, their compliance with the ING ESR framework and their plans to support the best practices in the sector, like the RSPO certification. As a result, Wilmar achieved several good results. For example, Wilmar is the first large palm oil company that publicly disclosed names and locations of its suppliers in its palm oil supply chain in Malaysia and Indonesia (see the sustainability section of Wilmar’s website), a major step in addressing deforestation.

We continue to monitor and remain in dialogue with Wilmar. Such a collaborative approach also allows ING and Wilmar to widen their perspectives and align sustainability objectives, leading to a deeper and more meaningful relationship with the aim to contribute to the betterment of the sector.”

Once we enter a business agreement with a client, we continuously monitor and evaluate whether they are complying with our policies.

What does ING’s ESR team do?

- Create and maintain policies for sensitive industry sectors.

- Assess transactions for environmental and social risk.

- Monitor and engage with high-risk clients to ensure compliance with our ESR policy and sustainability criteria.

- Spread ESR awareness throughout ING.

- Participate in European and global advisory groups (i.e. OECD advisory group, steering committee to the Equator Principles, Thun Group of Banks) to help bring all banks to the same high standard.

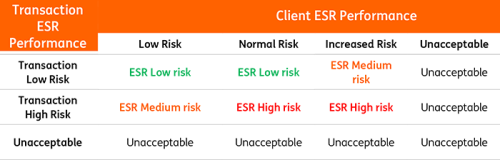

The ESR screening processes we apply are visualised and explained in the ESR framework (chapter 2). ESR is applied in practice in different ways, including an ESR client assessment during KYC onboarding and periodic reviews, an ESR transaction assessment for Wholesale Banking and name screening for transactions with fully restricted clients. These ESR check and controls are integrated into our client and transaction due diligence processes. The outcome of the ESR client assessment together with the outcome of the ESR transaction assessment will determine the overall ESR profile of the business engagement and the approval process thereafter (see table).