A green, green home

23 January 2019

Making your home more sustainable is a costly and complex affair. Enough reason for most people to do nothing. ING has big ambitions and some cool tools to make people take action, now.

“The goal is to remove the barriers not to act,” says Wim Flikweert, manager Living at ING in the Netherlands, segment of Individual Customers.

If you’re like most people, it’s a good month if you can pay all your bills and still put some money in your savings account. So to spend €10,000 to insulate the façade of your house? No way — nice for the environment, but you have other priorities.

Such attitudes are a big challenge as ING aims to make our residential mortgage portfolio in the Netherlands, Belgium and Germany energy positive, meaning the homes produce more energy than they use.

The ambition, announced late last year, is part of our overall climate ambition to steer our €600 billion loan book towards the well-below two-degree goal of the Paris Agreement.

So, what’s the first step? About 55% of the homes in our mortgage portfolio have an energy label of D to G (G is the worst score; homes built before 1980 typically have a D or lower.) Our first goal is to upgrade at least half of these homes to a C by 2022 by making homeowners and homebuyers more aware and motivated to upgrade, while at the same time making the financing simply too good to refuse.

Making it simple

Sharing information about different energy-efficiency measures and making it easy to find is critical, says Wim Flikweert, manager Living at ING in the Netherlands, segment of Individual Customers.

“We’re not saying to people: ‘You must have an energy-neutral house.’ The biggest gain, both in CO2 reduction and financially, is with houses that are not efficient. So we decided to focus on motivating them to come into action, and to start by giving them information.”

The kind of information given is important. Sometimes the complexity can be overwhelming. Take solar panels – they can be monocrystalline, polycrystalline or thin-film. Few people are familiar with the technical characteristics of each option and the calculations that underpin energy scans and the investment plans to make homes more sustainable.

Even the energy experts can disagree among themselves. “Different people might come to your home and one says ‘get solar panels’ while the other says ‘replace insulation’,” explains Wim. “Then people get confused and do nothing.”

So ING in the Netherlands has started to gently push information on its website and in conversations between mortgage advisors and clients.

And in the Dutch online ING store, ‘sustainable housing’ was recently added as a category. Now, in addition to buying phones, watches or a vacuum cleaner, ING customers can get discounts on green energy, solar panels, an energy scan, or a complete investment plan to upgrade their home.

Making it easy

The free energy scan is an example of how we make information easy to obtain, digest and understand. First you enter your Dutch zip code and house number and answer a few basic questions (how many people live there, is double glazing or insulation already present, is there a budget, etc.).

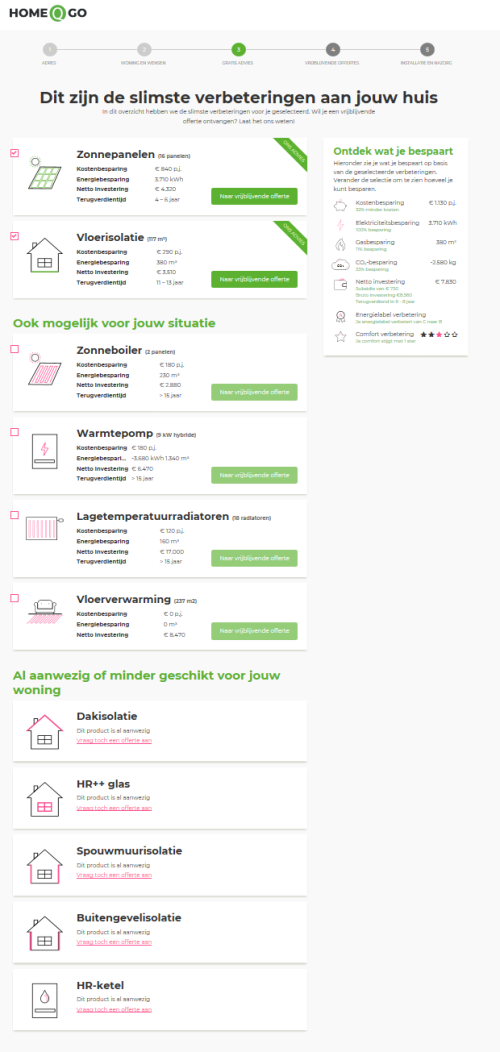

Then, the external tool we use immediately shows basic information about your property based on your answers and public data (square metres, current energy label, number of bathrooms, etc.), as well as an infographic of different types of upgrades you could make, including the costs, monthly savings as a result of making the change, payback time for the investment, etc.

Show me your home

Another way ING in the Netherlands is trying to motivate everyone to improve their home, especially the D-to-G target group, is by offering the chance to do a 30-minute live video call with an energy expert.

Wim says this is a great option for people who have already looked into possible energy-efficiency investments, but are still unsure about their choices or what they should do next.

During the video call, you show the energy expert the current situation as you move from room to room. The expert can give an initial assessment based on what he or she sees and suggest a few things that are worth investigating further. If the customer takes the next step, for example by ordering a more extensive energy advice or technical inspection, the video call is free (instead of €49).

“The goal is to remove the barriers not to act,” says Wim.

The final nudge

Once a homeowner has made the decision to upgrade and has an estimate for the work needed, the hardest part is over. Then comes figuring out how to pay for it. Many people have enough savings to make their home more sustainable.

But if not, ING wants to make a potential loan so appealing that it becomes an offer you can’t refuse. So we introduced a Green Personal Loan for customers with an existing ING mortgage. With an interest rate of 3.9% — regardless of the amount borrowed — the interest is much lower than a ‘normal’ loan.

“With €10,000, there’s a lot you can do to improve the energy efficiency of your home,” says Wim.

Plus, homeowners rarely regret such an investment because it leads to an almost immediate reduction in their energy bill combined with the non-financial benefit of higher comfort.

An amount of €10,000 is usually too low to tack onto an existing mortgage because of the extra costs involved (for notary, appraisals, etc.) That’s why the personal loan is such a powerful instrument to give homeowners that final ‘nudge’ into a higher energy label.

“During the financing stage, we’re pulling out all the stops. We really want people to be able to make an impact.”

Time to act

Houses generally account for about 20% of a country’s CO2 emissions (including methane and other greenhouse gases). Still, little will change until investing in energy-efficiency measures becomes a priority for most homeowners. Unfortunately, that isn’t yet the case, as ING’s own research shows.

Though more than 70% of homeowners in a recent ING Housing Survey held in the Netherlands had researched possible energy-saving investments, only 10% planned to take action in the short term. And the ING International Survey found that of the 55% in Europe who agree they can do more, 46% say it’s due to lack of funds and for 26% it’s lack of knowledge.