Fintechs help change our culture – Benoît Legrand

27 July 2017

By teaming up with fintechs, ING is looking from the outside in to improve services for customers globally. But why and how does ING go about choosing who it partners with? Benoît Legrand, the Bank’s global head of Fintech, explains.

Please note that this was recorded in April, and the number of fintech partnerships differs to the text below.

ING has around 100 fintech partnerships at the moment. Is the quantity important?

No, the number of fintech partnerships is not important, but it does say something about how serious we are about joining forces with fintechs. Partnering with them is one of the ways to get the best ideas from around the world. We do not have a monopoly on good ideas, that’s for sure.

Perhaps more important than the number of fintech partnerships is their diversity.

These partnerships are also a way of changing the culture of a large organisation and accelerate the pace of innovation.

When will customers see the benefits of all these partnerships?

They are experiencing them already. For instance, in Spain, new and existing customers can apply for an online loan in just a few minutes and without any paper. This is thanks to our partnership with Kabbage.

In Germany, new customers can open an account via a video call rather than visiting a branch or a post office.

On top of these examples, there is everything we learn from fintechs, which becomes part of our culture and helps us in the way we develop new products and services.

So what else can ING learn?

Entrepreneurship, agility and technological know-how. Fintechs look at banking not from a traditional point of view, but from a fresh perspective.

A year from now, what do you hope to be saying about fintech collaboration?

That thanks to these partnerships we have been able to make the lives of customers even easier through what we’ve learned and translated into useful innovations.

There’s also the impact that these partnerships are bringing to ING’s performance. Ultimately, we have to make sure that partnerships are meeting expectations and are having the desired impact.

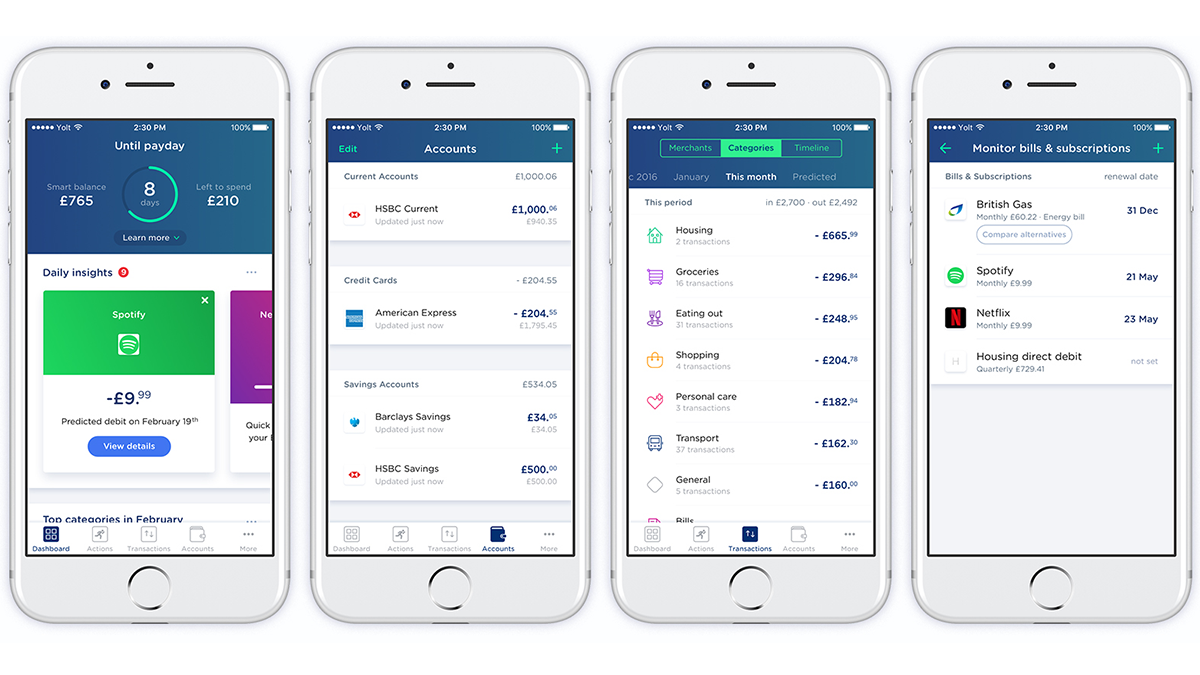

Last month, Fintonic announced a major ING investment. How important are aggregators like this and Yolt to ING?

Very important. Money management and aggregation are two of our innovation priorities and both Fintonic and Yolt represent our way to speed up the development in this area.

Fintonic is only active in Spain and Latin America, whereas Yolt is currently active in the UK. Fintonic is a marketplace for bank accounts and insurance products and offers its 400,000 users tools to manage their personal finances. From that perspective, it does serve the same goal as Yolt. We are committed to developing Yolt, but believe we can learn a great deal from other successful initiatives at the same time.

Not all start-ups are successful. Of the 100 or so partnerships we have at the moment, how many do you expect to still be in business by the end of the decade?

We won’t be able to always select the partners who will become the next big thing. Some might not be successful but a few will become big and strong. There are more than 15,000 start-ups in the world and we carefully select the ones relevant for customers and for us. I don’t want to put a number on it or even take a guess!

So how many partners have ING said goodbye to, in say, the last six months?

We’re not afraid to stop partnerships when they are not effective. In recent months we’ve halted more than 20. Most of these were ‘proof of concept’ fintechs, (those demonstrating an idea to illustrate scalability and profit potential) that either didn’t provide the expected technological solution, or didn’t provide a real solution for customers.

Is there a recurring theme when we choose our partners?

Yes, everything we do is linked to ING’s strategy. Our innovation priorities centre around disrupting core banking, platforms and beyond banking, so we select fintechs in these areas.

We are investing in fintechs so we can accelerate our strategy and, of course, keep an eye on our financial performance.

Banks and fintechs seem to have completely different cultures. Is this ever a problem?

We like to think we’re quite entrepreneurial. With ING Direct, for example, we were already a fintech ourselves 20 years ago. But of course there are big differences. One of the reasons we partner with fintechs, is that it helps us change our culture. The biggest driver of transformation, is cultural change.