Yolt Technology Services boosts open banking in the Netherlands

European businesses wanting to connect Dutch bank account APIs have been given a boost following the announcement this week that Yolt Technology Services (YTS), the business-to-business arm of Yolt, is now offering API coverage to over 90 percent of the Netherlands.

YTS, the leading open banking provider in Europe, now has application programming interfaces (API) connections in place with leading banks in the Netherlands including ING, Rabobank, ABN Amro, SNS Bank, Regio Bank, ASN Bank, Bunq, and Revolut.

Leon Muis, Chief Business Officer at YTS said it was great to see an increasing demand for PSD2 API connections in our home market, the Netherlands.

“This goes to show that businesses are really starting to see the benefits that open banking can bring in an increasingly competitive landscape. With the Dutch bank API connections fully live for our Dutch clients, we are now ready to help more businesses in The Netherlands invest in the future of open banking,” he said.

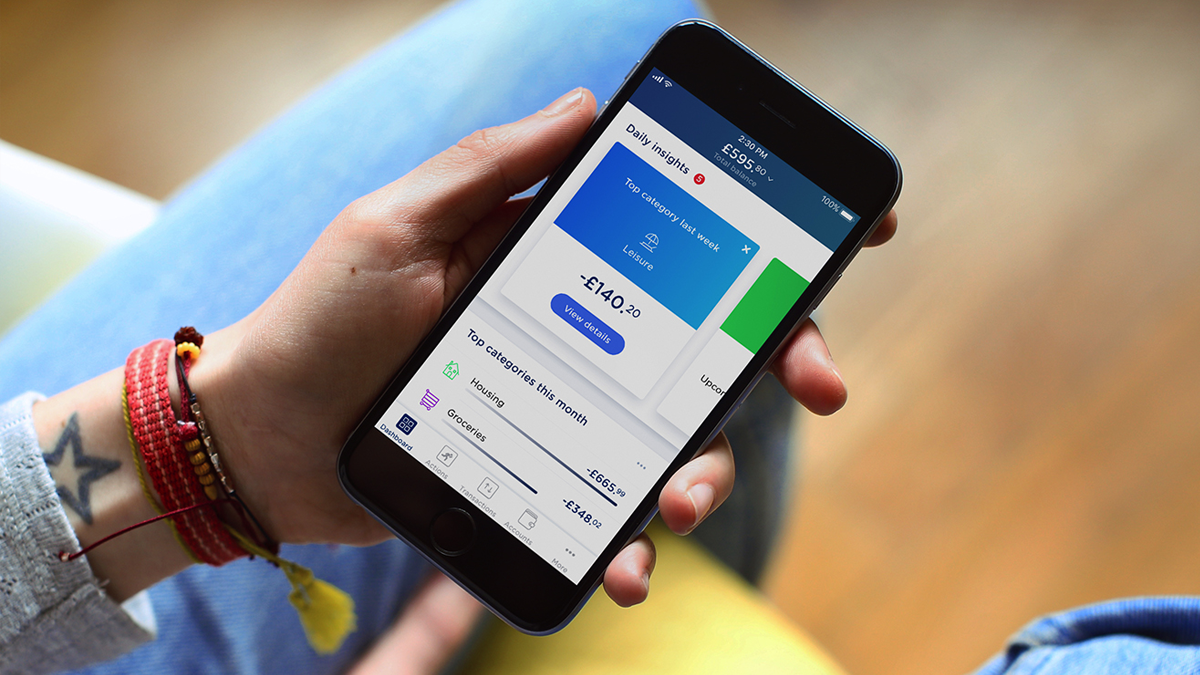

YTS, who makes on average 14 million API calls each week, offer three main services for financial institutions and tech businesses across Europe: An account information service, a payment initiation service and data enrichment service.

EU regulations known as PSD2 came into force in 2018, mandating banks to open up bank account data to external parties. APIs allow third-parties to access financial information efficiently, which promotes the development of new apps and services

Yolt, a venture of ING, was established in 2016.