Four things Richard Thaler taught us about irrational behaviour

11 October 2017

Behavioural economist Richard Thaler was awarded the Nobel Prize for Economics this week. What did we learn from him?

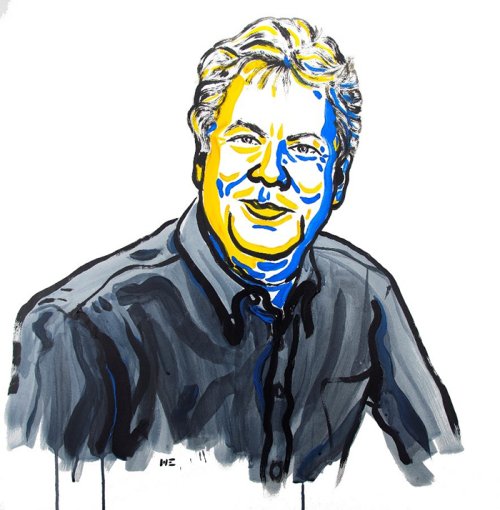

llustration: Niklas Elmehed. Copyright: Nobel Media AB 2017

As one of the pioneers in his field, Thaler has demonstrated that people often act in ways that are not in their best interest—especially around money.

His research has shown how and why people make choices that saddle them with unnecessary debt or leave them facing an uncertain retirement.

Understanding these decisions plays an important role in helping people get ahead in life and in business.

Here are four things that Thaler’s work has taught the world about financial behaviour.

1. People put money in jars

One euro, pound or dollar bill is the same as any other euro, pound or dollar bill: they can be swapped to save or spend however we like. This is known as the fungibility of money.

Yet the way we treat money can differ depending on how we received it or if it was originally earmarked for something else—that’s Thaler’s theory of mental accounting.

So while we may feel free to splurge with an unexpected windfall – an inheritance from a distant aunt, say – we might not feel as inclined to blow an equal amount if received as a salary increase.

Similarly, people may save money for something special, like a holiday, while simultaneously carrying expensive credit card debt. It would be more cost-effective to pay off the debt, but people are reluctant to touch the money they’ve saved.

2. Easy come, easy go

Mental accounting is related to the concept of house money, explained in a classic 1990 behavioural economics paper written by Thaler and Eric Johnson of Columbia Business School.

Imagine a scenario where someone enters a casino with EUR 200, gambles and is lucky enough to win another EUR 200. They’re likely to wager the winnings in a much more aggressive manner—simply because they view it as “house” money from the casino.

Thaler and Johnson found that, in real life, investors are more likely to buy risky stocks after profiting from a previous trade. Because “house money” doesn’t really feel like our own, it can be easier to spend.

3. Home sweet home

How much is your house worth? And would a potential buyer agree?

Economists have found that we tend to overvalue what we own simply because we have it—a phenomenon known as the “endowment effect”.

Thaler demonstrated the effect in action in a classic experiment in the 1980s while working at Cornell University in the US. He randomly handed out free coffee mugs to students and asked those who had received mugs how much they would sell them for, and those who hadn’t how much they would pay for them. The typical recipient of the mug demanded USD 4.75 but the typical buyer offered USD 2.25. The mere possession of the mug—which in this case was accidental—caused people to value it highly.

4. Pension prompts help

Thaler’s nudge theory is especially relevant to retirement planning. Research shows that when employees are automatically enrolled (given a “nudge”) into a retirement plan (with the option to withdraw), far more people sign up than would have if they had to enroll themselves.

Thaler also co-designed the “Save More Tomorrow” plan (SMT), in which people are invited to commit now to increase their savings rate later, such as the following year. As Thaler explains, “self-control is easier to accept if delayed rather than immediate”.

And, as planned increases are linked to pay raises, it is meant to diminish the effect of loss aversion – the tendency to feel losses larger than gains. Staff do not see their pay fall because the increase in the savings rate is a portion of the pay raise.

At the first company that implemented SMT, staff ended up almost quadrupling their savings rate from 3.5 percent to 13.6 percent in under four years.

The plan is now used by millions of people around the world, demonstrating the far-reaching effects of Thaler’s work in the field of behavioural economics.