ING 1Q16 underlying net result EUR 842 million

Amsterdam, 10 May 2016

- ING’s Think Forward strategy continues to improve the customer experience and drive commercial growth

- Strengthened focus on innovation with further investments in proprietary technologies and collaborations with fintechs

- ING Bank attracted EUR 8.8 billion of net customer deposits and recorded EUR 7.1 billion of net core lending growth in 1Q16

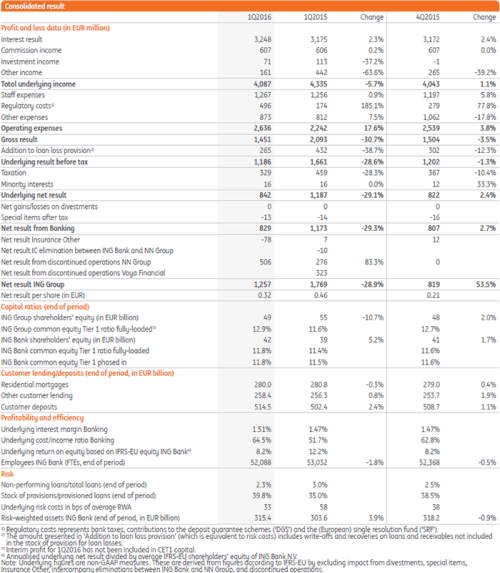

- ING Bank 1Q16 underlying net result EUR 842 million despite significant increase in regulatory expenses

- Underlying pre-tax result EUR 1,186 million; or EUR 1,682 million before EUR 496 million of regulatory costs in the quarter

- Net interest result increased, driven by volume growth and a higher interest margin; commission income held up well

- Quality of loan book improved: risk costs continue to decline and the NPL ratio decreased to 2.3%

- ING Group 1Q16 net result EUR 1,257 million (EUR 0.32 per share) including profit on sales of NN Group shares in January

- Group’s restructuring and strategic repositioning completed through the final sales of NN shares in January and April 2016

- Strong Group fully-loaded common equity Tier 1 (CET1) ratio of 12.9%, up from 12.7% at the end of December 2015

CEO Statement

“The digital banking landscape has never been more dynamic than it is today,” said Ralph Hamers, CEO of ING Group. “Customers are changing the way they bank, which requires us to be flexible and agile. Our Think Forward strategy has enabled us to rise to this challenge and deliver a differentiating experience to our more than 34 million customers around the world.”

“ING Bank’s most recent Net Promoter Scores rank us as number one relative to our competitors in seven countries. This recognition underscores that ING is delivering on the customer promise that is at the heart of our strategy. It also motivates us to keep getting better as we strive to achieve our purpose of empowering people in life and in business.”

Ralph Hamers, CEO of ING Group

Customers are changing the way they bank, which requires us to be flexible and agile. Our Think Forward strategy has enabled us to rise to this challenge and deliver a differentiating experience to our more than 34 million customers around the world.

“In the first quarter of 2016, we made further investments in customer-friendly technologies and outside collaborations. We became the first bank in France to introduce a digital financial advisor, ‘Coach Epargne’, which helps customers to make more informed savings and investment choices. In the Netherlands, we started working with small enterprises in our ‘Ondernemerslab’ facility to co-develop new services that meet their business needs in areas such as finance and marketing. In Wholesale Banking, we added new services to our InsideBusiness digital banking platform and expanded the platform’s availability to the UK and Ireland, empowering clients in these countries to manage their finances anytime and anywhere.”

“We actively monitor advances in the fintech space and are able to respond quickly to opportunities that have the potential to improve the customer experience. We are currently partnered with around 45 fintechs dedicated to creating innovative solutions for banking needs, such as money management, payments, lending and mobile on-boarding. For example, seven start-ups are working on their ‘proof-of-concept’ through the ING Fintech Village initiative in Belgium, and four through the Innovation Studio in the Netherlands. These open, collaborative programmes involve multiple partners and provide access to their respective networks, allowing the start-ups to accelerate their development.”

“Our strong customer focus reinforces the commercial momentum of our business. During the first quarter of 2016, customers entrusted ING with an additional EUR 8.8 billion of net deposits and we extended EUR 7.1 billion of net core lending. Margins remained healthy, supporting the higher quarterly interest result. The quality of the loan book also improved, as evidenced by lower risk costs and a further decline in the NPL ratio. The Bank’s solid underlying pre-tax result of EUR 1,186 million reflects these factors and EUR 496 million of regulatory costs. In 2016, regulatory costs are expected to increase by over EUR 300 million to approximately EUR 960 million, impacting our cost/income ratio as we look for ways to off set these higher costs.”

“In January and April 2016, we sold our remaining stake in NN Group, marking the completion of our divestment programme and the last step in our strategic repositioning. Including the net profit from the sales of NN Group shares in January, ING Group’s first-quarter net result was EUR 1,257 million. ING Group ended the quarter with a strong fully-loaded CET1 ratio of 12.9%, excluding the first-quarter net profit and the impact of the NN share sale in April. With our robust capital and liquidity position, we are well-placed to adapt to the ever-changing regulatory environment.”

“Looking ahead, our focus is to accelerate the execution of our Think Forward strategy. I am grateful to our employees for their dedication to serving our customers to the best of our ability. Our priorities are clear, and I am confident that ING’s strong portfolio of businesses will enable us to continue empowering our customers and deliver sustainable shareholder returns.”

Consolidated Results

Analyst and investor conference call

10 May 2016, at 9:00 a.m. CET

NL +31 20 794 8500

UK +44 20 7190 1537

US +1 480 629 9031

Listen to the investor conference call at www.ing.com

Media conference call

10 May 2016, at 11:00 a.m. CET

NL +31 20 531 5871

UK +44 203 365 3210

Listen to the media conference call at www.ing.com

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 52,000 employees offer retail and wholesale banking services to customers in over 40 countries.

ING Group shares are listed (in the form of depositary receipts) on the exchanges of Amsterdam (INGA NA, ING.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s corporate strategy, which is evidenced by ING Group shares being included in the FTSE4Good index and in the Dow Jones Sustainability Index (Europe and World) where ING is among the leaders in the Banks industry group.

IMPORTANT LEGAL INFORMATION

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS-EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2015 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in ING’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) breakup of the euro, (4) changes in the availability of, and costs associated with, sources of liquidity such as interbank funding, as well as conditions in the credit markets generally, including changes in borrower and counterparty creditworthiness, (5) changes affecting interest rate levels, (6) changes affecting currency exchange rates, (7) changes in investor and customer behaviour, (8) changes in general competitive factors, (9) changes in laws and regulations, (10) changes in the policies of governments and/or regulatory authorities, (11) conclusions with regard to purchase accounting assumptions and methodologies, (12) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (13) changes in credit ratings, (14) ING’s ability to achieve projected operational synergies and (15) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com.

Any forward-looking statements made by or on behalf of ING speak only as of the date they are made, and, ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.